Question

The company Seat has a new project, and is asking BBVA, the bank where you work as a credit manager a loan to proceed with

The company Seat has a new project, and is asking BBVA, the bank where you work as a credit manager a loan to proceed with the investment for an amount of 500.000 to be paid in 5 years.

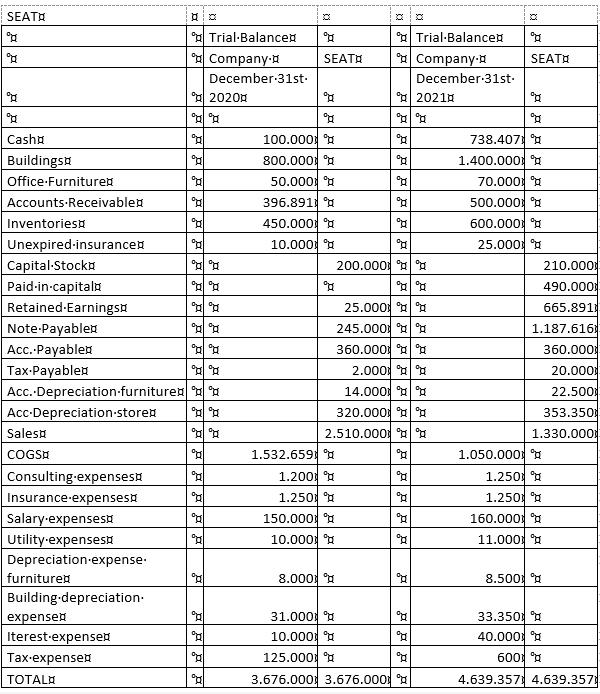

The company has delivered to you the trial balance for the years 2020 and 2021.

The company was founded in 1980 and has 100000 shares outstanding.

During the year the company issued 5000 shares at a market value of 100€.

Instructions:

Prepare Income statement for years 2020 and 2021 (10 points)

Balance Sheet for the years 2020 and 2021 (10 points)

Prepare Cash Flow for the year 2021. (30 points)

How do you explain the difference between the net income of year 2021 and the Operating Cash Flow of year 2021. (5 points)

How much is the investment for 2021 (assume all investments were paid in cash). (5 points)

What would you answer the company regarding the request for the loan? (5 points)

How much is the Earnings per share in years 2020 and 2021? (5 points)

How much is the PE ratio in year 2021? (10 points)

Explain your calculations in detail, only the answer is not enough.

SEATH 1 Trial-Balancen Company-a A Trial-Balancen Company- SEATH SEATH December-31st- December-31st- 2020 2021H Casha 100.000 738.407 Buildingst 800.000 1.400.000 Office-Furnituren 50.000 70.000 Accounts-Receivablen 396.891 a 500.000 A 450.000 A 600.000 Inventoriesa Unexpired-insurancer Capital-Stockr Paid-in-capitaln Retained-Earningsa Note-Payabler Acc. Payablen Tax-Payablen Acc. Depreciation-furnituret Acc-Depreciationstoren 10.000 25.000 200.000 H 210.000 490.000 25.000 245.00 665.891 1.187.616 360.000 H 360.000 2.000 20.000 14.000 22.500 320.000 353.350 Salesa 2.510.000 1.330.000 COGSH 1.532.659 1.050.000 A Consulting-expensest 1.200 1.250 Insurance-expenses 1.250 1.250 150.000 A 160.000 A Salary-expensesa Utility-expensesa Depreciation-expense- 10.000 11.000 furnituren 8.000 8.500 Building depreciation: expenset 31.000 a 33.350 Iterest-expensen 10.000 40.000 Tax-expensen 125.000 600 TOTALA 3.676.000 3.676.000 4.639.357 4.639.357

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Particular 2020 2021 Amount Amount Amount Amount Sales 251000000 133000000 Cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started