Question

Consider the following linear probability model of loan approvals. Interpret the coefficients on Black and Loan_amt in the OLS model in Figure 1. Test the

Consider the following linear probability model of loan approvals.

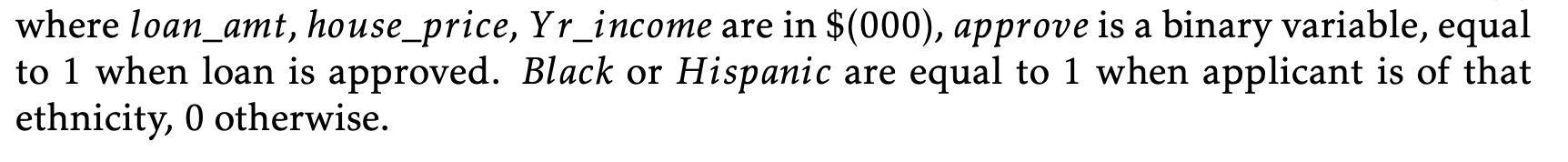

Interpret the coefficients on Black and Loan_amt in the OLS model in Figure 1.

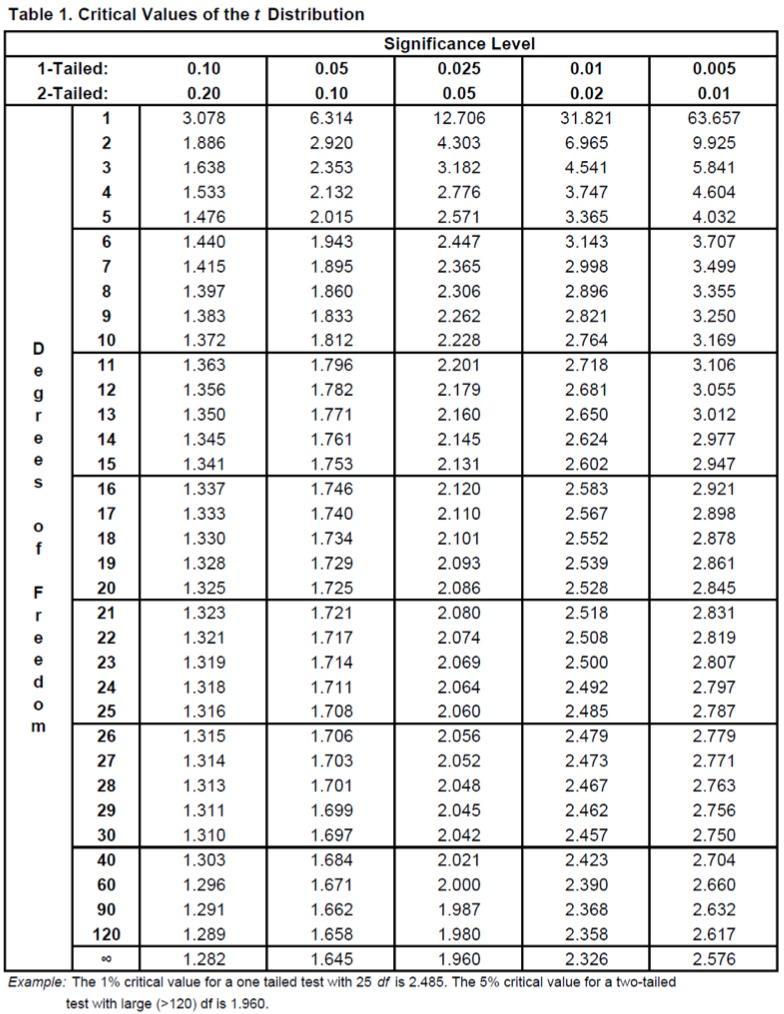

Test the hypothesis that the coefficients on Black and Hispanic is equal. The Var(βblack −βHispanic)= 0.00142395.

Why is heteroskedasticity present in the model? Outline the steps that should be taken to correct the model for heteroskedasticity.

There are 35 observations with predicted values under 0, or over 1. Is this a problem and how do we overcome it?

A WLS model’s output is shown in Figure 2. What are its advantages and how can we observe that from the Stata output? The t-test using WLS for (2) is now -1.734, does this change your conclusion in (2)?

![- reg approve loanamt appinc appinc2 price black hispan [aweight=1/h] (sum of wgt is ( 5.0074 mathrm{e}+04 ) ) Figure 2: L](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/63219046310e3_1663143997516.jpg)

approve = Bo+loan_amt+house_price+3 Yr_income+Yr_income+5Black+Hispanic+u

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of the annual constant growth rate g ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started