The company has created an activity based costing

The company has created an activity based costing

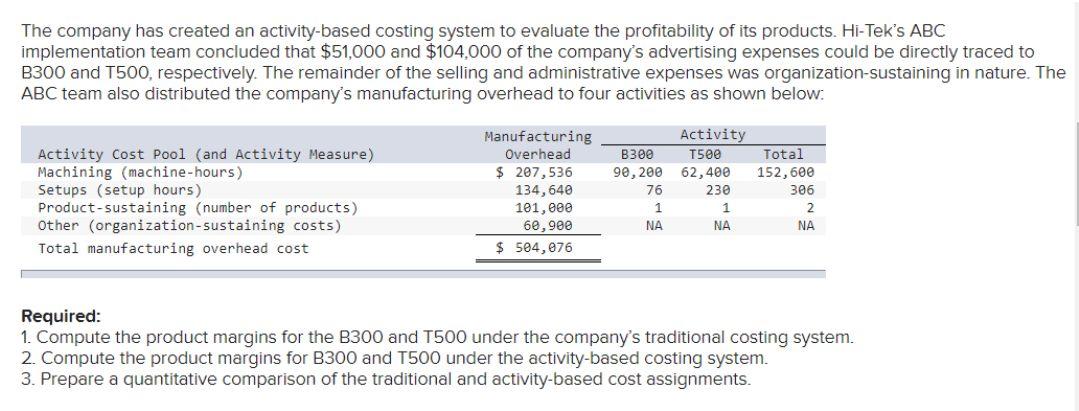

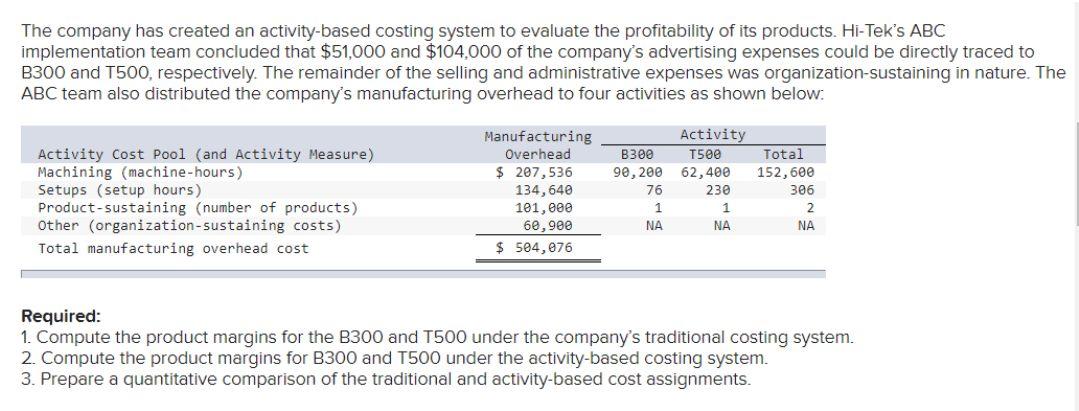

The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team concluded that $51,000 and $104,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) Total manufacturing overhead cost Manufacturing Overhead $ 207,536 134,640 101,000 60,900 $ 504, 076 B300 90,200 76 1 NA Activity T500 62,400 230 1 NA Total 152,600 306 2 NA Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team concluded that $51,000 and $104,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) Total manufacturing overhead cost Manufacturing Overhead $ 207,536 134,640 101,000 60,900 $ 504, 076 B300 90,200 76 1 NA Activity T500 62,400 230 1 NA Total 152,600 306 2 NA Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments

The company has created an activity based costing

The company has created an activity based costing