Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company for which you work recently implemented time-driven activity-based costing (TDABC) in conjunction with its enterprise resource planning (ERP) system. Management is pleased with

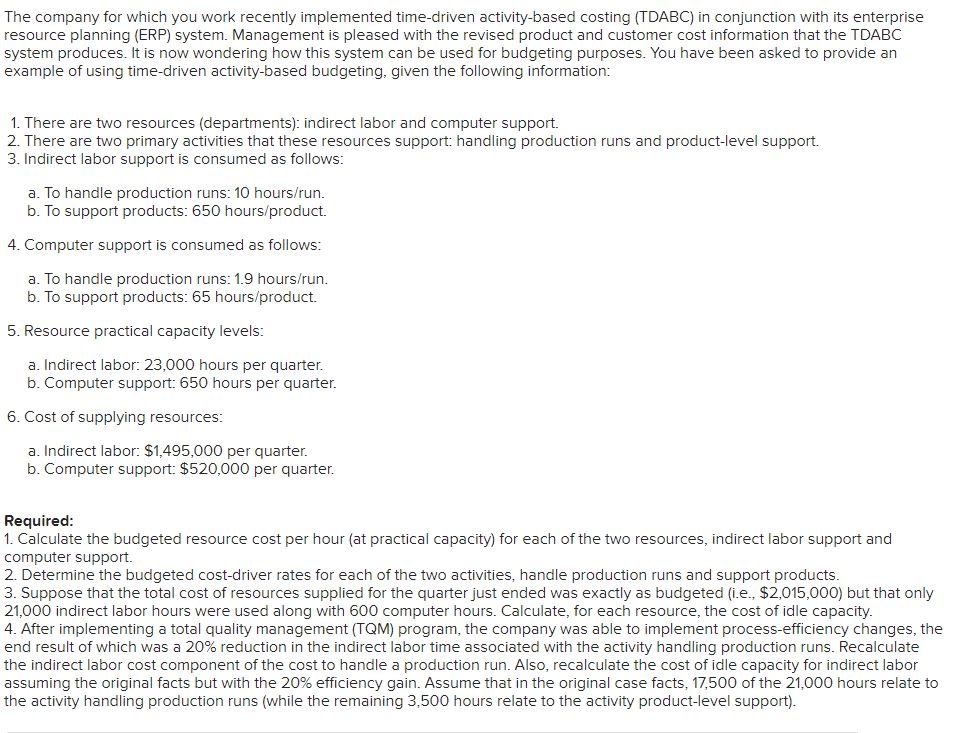

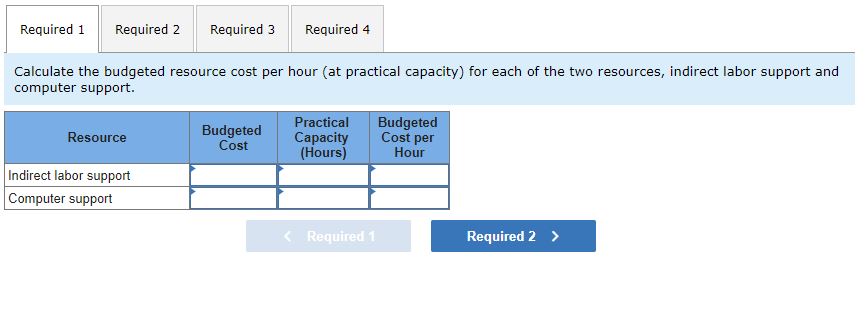

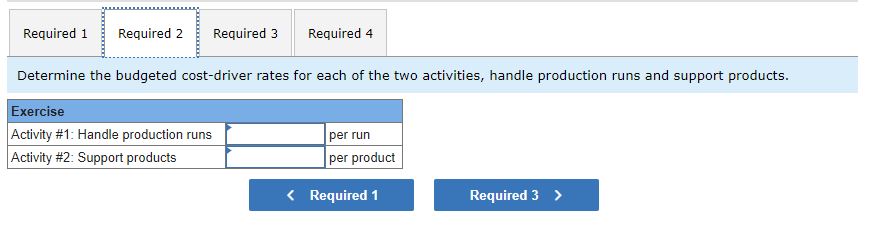

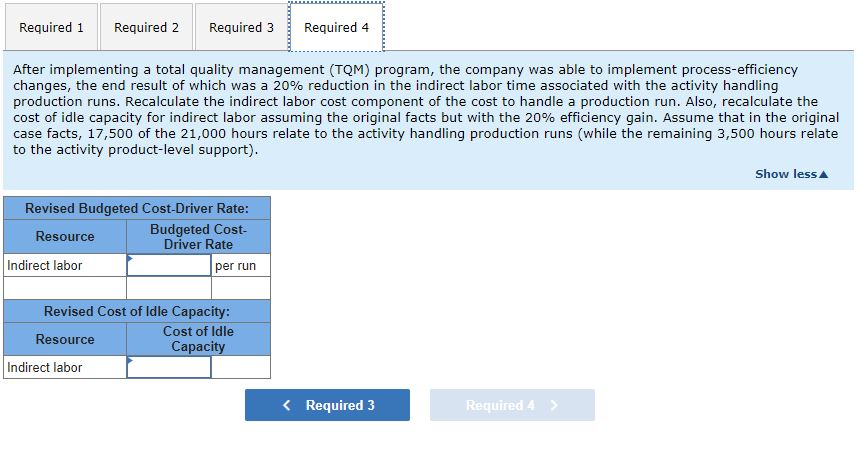

The company for which you work recently implemented time-driven activity-based costing (TDABC) in conjunction with its enterprise resource planning (ERP) system. Management is pleased with the revised product and customer cost information that the TDABC system produces. It is now wondering how this system can be used for budgeting purposes. You have been asked to provide an example of using time-driven activity-based budgeting, given the following information: 1. There are two resources (departments): indirect labor and computer support. 2. There are two primary activities that these resources support: handling production runs and product-level support. 3. Indirect labor support is consumed as follows: a. To handle production runs: 10 hours/run. b. To support products: 650 hours/product. 4. Computer support is consumed as follows: a. To handle production runs: 1.9 hours/run. b. To support products: 65 hours/product. 5. Resource practical capacity levels: a. Indirect labor: 23,000 hours per quarter. b. Computer support: 650 hours per quarter. 6. Cost of supplying resources: a. Indirect labor: $1,495,000 per quarter. b. Computer support: $520,000 per quarter. Required: 1. Calculate the budgeted resource cost per hour (at practical capacity) for each of the two resources, indirect labor support and computer support. 2. Determine the budgeted cost-driver rates for each of the two activities, handle production runs and support products. 3. Suppose that the total cost of resources supplied for the quarter just ended was exactly as budgeted (i.e., $2,015,000 ) but that only 21,000 indirect labor hours were used along with 600 computer hours. Calculate, for each resource, the cost of idle capacity. 4. After implementing a total quality management (TQM) program, the company was able to implement process-efficiency changes, the end result of which was a 20% reduction in the indirect labor time associated with the activity handling production runs. Recalculate the indirect labor cost component of the cost to handle a production run. Also, recalculate the cost of idle capacity for indirect labor assuming the original facts but with the 20% efficiency gain. Assume that in the original case facts, 17,500 of the 21,000 hours relate to the activity handling production runs (while the remaining 3,500 hours relate to the activity product-level support). Calculate the budgeted resource cost per hour (at practical capacity) for each of the two resources, indirect labor support and computer support. Determine the budgeted cost-driver rates for each of the two activities, handle production runs and support products. Suppose that the total cost of resources supplied for the quarter just ended was exactly as budgeted (i.e., $2,015,000 ) but that only 21,000 indirect labor hours were used along with 600 computer hours. Calculate, for each resource, the cost of idle capacity. After implementing a total quality management (TQM) program, the company was able to implement process-efficiency changes, the end result of which was a 20% reduction in the indirect labor time associated with the activity handling production runs. Recalculate the indirect labor cost component of the cost to handle a production run. Also, recalculate the cost of idle capacity for indirect labor assuming the original facts but with the 20% efficiency gain. Assume that in the original case facts, 17,500 of the 21,000 hours relate to the activity handling production runs (while the remaining 3,500 hours relate to the activity product-level support)

The company for which you work recently implemented time-driven activity-based costing (TDABC) in conjunction with its enterprise resource planning (ERP) system. Management is pleased with the revised product and customer cost information that the TDABC system produces. It is now wondering how this system can be used for budgeting purposes. You have been asked to provide an example of using time-driven activity-based budgeting, given the following information: 1. There are two resources (departments): indirect labor and computer support. 2. There are two primary activities that these resources support: handling production runs and product-level support. 3. Indirect labor support is consumed as follows: a. To handle production runs: 10 hours/run. b. To support products: 650 hours/product. 4. Computer support is consumed as follows: a. To handle production runs: 1.9 hours/run. b. To support products: 65 hours/product. 5. Resource practical capacity levels: a. Indirect labor: 23,000 hours per quarter. b. Computer support: 650 hours per quarter. 6. Cost of supplying resources: a. Indirect labor: $1,495,000 per quarter. b. Computer support: $520,000 per quarter. Required: 1. Calculate the budgeted resource cost per hour (at practical capacity) for each of the two resources, indirect labor support and computer support. 2. Determine the budgeted cost-driver rates for each of the two activities, handle production runs and support products. 3. Suppose that the total cost of resources supplied for the quarter just ended was exactly as budgeted (i.e., $2,015,000 ) but that only 21,000 indirect labor hours were used along with 600 computer hours. Calculate, for each resource, the cost of idle capacity. 4. After implementing a total quality management (TQM) program, the company was able to implement process-efficiency changes, the end result of which was a 20% reduction in the indirect labor time associated with the activity handling production runs. Recalculate the indirect labor cost component of the cost to handle a production run. Also, recalculate the cost of idle capacity for indirect labor assuming the original facts but with the 20% efficiency gain. Assume that in the original case facts, 17,500 of the 21,000 hours relate to the activity handling production runs (while the remaining 3,500 hours relate to the activity product-level support). Calculate the budgeted resource cost per hour (at practical capacity) for each of the two resources, indirect labor support and computer support. Determine the budgeted cost-driver rates for each of the two activities, handle production runs and support products. Suppose that the total cost of resources supplied for the quarter just ended was exactly as budgeted (i.e., $2,015,000 ) but that only 21,000 indirect labor hours were used along with 600 computer hours. Calculate, for each resource, the cost of idle capacity. After implementing a total quality management (TQM) program, the company was able to implement process-efficiency changes, the end result of which was a 20% reduction in the indirect labor time associated with the activity handling production runs. Recalculate the indirect labor cost component of the cost to handle a production run. Also, recalculate the cost of idle capacity for indirect labor assuming the original facts but with the 20% efficiency gain. Assume that in the original case facts, 17,500 of the 21,000 hours relate to the activity handling production runs (while the remaining 3,500 hours relate to the activity product-level support) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started