Answered step by step

Verified Expert Solution

Question

1 Approved Answer

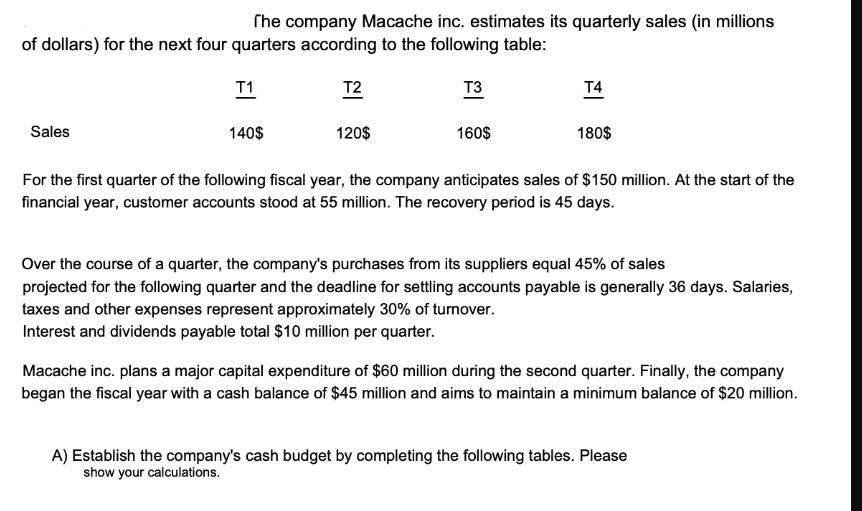

The company Macache inc. estimates its quarterly sales (in millions of dollars) for the next four quarters according to the following table: Sales T1

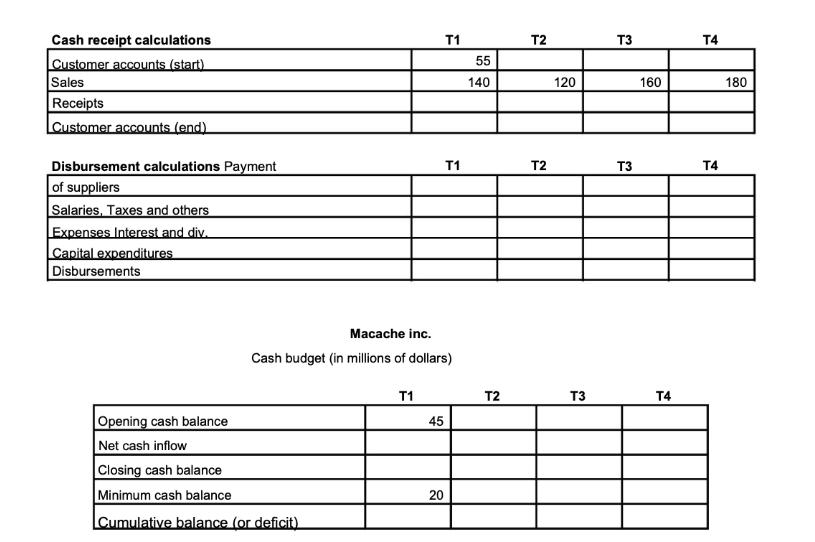

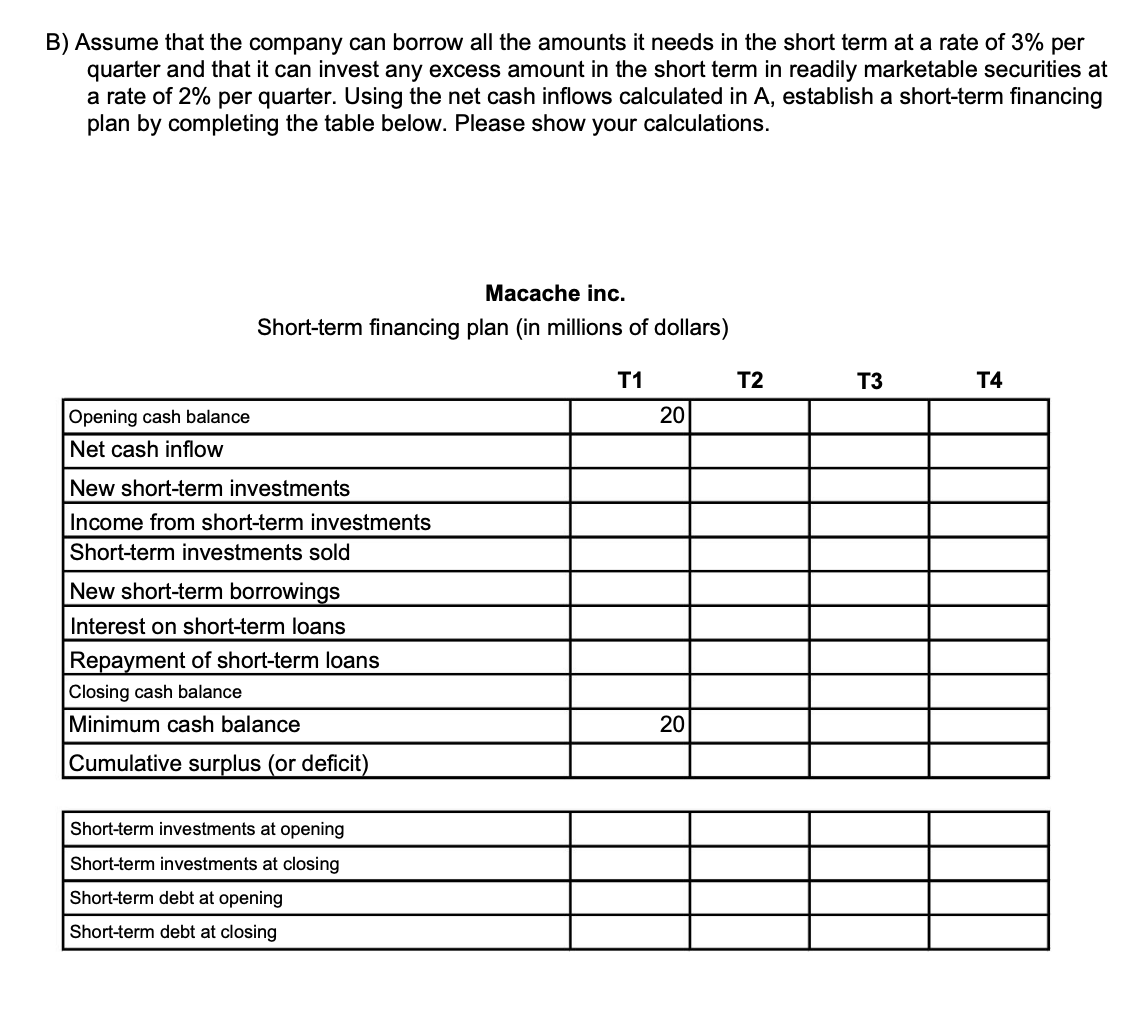

The company Macache inc. estimates its quarterly sales (in millions of dollars) for the next four quarters according to the following table: Sales T1 T2 T3 140$ 120$ 160$ T4 180$ For the first quarter of the following fiscal year, the company anticipates sales of $150 million. At the start of the financial year, customer accounts stood at 55 million. The recovery period is 45 days. Over the course of a quarter, the company's purchases from its suppliers equal 45% of sales projected for the following quarter and the deadline for settling accounts payable is generally 36 days. Salaries, taxes and other expenses represent approximately 30% of turnover. Interest and dividends payable total $10 million per quarter. Macache inc. plans a major capital expenditure of $60 million during the second quarter. Finally, the company began the fiscal year with a cash balance of $45 million and aims to maintain a minimum balance of $20 million. A) Establish the company's cash budget by completing the following tables. Please show your calculations. Cash receipt calculations Customer accounts (start) Sales Receipts Customer accounts (end) Disbursement calculations Payment of suppliers Salaries, Taxes and others Expenses Interest and div. Capital expenditures Disbursements Macache inc. T1 T2 T3 T4 55 140 120 160 180 T1 T2 T3 T4 Cash budget (in millions of dollars) T1 T2 T3 45 Opening cash balance Net cash inflow Closing cash balance Minimum cash balance 20 Cumulative balance (or deficit) T4 B) Assume that the company can borrow all the amounts it needs in the short term at a rate of 3% per quarter and that it can invest any excess amount in the short term in readily marketable securities at a rate of 2% per quarter. Using the net cash inflows calculated in A, establish a short-term financing plan by completing the table below. Please show your calculations. Macache inc. Short-term financing plan (in millions of dollars) Opening cash balance Net cash inflow New short-term investments Income from short-term investments Short-term investments sold New short-term borrowings Interest on short-term loans Repayment of short-term loans Closing cash balance Minimum cash balance Cumulative surplus (or deficit) Short-term investments at opening Short-term investments at closing Short-term debt at opening Short-term debt at closing T1 T2 T3 T4 20 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started