Question

The company has 150,000 preferred shares issued and outstanding for the entire year. The preferred shares are non-cumulative and non-participating. There is a conversion feature

The company has 150,000 preferred shares issued and outstanding for the entire year. The preferred shares are non-cumulative and non-participating. There is a conversion feature where each preferred share can be converted into 50 common shares.

On January 1, 2020; the company had 500,000 common shares outstanding. On April 1, the company issued 100,000 common shares. There was a 2 for 1 stock split on June 1. These transactions have been accounted for and are included on the trial balance (dollar value of common shares). These items are needed to calculate weighted average common shares – to calculate basic and diluted EPS.

The company can issue an unlimited number of common shares.

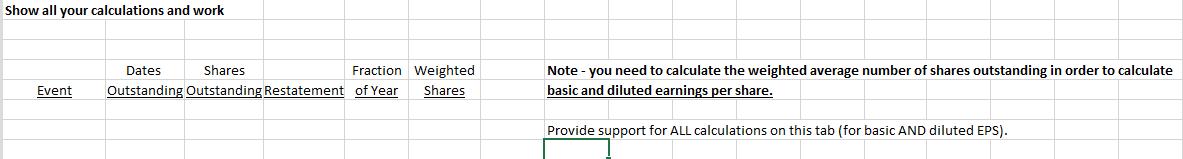

In the Excel spreadsheet, use the tab “Diluted EPS Calculation” to show your work relating to, weighted average number or shares and Earnings per Share and to make any dividend calculations. Post appropriate journal entries.

Only calculate EPS and Diluted EPS for 2020.

There was no change in shares during 2019.

Trial Balance 2019 & 2020

| Preferred Shares | 500,000 | 500,000 | ||

| Common Stock | 1,000,000 | 1,500,000 | ||

| Common Stock Subscribed | 100,000 | |||

| Retained Earnings | 337,366 | 692,275 |

Show all your calculations and work Dates Shares Fraction Event Outstanding Outstanding Restatement of Year Weighted Shares Note - you need to calculate the weighted average number of shares outstanding in order to calculate basic and diluted earnings per share. Provide support for ALL calculations on this tab (for basic AND diluted EPS).

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Calculate Earning Per share and diluted 150000 prefered shares nonCumulati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started