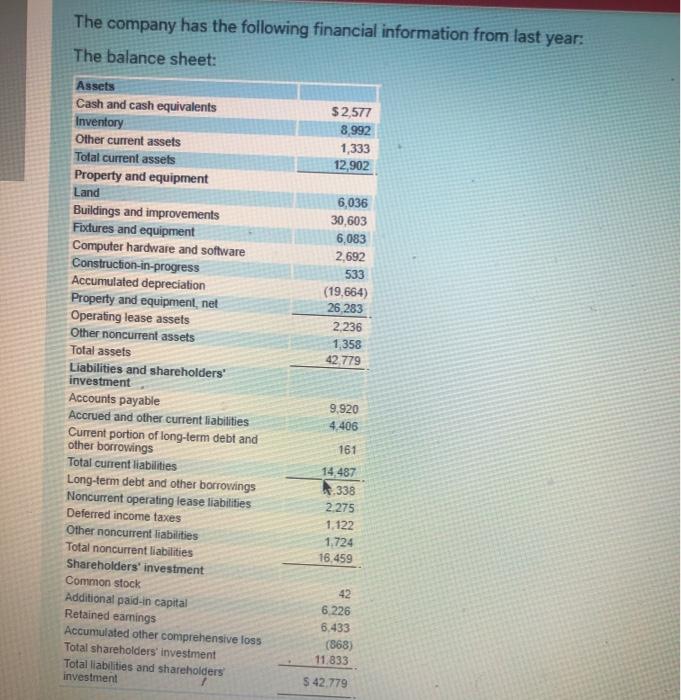

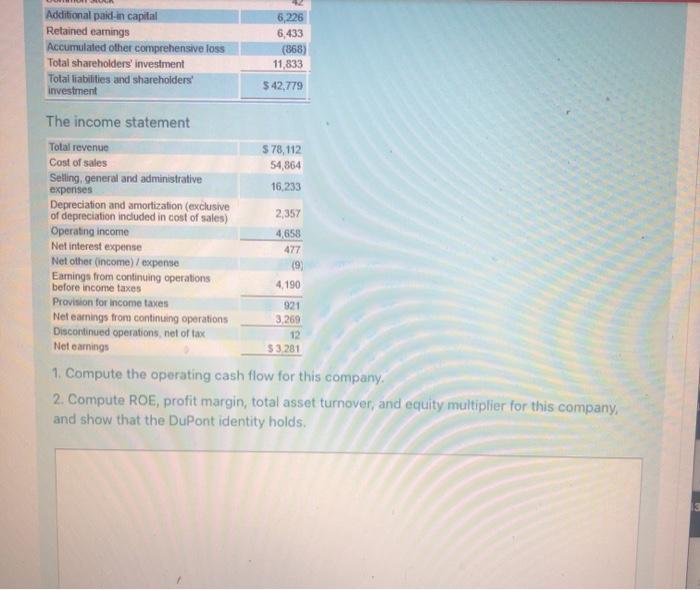

The company has the following financial information from last year: The balance sheet: $ 2,577 8,992 1,333 12,902 6,036 30,603 6,083 2,692 533 (19,664) 26 283 2.236 1.358 42.779 Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Operating lease assets Other noncurrent assets Total assets Liabilities and shareholders investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrovings Noncurrent operating lease fiabilities Deferred income taxes Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders investment Total liabilities and shareholders investment 9,920 4,406 161 14,487 .338 2.275 1.122 1,724 16.459 42 6.226 6.433 (868) 11.833 5 42.779 Additional paid-in capital 6,226 Retained earnings 6,433 Accumulated other comprehensive loss Total shareholders' investment 11,833 Total liabilities and shareholders' investment $ 42,779 The income statement Total revenue $ 78,112 Cost of sales 54,864 Selling, general and administrative expenses 16,233 Depreciation and amortization (exclusive of depreciation included in cost of sales) 2357 Operating income 4,658 Net interest expense 477 Net other (income) / expense (9) Earnings from continuing operations 4,190 before income taxes Provision for income taxes 921 Net earnings from continuing operations 3.269 Discontinued operations, net of tax 12 Net earnings $3281 1. Compute the operating cash flow for this company. 2. Compute ROE, profit margin, total asset turnover, and equity multiplier for this company, and show that the DuPont identity holds. The company has the following financial information from last year: The balance sheet: $ 2,577 8,992 1,333 12,902 6,036 30,603 6,083 2,692 533 (19,664) 26 283 2.236 1.358 42.779 Assets Cash and cash equivalents Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Operating lease assets Other noncurrent assets Total assets Liabilities and shareholders investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and other borrowings Total current liabilities Long-term debt and other borrovings Noncurrent operating lease fiabilities Deferred income taxes Other noncurrent liabilities Total noncurrent liabilities Shareholders' investment Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders investment Total liabilities and shareholders investment 9,920 4,406 161 14,487 .338 2.275 1.122 1,724 16.459 42 6.226 6.433 (868) 11.833 5 42.779 Additional paid-in capital 6,226 Retained earnings 6,433 Accumulated other comprehensive loss Total shareholders' investment 11,833 Total liabilities and shareholders' investment $ 42,779 The income statement Total revenue $ 78,112 Cost of sales 54,864 Selling, general and administrative expenses 16,233 Depreciation and amortization (exclusive of depreciation included in cost of sales) 2357 Operating income 4,658 Net interest expense 477 Net other (income) / expense (9) Earnings from continuing operations 4,190 before income taxes Provision for income taxes 921 Net earnings from continuing operations 3.269 Discontinued operations, net of tax 12 Net earnings $3281 1. Compute the operating cash flow for this company. 2. Compute ROE, profit margin, total asset turnover, and equity multiplier for this company, and show that the DuPont identity holds