Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company is considering to invest in a machine to boost production in line with increased demand. It is expected that the increased demand

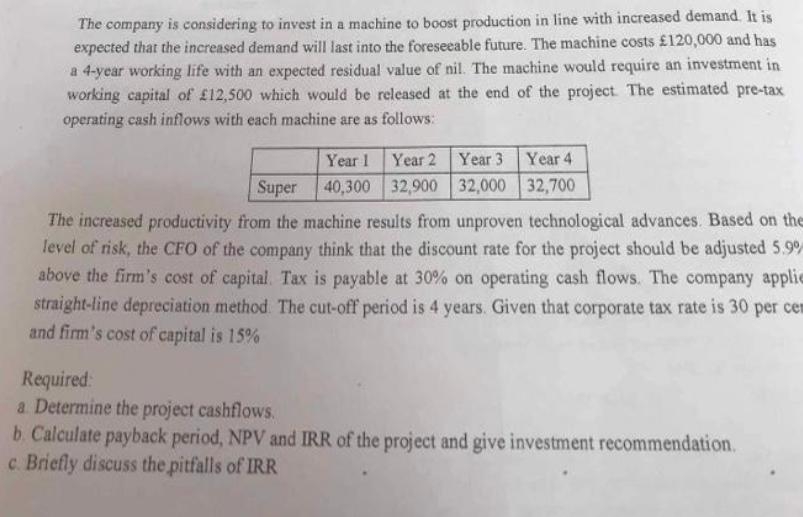

The company is considering to invest in a machine to boost production in line with increased demand. It is expected that the increased demand will last into the foreseeable future. The machine costs 120,000 and has a 4-year working life with an expected residual value of nil. The machine would require an investment in working capital of 12,500 which would be released at the end of the project. The estimated pre-tax operating cash inflows with each machine are as follows: Year 1 Year 2 Super 40,300 32,900 Year 3 Year 4 32,700 32,000 The increased productivity from the machine results from unproven technological advances. Based on the level of risk, the CFO of the company think that the discount rate for the project should be adjusted 5.9% above the firm's cost of capital. Tax is payable at 30% on operating cash flows. The company applie straight-line depreciation method. The cut-off period is 4 years. Given that corporate tax rate is 30 per cen and firm's cost of capital is 15% Required: a Determine the project cashflows. b. Calculate payback period, NPV and IRR of the project and give investment recommendation. c. Briefly discuss the pitfalls of IRR

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the project evaluation step by step a Determine the project cash flows First calculate the annual depreciation expense using the strai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started