The company is CNU (Chrous Limited). How do I calculate return index and market index for this company. What are 'calculations on business risk'? and how do I find the data for and calculate the three day return etc? Thank you. Don't need specific answers, just a way of finding them.

The company is CNU (Chrous Limited). How do I calculate return index and market index for this company. What are 'calculations on business risk'? and how do I find the data for and calculate the three day return etc? Thank you. Don't need specific answers, just a way of finding them.

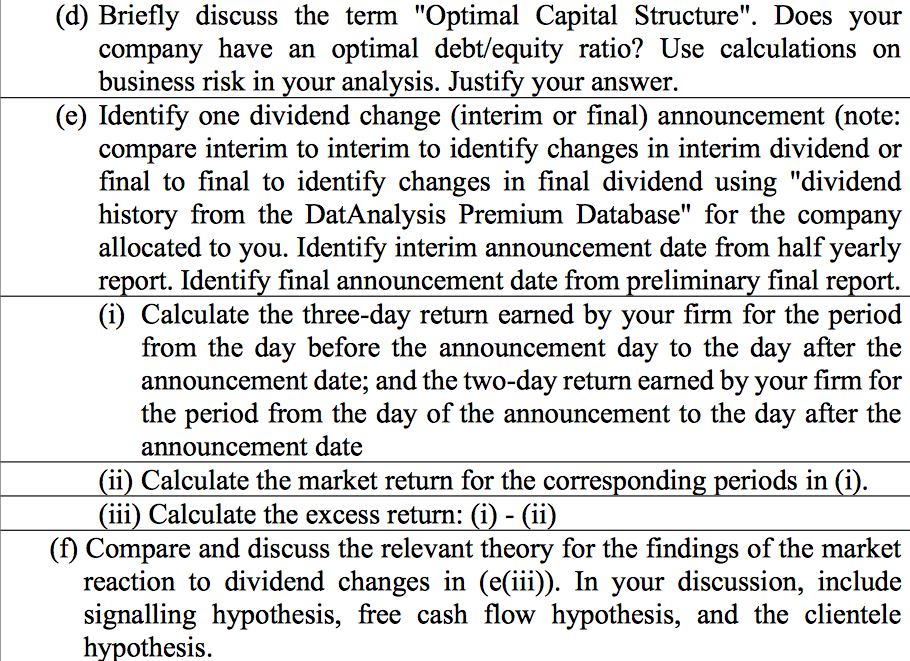

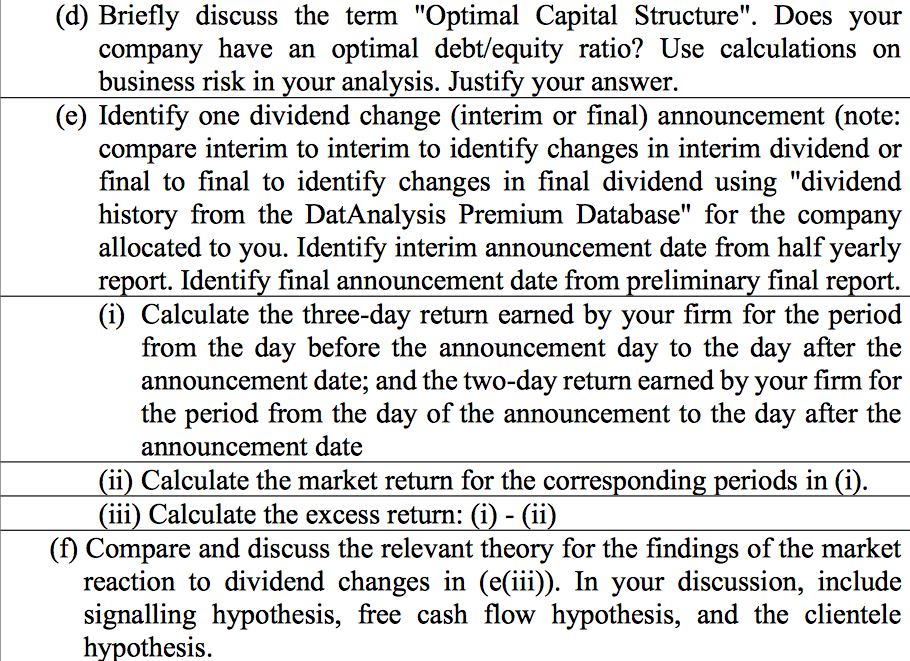

(d) Briefly discuss the term "Optimal Capital Structure". Does your company have an optimal debt/equity ratio? Use calculations on business risk in your analysis. Justify your answer. (e) Identify one dividend change (interim or final) announcement (note: compare interim to interim to identify changes in interim dividend or final to final to identify changes in final dividend using "dividend history from the DatAnalysis Premium Database" for the company allocated to you. Identify interim announcement date from half yearly report. Identify final announcement date from preliminary final report. (i) Calculate the three-day return earned by your firm for the period from the day before the announcement day to the day after the announcement date; and the two-day return earned by your firm for the period from the day of the announcement to the day after the announcement date (ii) Calculate the market return for the corresponding periods in (i). (iii) Calculate the excess return: (i) - (ii) (f) Compare and discuss the relevant theory for the findings of the market reaction to dividend changes in (e(iii)). In your discussion, include signalling hypothesis, free cash flow hypothesis, and the clientele hypothesis. (d) Briefly discuss the term "Optimal Capital Structure". Does your company have an optimal debt/equity ratio? Use calculations on business risk in your analysis. Justify your answer. (e) Identify one dividend change (interim or final) announcement (note: compare interim to interim to identify changes in interim dividend or final to final to identify changes in final dividend using "dividend history from the DatAnalysis Premium Database" for the company allocated to you. Identify interim announcement date from half yearly report. Identify final announcement date from preliminary final report. (i) Calculate the three-day return earned by your firm for the period from the day before the announcement day to the day after the announcement date; and the two-day return earned by your firm for the period from the day of the announcement to the day after the announcement date (ii) Calculate the market return for the corresponding periods in (i). (iii) Calculate the excess return: (i) - (ii) (f) Compare and discuss the relevant theory for the findings of the market reaction to dividend changes in (e(iii)). In your discussion, include signalling hypothesis, free cash flow hypothesis, and the clientele hypothesis

The company is CNU (Chrous Limited). How do I calculate return index and market index for this company. What are 'calculations on business risk'? and how do I find the data for and calculate the three day return etc? Thank you. Don't need specific answers, just a way of finding them.

The company is CNU (Chrous Limited). How do I calculate return index and market index for this company. What are 'calculations on business risk'? and how do I find the data for and calculate the three day return etc? Thank you. Don't need specific answers, just a way of finding them.