Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company name is Proton, which based in Malaysia PART A: FM4013 - INTRODUCTION TO FINANCIAL MANAGEMENT (20%) Requirements: Choose a company that meets the

The company name is Proton, which based in Malaysia

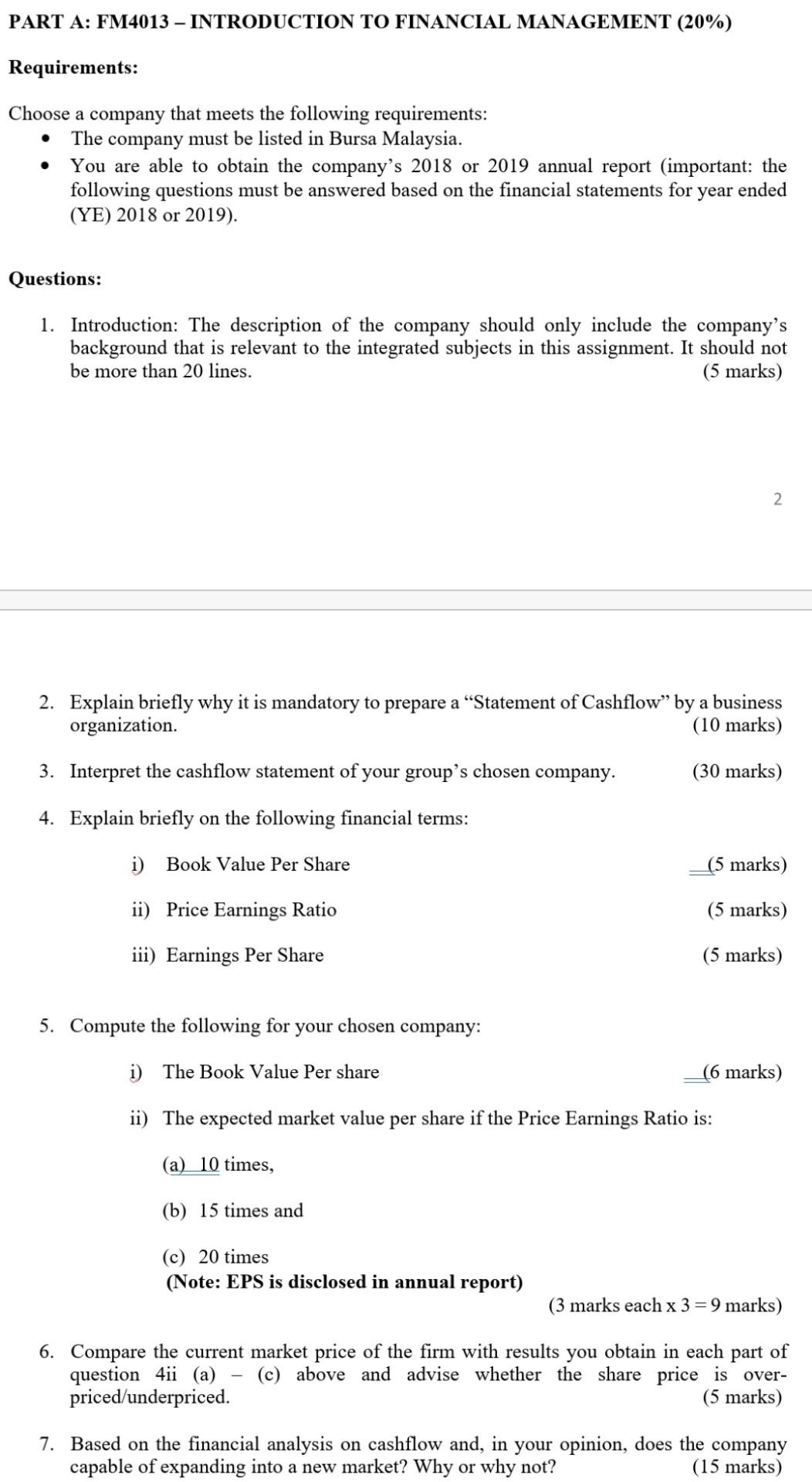

PART A: FM4013 - INTRODUCTION TO FINANCIAL MANAGEMENT (20%) Requirements: Choose a company that meets the following requirements: The company must be listed in Bursa Malaysia. You are able to obtain the company's 2018 or 2019 annual report (important: the following questions must be answered based on the financial statements for year ended (YE) 2018 or 2019). . Questions: 1. Introduction: The description of the company should only include the company's background that is relevant to the integrated subjects in this assignment. It should not be more than 20 lines. (5 marks) 2 2. Explain briefly why it is mandatory to prepare a Statement of Cashflow" by a business organization. (10 marks) 3. Interpret the cashflow statement of your group's chosen company. (30 marks) 4. Explain briefly on the following financial terms: i) Book Value Per Share (5 marks) ii) Price Earnings Ratio (5 marks) iii) Earnings Per Share (5 marks) 5. Compute the following for your chosen company: i) The Book Value Per share (6 marks) ii) The expected market value per share if the Price Earnings Ratio is: (a) 10 times, (b) 15 times and (c) 20 times (Note: EPS is disclosed in annual report) (3 marks each x 3 = 9 marks) 6. Compare the current market price of the firm with results you obtain in each part of question 4ii (a) (c) above and advise whether the share price is over- priced/underpriced. (5 marks) 7. Based on the financial analysis on cashflow and, in your opinion, does the company capable of expanding into a new market? Why or why not? (15 marks) PART A: FM4013 - INTRODUCTION TO FINANCIAL MANAGEMENT (20%) Requirements: Choose a company that meets the following requirements: The company must be listed in Bursa Malaysia. You are able to obtain the company's 2018 or 2019 annual report (important: the following questions must be answered based on the financial statements for year ended (YE) 2018 or 2019). . Questions: 1. Introduction: The description of the company should only include the company's background that is relevant to the integrated subjects in this assignment. It should not be more than 20 lines. (5 marks) 2 2. Explain briefly why it is mandatory to prepare a Statement of Cashflow" by a business organization. (10 marks) 3. Interpret the cashflow statement of your group's chosen company. (30 marks) 4. Explain briefly on the following financial terms: i) Book Value Per Share (5 marks) ii) Price Earnings Ratio (5 marks) iii) Earnings Per Share (5 marks) 5. Compute the following for your chosen company: i) The Book Value Per share (6 marks) ii) The expected market value per share if the Price Earnings Ratio is: (a) 10 times, (b) 15 times and (c) 20 times (Note: EPS is disclosed in annual report) (3 marks each x 3 = 9 marks) 6. Compare the current market price of the firm with results you obtain in each part of question 4ii (a) (c) above and advise whether the share price is over- priced/underpriced. (5 marks) 7. Based on the financial analysis on cashflow and, in your opinion, does the company capable of expanding into a new market? Why or why not? (15 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started