Question

the company needs to quantify its future value creation capability, you are also asked to estimate the company's Weighted Average Cost of Capital. You may

the company needs to quantify its future value creation capability, you are also asked to estimate the company's Weighted Average Cost of Capital. You may assume the following:

a) Corporate tax rate for Tekno is 15% b) Target Capital structure (D/V) for Tekno is 20% c) The group of similar companies is as listed in the Similars sheet provided in this file. d) To estimate the corporate tax rate for for the similars, you may use the actual taxes reflected in the most recent Income Statement found in Yahoo Finance. e) For leverage calculation of similars, your D can be assumed to be equal to Total Debt as presented in Yahoo Finance

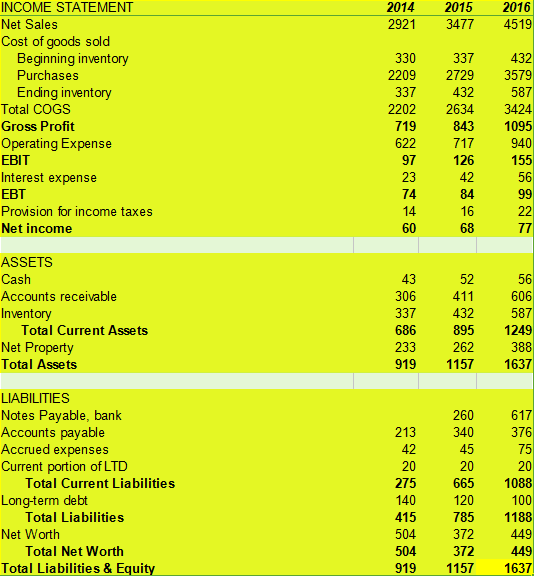

INCOME STATEMENT Net Sales Cost of goods sold Beginning inventory Purchases Ending inventory Total COGS Gross Profit Operating Expense EBIT Interest expense EBT Provision for income taxes Net income ASSETS Cash Accounts receivable Inventory Total Current Assets Net Property Total Assets LIABILITIES Notes Payable, bank Accounts payable Accrued expenses Current portion of LTD Total Current Liabilities Long-term debt Total Liabilities Net Worth Total Net Worth Total Liabilities & Equ 2014 2015 2016 2921 3477 4519 330 337 432 2209 2729 3579 337 432 587 2202 2634 3424 719 843 1095 622 940 97 126 155 23 42 56 74 99 14 16 60 68 43 52 56 306 411 606 337 432 587 686 895 1249 233 262 388 919 1157 1637 260 617 213 340 376 42 45 75 20 20 20 275 665 1088 140 120 100 415 785 1188 504 372 449 504 372 449 919 1157 1637 INCOME STATEMENT Net Sales Cost of goods sold Beginning inventory Purchases Ending inventory Total COGS Gross Profit Operating Expense EBIT Interest expense EBT Provision for income taxes Net income ASSETS Cash Accounts receivable Inventory Total Current Assets Net Property Total Assets LIABILITIES Notes Payable, bank Accounts payable Accrued expenses Current portion of LTD Total Current Liabilities Long-term debt Total Liabilities Net Worth Total Net Worth Total Liabilities & Equ 2014 2015 2016 2921 3477 4519 330 337 432 2209 2729 3579 337 432 587 2202 2634 3424 719 843 1095 622 940 97 126 155 23 42 56 74 99 14 16 60 68 43 52 56 306 411 606 337 432 587 686 895 1249 233 262 388 919 1157 1637 260 617 213 340 376 42 45 75 20 20 20 275 665 1088 140 120 100 415 785 1188 504 372 449 504 372 449 919 1157 1637Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started