Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company has an exclusive right to sell LunaGlows and sales have been brisk.The Master Budget will be for the next three months starting April

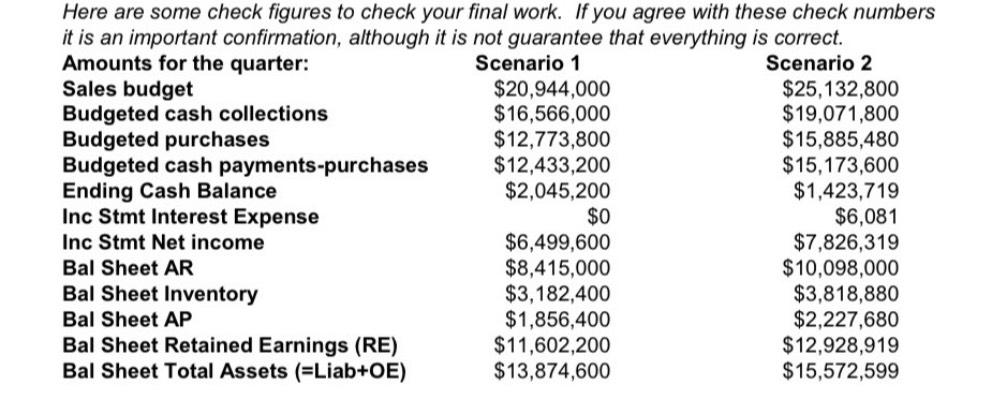

The company has an exclusive right to sell LunaGlows and sales have been brisk.The Master Budget will be for the next three months starting April The following information isavailable related to the budget.The company needs to maintain a minimum cash balance at the end of everymonth in the amount of $ The Glows are forecasted to sell at $ each.Recent actual and projected sales in units are as followsActual Projected ProjectedJan Apr Jul Feb May Aug Mar Jun Sep In order to meet the product demand, the company has established a policyrequiring that ending inventory for each month must be equal to of theunits expected to sold in the next month. The cost to purchase each unit of product is $Purchases are typically paid for as follows: paid in the month of purchase,and the remaining paid in the month after purchase. All sales are on credit,with no discount, and payable within days. The company's collections onaccount usually are in the month of sale, in the month immediatelyafter the sale, and in the second month after sale. The company hasa very rigorous credit policy and there are virtually no bad debts.The company's operating expenses are shown below:Variable:Sales Commissions $ per unitFixed:Wages $Utilities Insurance expired Depreciation Miscellaneous All operating expenses are paid during the month, in cash, with the exceptionof depreciation and insurance expired. New fixed assets will be purchasedduring May for $ The company declares dividends of $ eachquarter, payable in the first month of the following quarter.Page Le Le Cos Balance Sheet at March is as follows.ASSETSCash $Accounts receivableInventory unitsUnexpired insurance Fixed assets net of depreciationTotal Assets $LIABILITIES AND EQUITYAccounts payable purchases $Dividends payable Capital stock, no parRetained Earnings Total Liabilities & Equity $Accounts receivable consists of $ from February salesand $ from March Sales. Use these numbers for both scenarios. Use this same March ending inventory number for both scenarios.The company has a good relationship with its bank and can borrow moneyat a annual rate at any time and in any amount. All borrowingand repayments must be made at the end of the month. When the companyis ready to make a payment, all unpaid interest must be paid first. After theunpaid interest is paid, then principal can be repaid as long as the minimumcash balance is maintained.Page Le Le Co Required:You will complete all tasks listed below for the original facts above...thiswill be Scenario Then you will repeat the entire process for Scenario This second scenario will show what would happen if there was an increase oftwenty percent in the number of units sold. This is essentially a flexible budget.SCENARIO Prepare a Master Budget for the three month period ending June th Includethe following detailed budgets: a A sales budget by month and in total.b A schedule of budgeted cash collections from sales and accountsreceivable by month and in total.c A purchases budget in units and dollars by month and in total.d A schedule of budgeted cash payments for purchasesby month and in total A cash budget by month and in total A budgeted income statement for the threemonth period endingJune Use the contribution margin approach A budgeted balance sheet as of June Calculate the Contribution Margin and BreakEven amounts for the three month periodbased on your assumptions about variable and fixed costs.SCENARIO Repeat all the steps shown above assuming that the number of unitsexpected to be sold increase by The months January to March havealready occurred so those will be the same for both Scenarios.Please pay attention to the information above when it says:Accounts receivable consists of $ from February salesand $ from March Sales. Use these numbers for both scenarios. Use this same March ending inventory number for both scenarios.Budgeted Ending Inventory for June is based on July sales. Thereforeyou will need to increase the expected July sales in Scenario andthis will mean June Ending Inventory will be different in Scenario Here are some check figures to check your final work. If you agree with these check numbers it is an important confirmation, although it is not guarantee that everything is correct. Amounts for the quarter: Scenario Scenario Sales budget $ $ Budgeted cash collections $ $ Budgeted purchases $ $ Budgeted cash paymentspurchases $ $ Ending Cash Balance $ $ Inc Stmt Interest Expense $ $ Inc Stmt Net income $ $ Bal Sheet AR $ $ Bal Sheet Inventory $ $ Bal Sheet AP Bal Sheet Retained Earnings RE $ $ Bal Sheet Total Assets LiabE $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started