Question

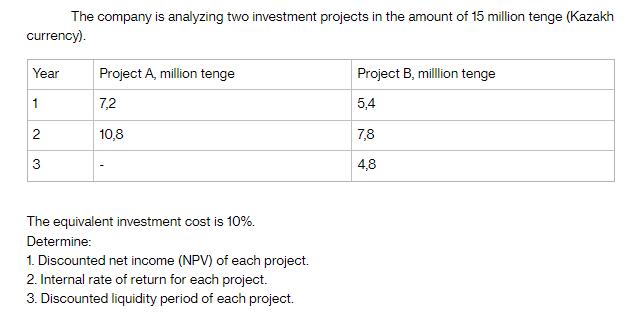

The company is analyzing two investment projects in the amount of 15 million tenge (Kazakh currency). Year 1 2 Project A, million tenge 7,2

The company is analyzing two investment projects in the amount of 15 million tenge (Kazakh currency). Year 1 2 Project A, million tenge 7,2 10,8 The equivalent investment cost is 10%. Determine: 1. Discounted net income (NPV) of each project. 2. Internal rate of return for each project. 3. Discounted liquidity period of each project. Project B, milllion tenge 5,4 7,8 4,8

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the discounted net income NPV of each project we need to discount each years net income using the equivalent investment cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Corporate Finance What Companies Do

Authors: John Graham, Scott Smart

3rd edition

9781111532611, 1111222282, 1111532613, 978-1111222284

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App