Question

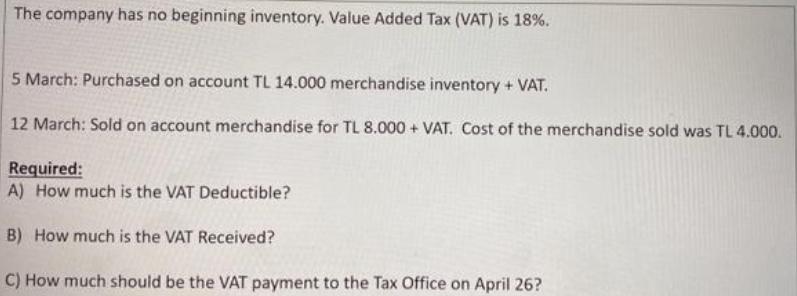

The company has no beginning inventory. Value Added Tax (VAT) is 18%. 5 March: Purchased on account TL 14.000 merchandise inventory + VAT. 12

The company has no beginning inventory. Value Added Tax (VAT) is 18%. 5 March: Purchased on account TL 14.000 merchandise inventory + VAT. 12 March: Sold on account merchandise for TL 8.000 + VAT. Cost of the merchandise sold was TL 4.000. Required: A) How much is the VAT Deductible? B) How much is the VAT Received? C) How much should be the VAT payment to the Tax Office on April 26?

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information for Decisions

Authors: John J. Wild

8th edition

125953300X, 978-1259533006

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App