Answered step by step

Verified Expert Solution

Question

1 Approved Answer

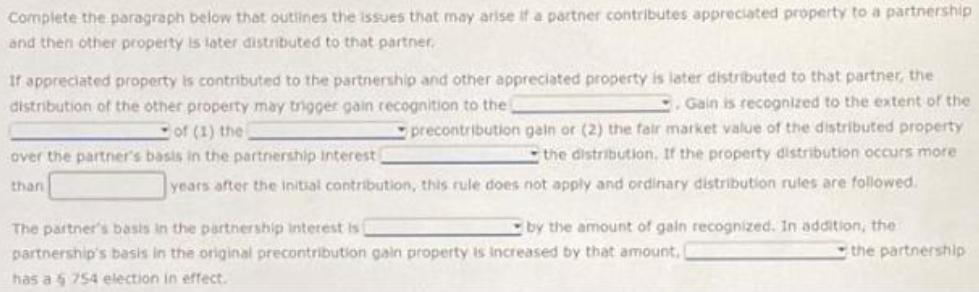

Complete the paragraph below that outlines the issues that may arise if a partner contributes appreciated property to a partnership and then other property

Complete the paragraph below that outlines the issues that may arise if a partner contributes appreciated property to a partnership and then other property is later distributed to that partner. If appreciated property is contributed to the partnership and other appreciated property is later distributed to that partner, the distribution of the other property may trigger gain recognition to the Gain is recognized to the extent of the precontribution gain or (2) the fair market value of the distributed property the distribution. If the property distribution occurs more years after the initial contribution, this rule does not apply and ordinary distribution rules are followed. of (1) the over the partner's basis in the partnership Interest than by the amount of gain recognized. In addition, the the partnership The partner's basis in the partnership interest is partnership's basis in the original precontribution gain property is increased by that amount, has a 5754 election in effect.

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer The distribution of the other property may trigger gain recognition to the Contrbuting partn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started