Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company took out a bank loan of $60,000 with an annual interest rate of 5%. The loan terms require a $1,000 principal repayment

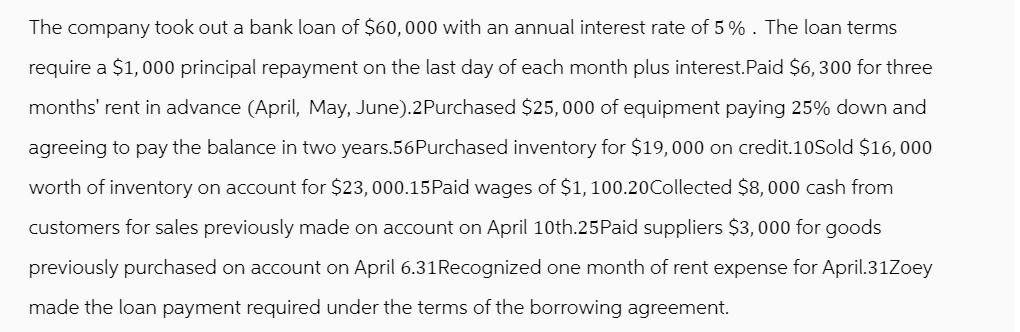

The company took out a bank loan of $60,000 with an annual interest rate of 5%. The loan terms require a $1,000 principal repayment on the last day of each month plus interest.Paid $6,300 for three months' rent in advance (April, May, June).2 Purchased $25,000 of equipment paying 25% down and agreeing to pay the balance in two years.56Purchased inventory for $19,000 on credit.10Sold $16,000 worth of inventory on account for $23,000.15Paid wages of $1,100.20Collected $8,000 cash from customers for sales previously made on account on April 10th.25Paid suppliers $3,000 for goods previously purchased on account on April 6.31 Recognized one month of rent expense for April.31Zoey made the loan payment required under the terms of the borrowing agreement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Loan payment Debit Cash 1000 Credit Loan Payable 1000 Rent payment Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started