Question

The company is Alteryx, Inc. and the proposed investment is moving additional operations to Shenzen, China Alternate financial scenarios. Use this section to discuss the

The company is Alteryx, Inc. and the proposed investment is moving additional operations to Shenzen, China

Alternate financial scenarios. Use this section to discuss the sensitivity of your financial projections to different scenarios.

Be sure to address: a. How would your projected financial performance change if sales fall 20% short of or are 20% higher than your base assumption? What does your analysis of these two scenarios imply for the proposed investment? Justify your response.

b. What do the net present value, internal rate of return, and payback values from your base scenario and the sales variation scenarios above imply for the proposed investment? Be sure to explain how the time value of money affects your calculations and analysis.

Additional Color:

Class: In order to do this correctly, you will have to have your sales projections from a previous assignment where you estimated future dollar amounts for the company. I want to see actual amounts. If sales fall 20% that doesn’t mean Net Profit would fall 20% -- same with if sales increase 20% - I expect that net profit would be a lot higher than 20%. Use an excel spreadsheet and copy and paste it in the actual body.

Here’s an example of what I’m looking for:

Sales Over and Under by 20%

EXAMPLE | Historical Year 1 | Historical Year 2 | Projection current year | Sensitivity Analysis | |

2017 | 2018 | 2019 | +20% Sales | -20% Sales | |

Revenue/Sales | 1000 | 1500 | 2000 | 2400 | 1600 |

Cost of Sales | 500 | 750 | 1000 | 1200 | 800 |

Gross Profit | 500 | 750 | 1000 | 1200 | 800 |

Total Expenses | 300 | 400 | 600 | 720 | 480 |

Net Profit | 200 | 350 | 400 | 480 | 320 |

Now speak to how that +20% or -20% Net Profit would change the proposed project decision.

What do the net present value, internal rate of return, and payback values from your base scenario and the sales variation scenarios above imply for the proposed investment.

In this section use the Amount you are expecting to SPEND on the Project as Year 0 and the potential After Tax Cash Flows for at least 5 years (Refer to them as Year 1, Year 2, Year 3, Year 4, Year 5). You should turn in 3 different scenarios for this section. See below example showing a 3 Year Cash Flow scenario.

HOW TO COMPUTE THE CASH FLOWS:

This is totally up to you, but do not over estimate. For instance an investment of $1,000,000 would not bring in $900,000,000 the first year. Be realistic! The NPV only needs to show up as a positive number to be a “go” for the company. You should be more interested in the IRR!

Explain how the time value of money affects your calculations and analysis. In order to get full credit on this, you MUST complete these calculations. Again, use an excel spreadsheet. I want to see NPV, IRR and Payback for Normal Projections, 20% sales decrease and 20% sales increase.

Here is an example of what I’m looking for:

Now that you can see how I want the Section for estimating 20% up or 20% down, please complete the next section using the format below: You can use formulas for NPV and IRR and simple addition/subtraction for Payback.

=npv(Rate,cashflow1,cashflow2,cashflow3)+Investment

=IRR(Grab all the numbers starting with Investment and go to last Profit) In this case =irr(b4:b7)

Below is an example of a 3 year cash flow for a fictitious company. You will prepare this with at least a FIVE YEAR Cash Flow

COMPANY NAME | |||

-20% | 100% | 20% | |

Discount Factor | 10% | 10% | 10% |

Investment | ($1,000,000) | ($1,000,000) | ($1,000,000) |

Cash Flow Year 1 for the project | 450,000 | 600,000 | 700,000 |

Cash Flow Year 2 for the project | 500,000 | 650,000 | 750,000 |

Cash Flow Year 3 for the project | 550,000 | 700,000 | 775,000 |

NPV | $235,537.19 | $608,564.99 | $838,467.32 |

IRR | 22% | 41% | 53% |

Payback | Around 2 yr | Around 1.5 yr | Around 1.4 year |

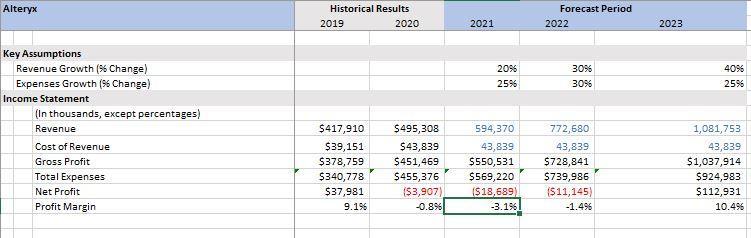

Alteryx Key Assumptions Revenue Growth (% Change) Expenses Growth (% Change) Income Statement (In thousands, except percentages) Revenue Cost of Revenue Gross Profit Total Expenses Net Profit Profit Margin Historical Results 2019 $417,910 $39,151 $378,759 $340,778 $37,981 9.1% 2020 20% 25% $495,308 594,370 $43,839 43,839 $451,469 $550,531 $455,376 $569,220 ($18,689) ($3,907) -0.8% -3.1% 2021 Forecast Period 2022 30% 30% 772,680 43,839 $728,841 $739,986 ($11,145) -1.4% 2023 40% 25% 1,081,753 43,839 $1,037,914 $924,983 $112,931 10.4%

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a If sales fall 20 short of the base assumption then the companys financial performance would likely suffer This is because the company would have to sell less product which would lead to lower revenu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started