Answered step by step

Verified Expert Solution

Question

1 Approved Answer

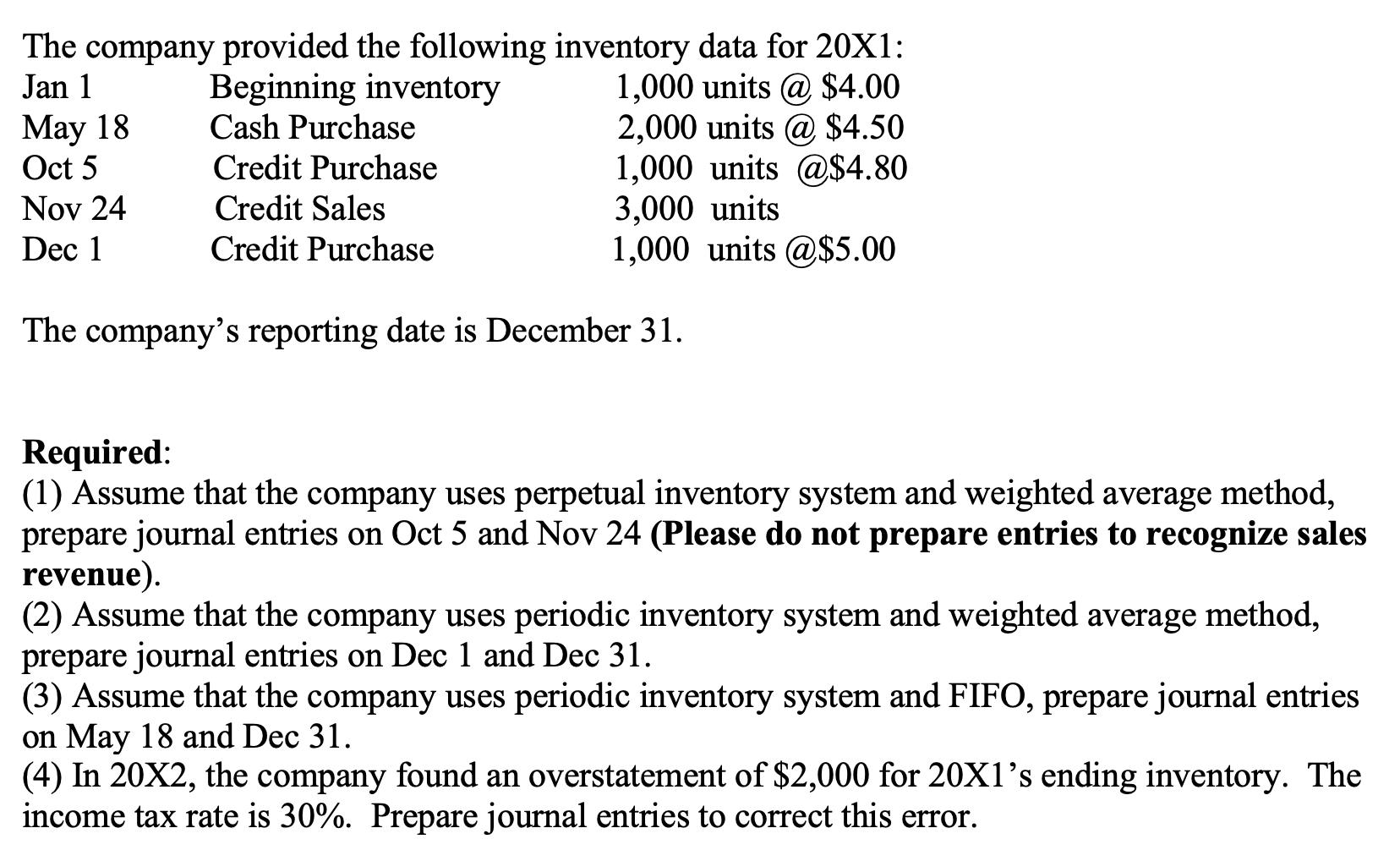

The company provided the following inventory data for 20X1: Jan 1 1,000 units @ $4.00 2,000 units @ $4.50 1,000 units @$4.80 3,000 units

The company provided the following inventory data for 20X1: Jan 1 1,000 units @ $4.00 2,000 units @ $4.50 1,000 units @$4.80 3,000 units 1,000 units @$5.00 Beginning inventory Cash Purchase May 18 Oct 5 Credit Purchase Nov 24 Credit Sales Dec 1 Credit Purchase The company's reporting date is December 31. Required: (1) Assume that the company uses perpetual inventory system and weighted average method, prepare journal entries on Oct 5 and Nov 24 (Please do not prepare entries to recognize sales revenue). (2) Assume that the company uses periodic inventory system and weighted average method, prepare journal entries on Dec 1 and Dec 31. (3) Assume that the company uses periodic inventory system and FIFO, prepare journal entries on May 18 and Dec 31. (4) In 20X2, the company found an overstatement of $2,000 for 20X1's ending inventory. The income tax rate is 30%. Prepare journal entries to correct this error.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question Part 1 Oct 5 2011 Inventory account Dr 4800 To Accounts Payable 4800 Credit purchase of 1000 units 48 per Unit Nov 24 2011 Cost of Goods Sold Dr 13500 To Inventory account 13500 Sales of 3000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60915c5d9aedc_204112.pdf

180 KBs PDF File

60915c5d9aedc_204112.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started