You should be able to identify the business causes and implications of key items on the profit and loss account. Exercise 2 1513 Shown

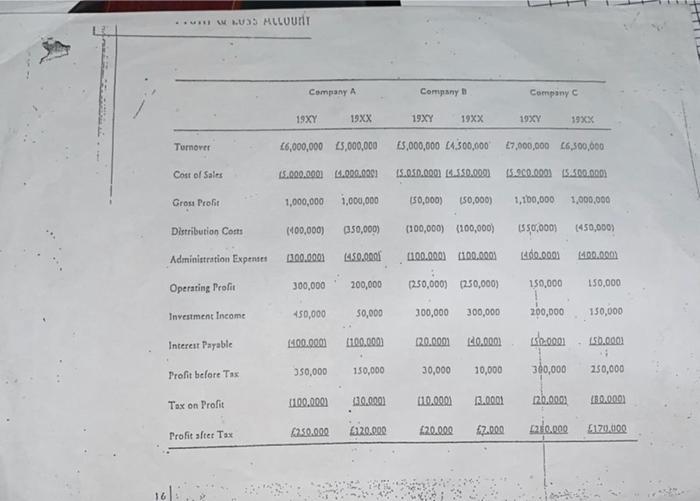

You should be able to identify the business causes and implications of key items on the profit and loss account. Exercise 2 1513 Shown next are summary profit and loss accounts for three companies with comparative figures for last year shown alongside. Study these accounts and then answer the following questions: 1) Which company sold an investment in ABC Holdings Limited for 450,000 profit? 2) Which company sold its goods for less than it cost to make them) 3) Which company has shown he greatest percentage increase in sustainable core business profit? 4) Which company cut its gross margin percentage this year due to intense competition? 5) In which company would you most like to invest? Assume all investment income and interest payable relates to only one item per year ***** LUSS ALLOUNT Turnover Cost of Sales Gross Profit Distribution Costs Administration Expenses Operating Profit Investment Income Interest Payable Profit before Tax Tax on Profit Profit after Tax Company A 19XY 6,000,000 5,000,000 15.000.000) (4.000.000) 1,000,000 1,000,000 (400,000) 1300.0001 ; 300,000 450,000 19XX 350,000 (100.000) (400.000) (100.000) 250.000 (350,000) 14.50.000 200,000 50,000 150,000 130.0001 120.000 Company B 19XY 19XX (50,000) (50,000) (100,000) (100,000) (100.000) (100.0001 ES,000,000 4,500,000 7,000,000 6,500,000 15.050.000) (4.550.000) (250,000) (250,000) 300,000 300,000 120.0001 140.000) 30,000 10,000 (10.000) 20.000 13.0001 Company C 7.000 19XY 19XX (5.900.000) (5.500.000) 1,100,000 1,000,000 (550,000) (450,000) 1400.0001 (400.000) 150,000 250.000 150,000 200,000 150,000 (sh.0001 -L50.0001 4 300,000 250,000 120.000) (80.000) 170,000

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Company A Explanation It is given that all investment income relates to one item per year Profit a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started