Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company is financing its investments by three various bank loans (data given below). Additionally the external capital is being added by long term financing

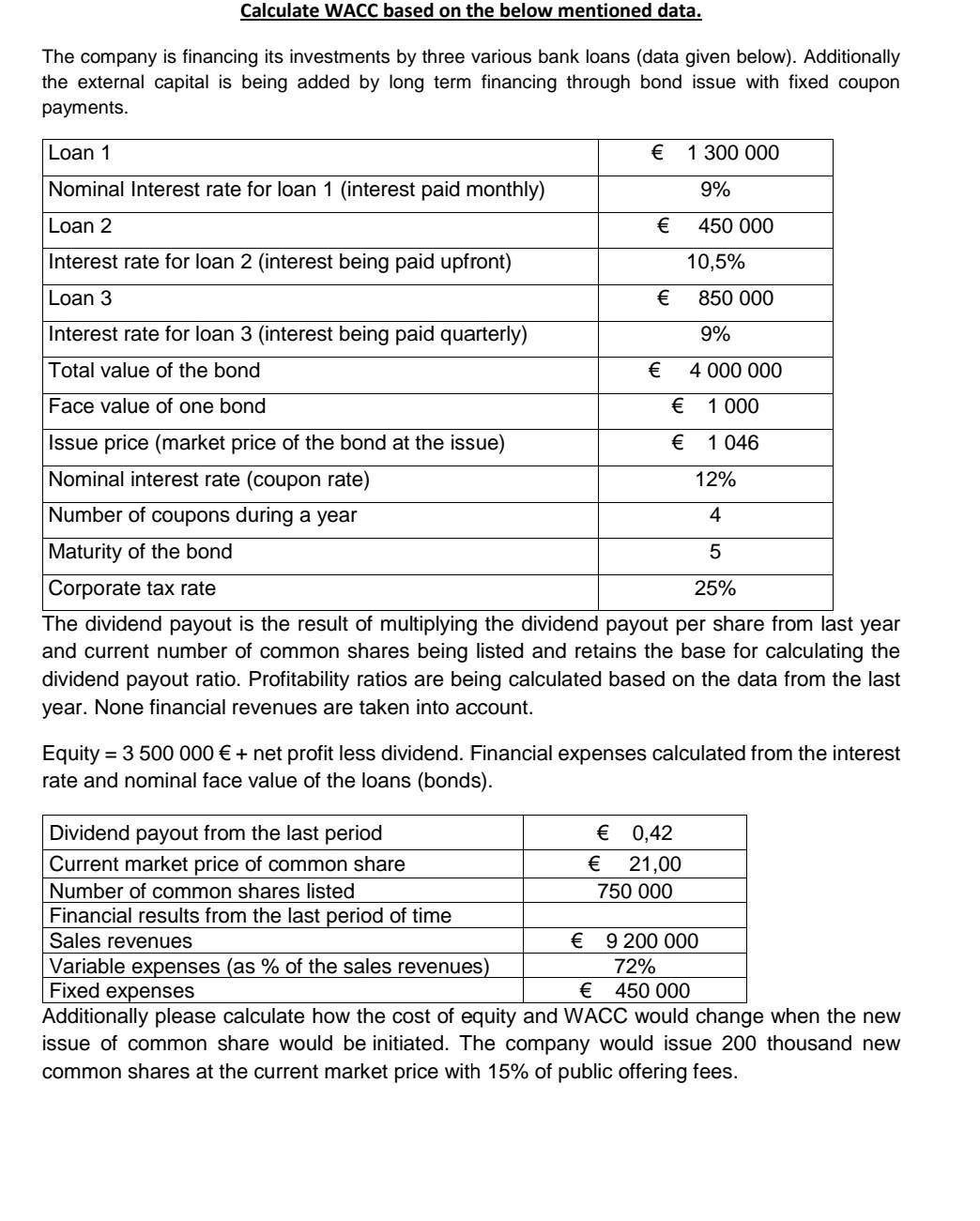

The company is financing its investments by three various bank loans (data given below). Additionally the external capital is being added by long term financing through bond issue with fixed coupon payments. The dividend payout is the result of multiplying the dividend payout per share from last year and current number of common shares being listed and retains the base for calculating the dividend payout ratio. Profitability ratios are being calculated based on the data from the last year. None financial revenues are taken into account. Equity =3500000+ net profit less dividend. Financial expenses calculated from the interest rate and nominal face value of the loans (bonds). Additionally please calculate how the cost of equity and WACC would change when the new issue of common share would be initiated. The company would issue 200 thousand new common shares at the current market price with 15% of public offering fees

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started