Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company had sales of $887,980 in 2024 and $832,500 in 2023. All sales were on account. Calculate Carla Vista's accounts receivable turnover ratio

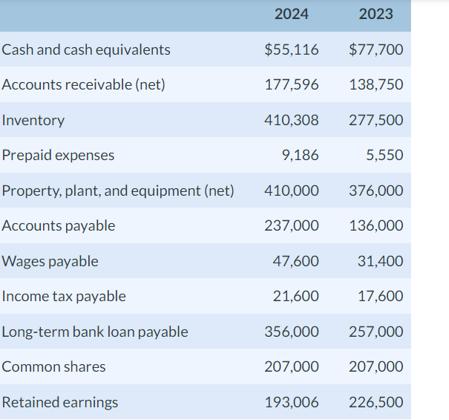

The company had sales of $887,980 in 2024 and $832,500 in 2023. All sales were on account. Calculate Carla Vista's accounts receivable turnover ratio and average collection period for the current and preceding years. For the accounts receivable turnover ratio, use the balance of accounts receivable at each year end for this calculation, rather than average balances. (Round accounts receivable turnover ratio to 2 decimal places, eg. 15.25 and average collection period to 1 decimal place, e.g. 15.1. Use 365 days for calculation.) 2024 Accounts receivable turnover ratio times Average collection period days 2023 times days 2024 2023 Cash and cash equivalents $55,116 $77,700 Accounts receivable (net) 177,596 138,750 Inventory 410,308 277,500 Prepaid expenses Property, plant, and equipment (net) Accounts payable 9,186 5,550 410,000 376,000 237,000 136,000 Wages payable 47,600 31,400 Income tax payable Long-term bank loan payable 21,600 17,600 356,000 257,000 Common shares Retained earnings 207,000 207,000 193,006 226,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started