Question

The company Transport OCD Ltd. is considering alternative investments which are related to its logistics centre. Specifically, it is considering investing its capital and it

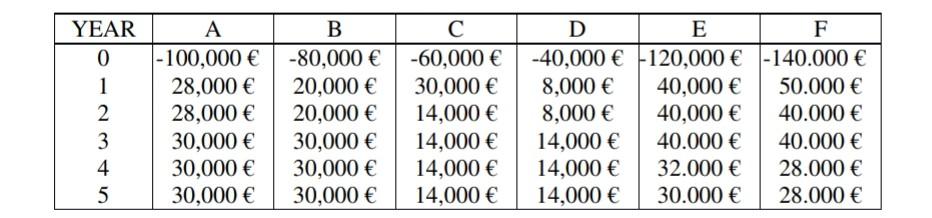

The company Transport OCD Ltd. is considering alternative investments which are related to its logistics centre. Specifically, it is considering investing its capital and it evaluates the following investments and the relevant cash flows (inflows and outflows): A, B, C, D, E and F.

PLEASE ANSWER THE FOLLOWING QUESTIONS If the firms cost of capital is 10% it is required: A. Calculate Net Present Value, Internal Rate of Return and Simple Payback for each project. B. Classify each investment according to each of the aforementioned three criteria (NPV, IRR and SP). C. Which investments according to your opinion should Transport OCD Ltd. undertake if it had 240,000 as available funds for investment? D. How your answer in question C would change if Transport OCD Ltd. could attract extra funding (i) 60,000 more (ii) 100,000?

YEAR 0 1 2 3 4 5 A B -100,000 -80,000 28,000 20,000 28,000 20,000 30,000 30,000 30,000 30,000 30,000 30,000 D E F -60,000 -40,000 120,000 -140.000 30,000 8,000 40,000 50.000 14,000 8,000 40,000 40.000 14,000 14,000 40.000 40.000 14,000 14,000 32.000 28.000 14,000 14,000 30.000 28.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started