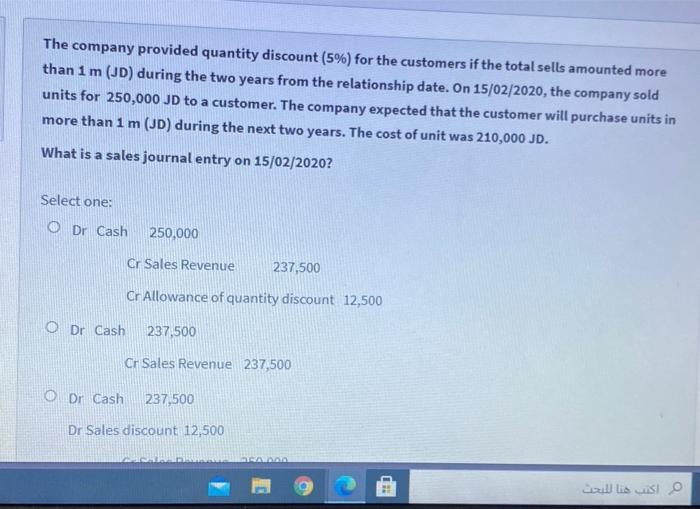

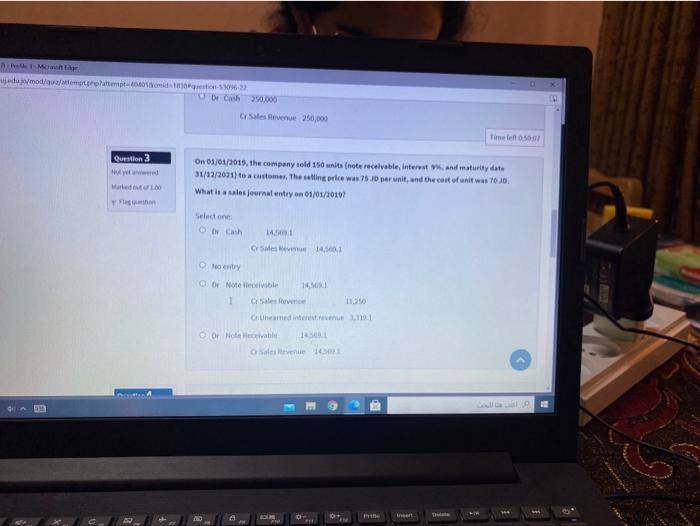

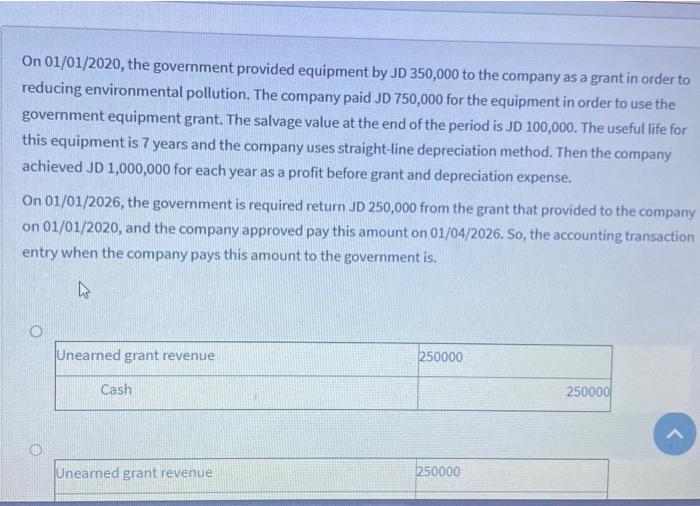

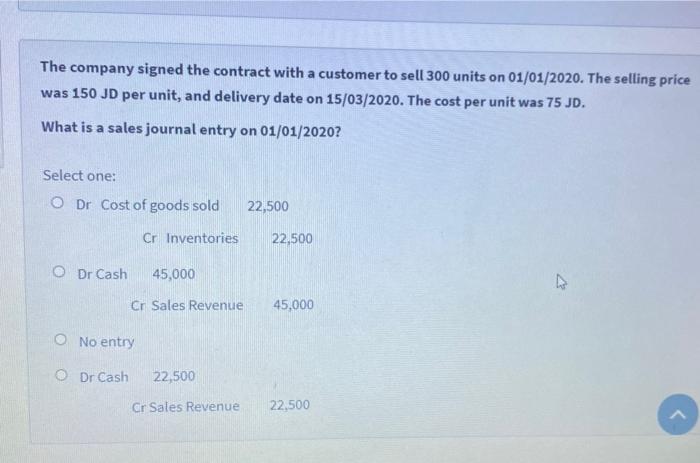

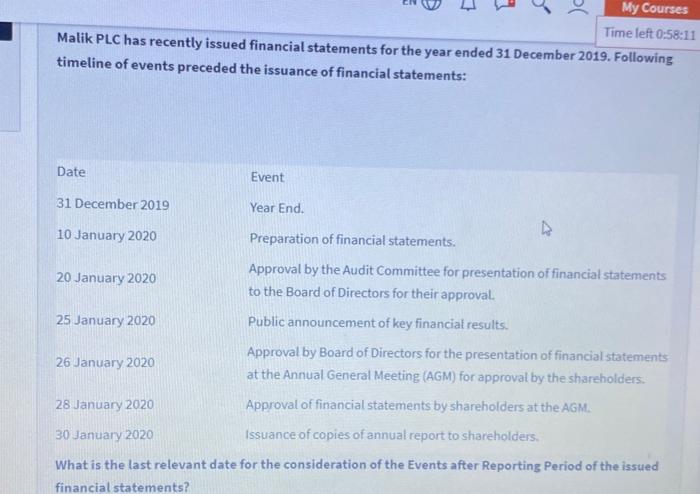

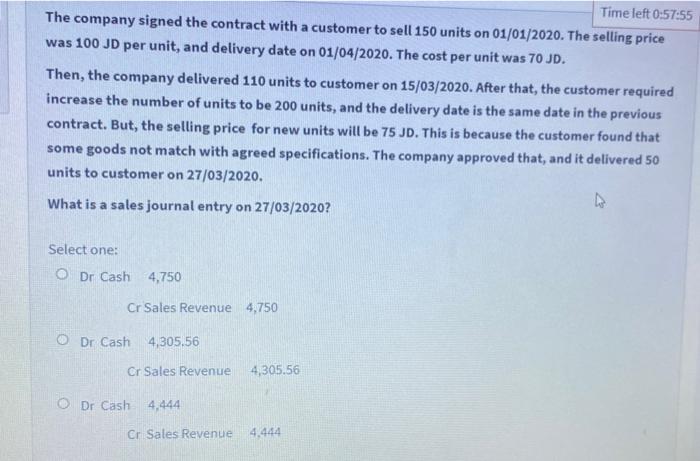

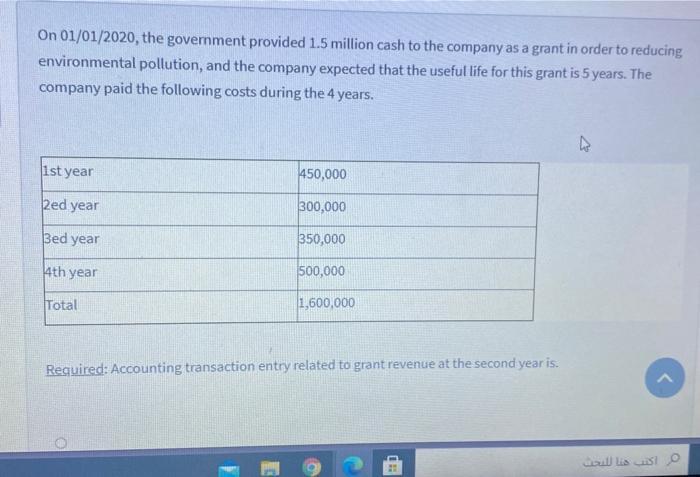

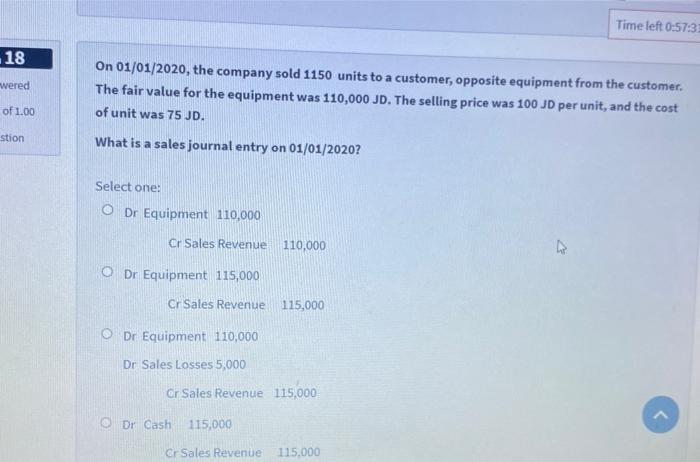

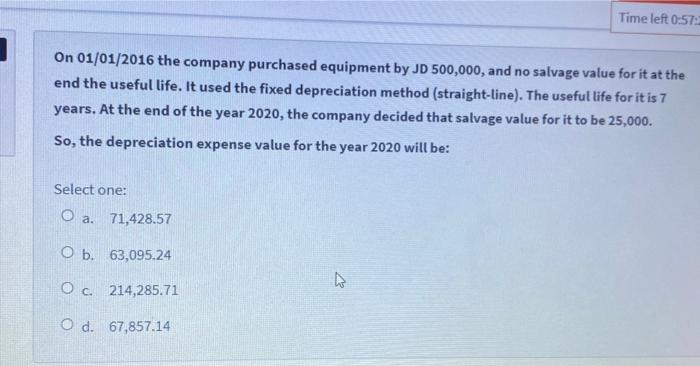

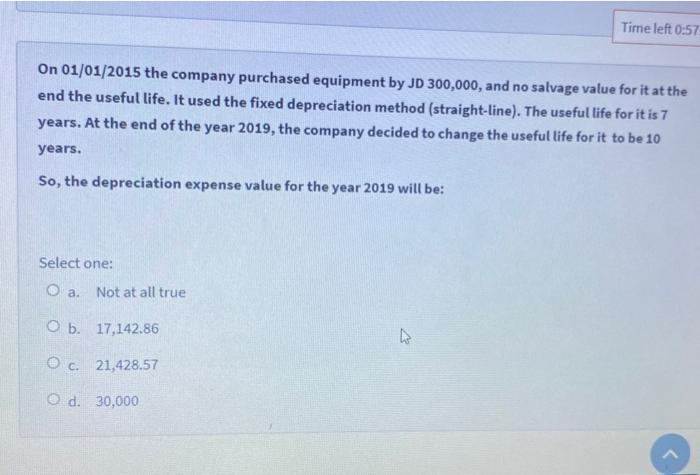

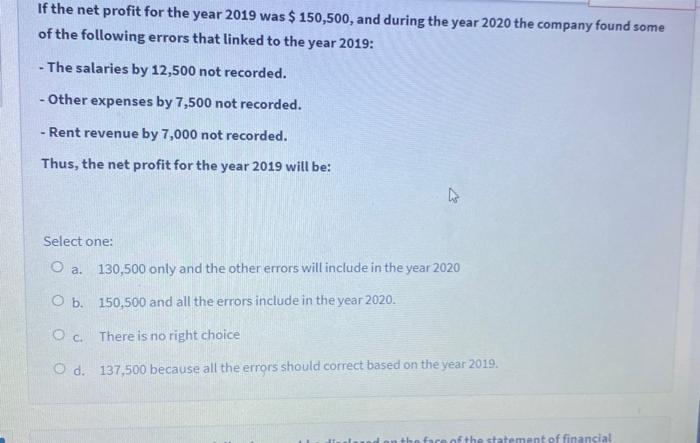

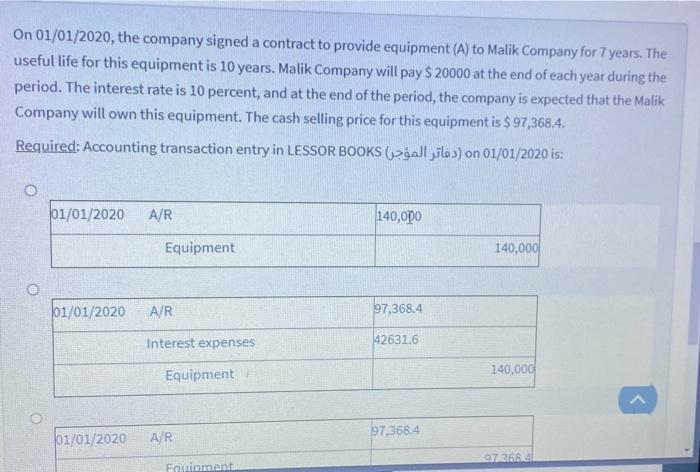

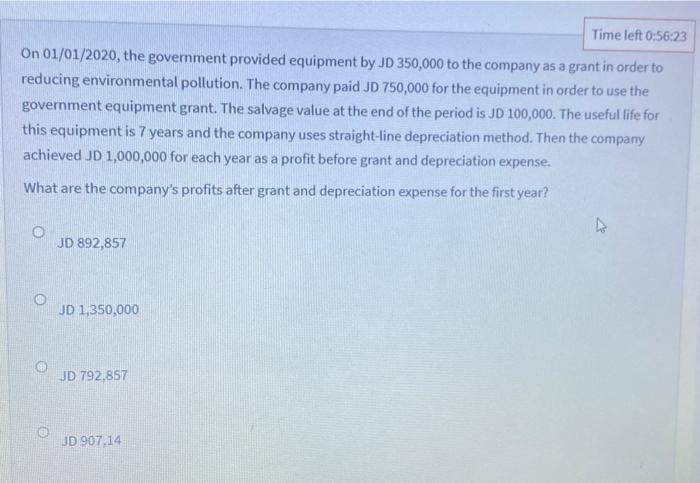

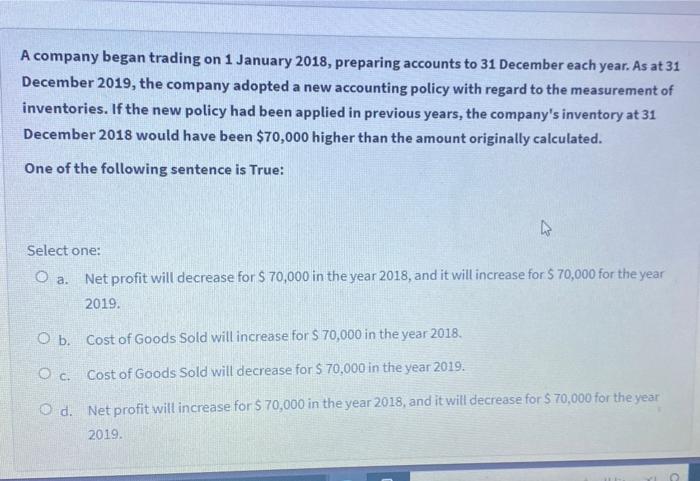

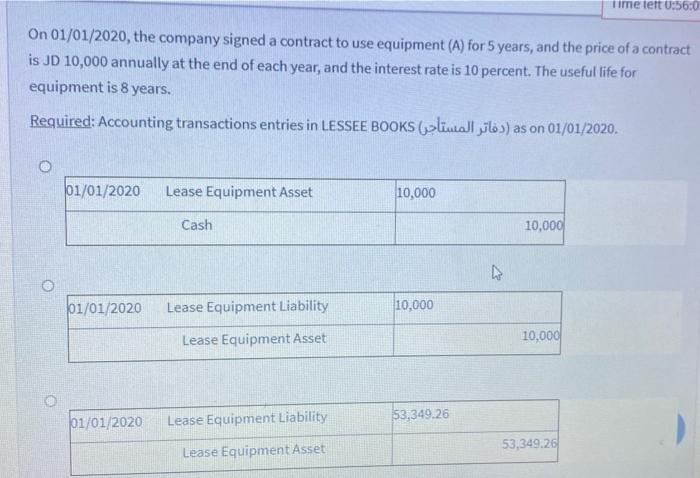

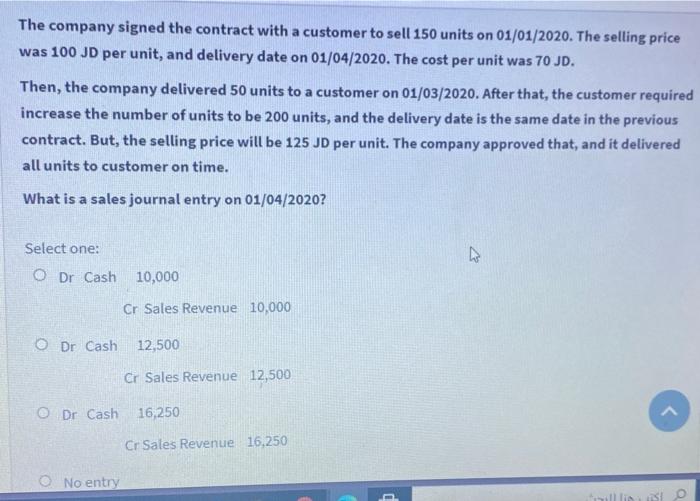

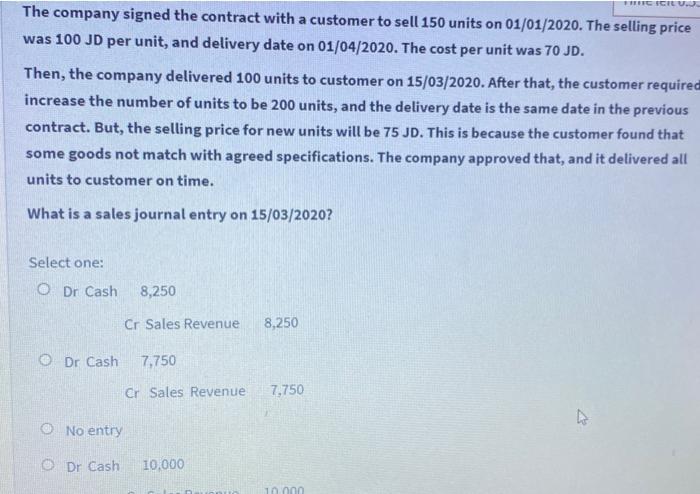

The company provided quantity discount (5%) for the customers if the total sells amounted more than 1 m (JD) during the two years from the relationship date. On 15/02/2020, the company sold units for 250,000 JD to a customer. The company expected that the customer will purchase units in more than 1 m (JD) during the next two years. The cost of unit was 210,000 JD. What is a sales journal entry on 15/02/2020? Select one: O Dr Cash 250,000 Cr Sales Revenue 237,500 Cr Allowance of quantity discount 12,500 O Dr Cash 237,500 Cr Sales Revenue 237,500 Dr Cash 237,500 Dr Sales discount 12,500 UN BRAND Mch edu/mod/quimolattempted to Cash 350,000 C Sales venue 250,000 Time 500 Question 3 On 01/01/2019, the company told 150 units (not receivable, interest and maturity date 31/12/2031) to a customer. The selling price was 75.D per unit, and the cost of unit was 700 What is a sales journal entry on 01/01/2017 F Select one O or cash CS 14 entry Note Web 16. 1 Cabes Cunedine 111 Or Note or sales tevenue and On 01/01/2020, the government provided equipment by JD 350,000 to the company as a grant in order to reducing environmental pollution. The company paid JD 750,000 for the equipment in order to use the government equipment grant. The salvage value at the end of the period is JD 100,000. The useful life for this equipment is 7 years and the company uses straight-line depreciation method. Then the company achieved JD 1,000,000 for each year as a profit before grant and depreciation expense. On 01/01/2026, the government is required return JD 250,000 from the grant that provided to the company on 01/01/2020, and the company approved pay this amount on 01/04/2026. So, the accounting transaction entry when the company pays this amount to the government is. Do Unearned grant revenue 1250000 Cash 250000 Unearned grant revenue 250000 The company signed the contract with a customer to sell 300 units on 01/01/2020. The selling price was 150 JD per unit, and delivery date on 15/03/2020. The cost per unit was 75 JD. What is a sales journal entry on 01/01/2020? Select one: O Dr Cost of goods sold 22,500 Cr Inventories 22.500 O Dr Cash 45,000 Cr Sales Revenue 45,000 O No entry Dr Cash 22,500 Cr Sales Revenue 22.500 My Courses Time left 0:58:11 Malik PLC has recently issued financial statements for the year ended 31 December 2019. Following timeline of events preceded the issuance of financial statements: Date Event 31 December 2019 Year End 10 January 2020 Preparation of financial statements. 20 January 2020 Approval by the Audit Committee for presentation of financial statements to the Board of Directors for their approval 25 January 2020 Public announcement of key financial results. 26 January 2020 Approval by Board of Directors for the presentation of financial statements at the Annual General Meeting (AGM) for approval by the shareholders 28 January 2020 Approval of financial statements by shareholders at the AGM 30 January 2020 Issuance of copies of annual report to shareholders. What is the last relevant date for the consideration of the Events after Reporting Period of the issued financial statements? Time left 0:57:55 The company signed the contract with a customer to sell 150 units on 01/01/2020. The selling price was 100 JD per unit, and delivery date on 01/04/2020. The cost per unit was 70 JD. Then, the company delivered 110 units to customer on 15/03/2020. After that, the customer required increase the number of units to be 200 units, and the delivery date is the same date in the previous contract. But, the selling price for new units will be 75 JD. This is because the customer found that some goods not match with agreed specifications. The company approved that, and it delivered 50 units to customer on 27/03/2020. What is a sales journal entry on 27/03/2020? Select one: Dr Cash 4,750 Cr Sales Revenue 4.750 O Dr Cash 4,305.56 Cr Sales Revenue 4,305,56 O Dr Cash 4,444 Cr Sales Revenue 4.444 On 01/01/2020, the government provided 1.5 million cash to the company as a grant in order to reducing environmental pollution, and the company expected that the useful life for this grant is 5 years. The company paid the following costs during the 4 years. 1st year 450,000 2ed year 300,000 Bed year 350,000 14th year 500,000 Total 1,600,000 Required: Accounting transaction entry related to grant revenue at the second year is. Time left 0:57:31 18 wered On 01/01/2020, the company sold 1150 units to a customer, opposite equipment from the customer. The fair value for the equipment was 110,000 JD. The selling price was 100 JD per unit, and the cost of unit was 75 JD. of 1.00 stion What is a sales journal entry on 01/01/2020? Select one: O Dr Equipment 110,000 Cr Sales Revenue 110,000 O Dr Equipment 115,000 Cr Sales Revenue 115,000 Dr Equipment 110,000 Dr Sales Losses 5,000 Cr Sales Revenue 115,000 Dr Cash 115,000 Cr Sales Revenue 115.000 Time left 0:57: On 01/01/2016 the company purchased equipment by JD 500,000, and no salvage value for it at the end the useful life. It used the fixed depreciation method (straight-line). The useful life for it is 7 years. At the end of the year 2020, the company decided that salvage value for it to be 25,000. So, the depreciation expense value for the year 2020 will be: Select one: O a. 71,428.57 O b. 63,095.24 ET O c. 214,285.71 O d. 67,857.14 Time left 0:57 On 01/01/2015 the company purchased equipment by JD 300,000, and no salvage value for it at the end the useful life. It used the fixed depreciation method (straight-line). The useful life for it is 7 years. At the end of the year 2019, the company decided to change the useful life for it to be 10 years. So, the depreciation expense value for the year 2019 will be: Select one: a. Not at all true O b. 17,142.86 c. 21,428.57 O d. 30,000 If the net profit for the year 2019 was $ 150,500, and during the year 2020 the company found some of the following errors that linked to the year 2019: - The salaries by 12,500 not recorded. - Other expenses by 7,500 not recorded. Rent revenue by 7,000 not recorded. Thus, the net profit for the year 2019 will be: Select one: O a. 130,500 only and the other errors will include in the year 2020 O b. 150,500 and all the errors include in the year 2020. Oc. There is no right choice Od 137,500 because all the errors should correct based on the year 2019. on the form of the statement of financial On 01/01/2020, the company signed a contract to provide equipment (A) to Malik Company for 7 years. The useful life for this equipment is 10 years. Malik Company will pay $ 20000 at the end of each year during the period. The interest rate is 10 percent, and at the end of the period, the company is expected that the Malik Company will own this equipment. The cash selling price for this equipment is S 97,368.4. Required: Accounting transaction entry in LESSOR BOOKS (gall flos) on 01/01/2020 is: 01/01/2020 A/R 140,000 Equipment 140,000 01/01/2020 AR 97,368.4 Interest expenses 426316 Equipment 140,000