Question

Refer to the financial statements of Urban Outfitters given in Appendix C at the end of this book. Required: 1. The company uses lower of

Refer to the financial statements of Urban Outfitters given in Appendix C at the end of this book.

Required:

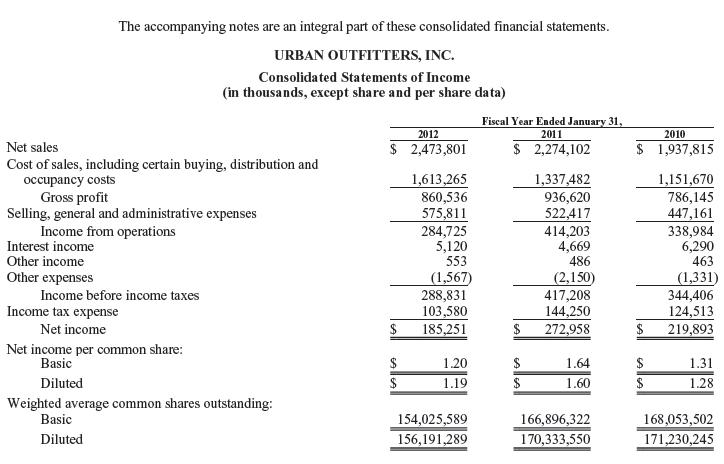

1. The company uses lower of cost or market to account for its inventory. At the end of the year, do you expect the company to write its inventory down to replacement cost or net realizable value? Explain your answer.

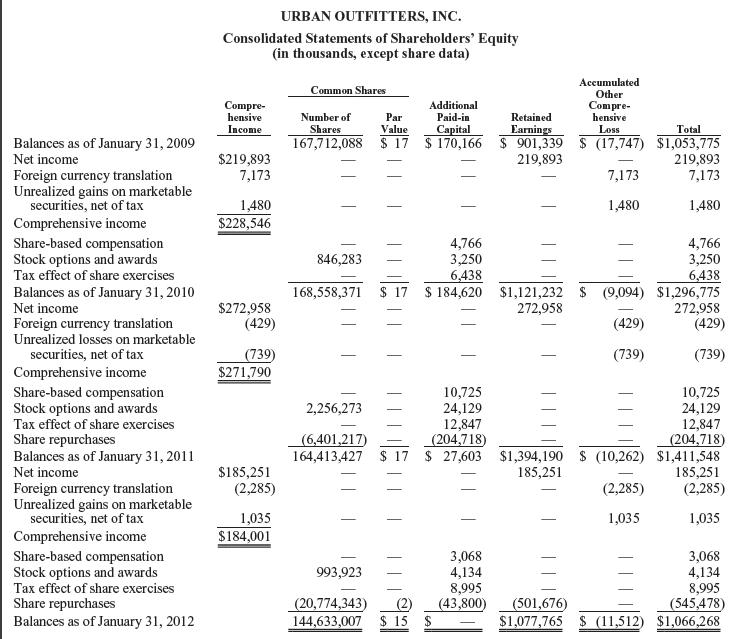

2. What method does the company use to determine the cost of its inventory? Where did you find this information?

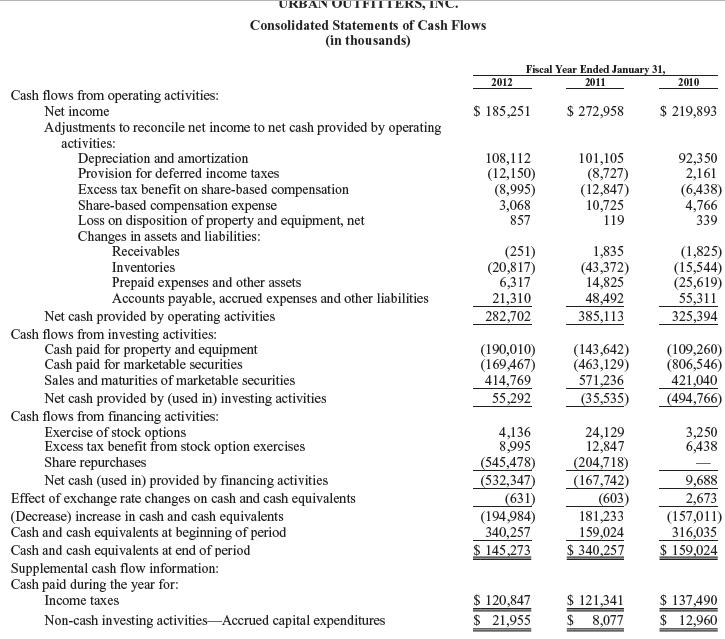

3. If the company overstated ending inventory by $10 million for the year ended January 31, 2012, what would be the corrected value for Income before Income Taxes?

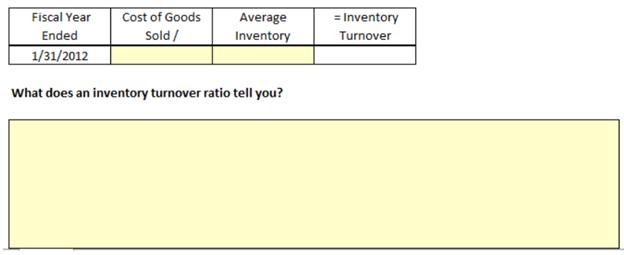

4. Compute the inventory turnover ratio for the current year.

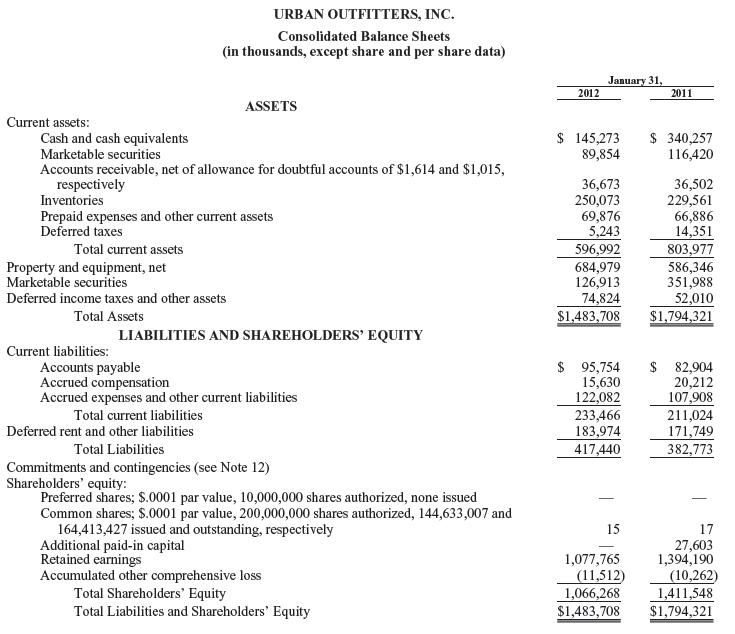

URBAN OUTFITTERS, INC. Consolidated Balance Sheets (in thousands, except share and per share data) January 31, 2011 2012 ASSETS Current assets: $ 145,273 89,854 $ 340,257 116,420 Cash and cash equivalents Marketable securities Accounts receivable, net of allowance for doubtful accounts of $1,614 and $1,015, respectively Inventories Prepaid expenses and other current assets Deferred taxes 36,673 250,073 69,876 5,243 596,992 684,979 126,913 74,824 $1,483,708 36,502 229,561 66,886 14,351 803,977 586,346 351,988 52,010 $1,794,321 Total current assets Property and equipment, net Marketable securities Deferred income taxes and other assets Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: $ 95,754 15,630 122,082 233,466 183,974 417,440 $ 82,904 20,212 107,908 211,024 171,749 382,773 Accounts payable Accrued compensation Accrued expenses and other current liabilities Total current liabilities Deferred rent and other liabilities Total Liabilities Commitments and contingencies (see Note 12) Shareholders' equity: Preferred shares; $.0001 par value, 10,000,000 shares authorized, none issued Common shares; $.0001 par value, 200,000,000 shares authorized, 144,633,007 and 164,413,427 issued and outstanding, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total Shareholders' Equity Total Liabilities and Shareholders' Equity 15 17 1,077,765 (11,512) 1,066,268 $1,483,708 27,603 1,394,190 (10,262) 1,411,548 $1,794,321

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 In my opinion the company should write down its inventory to replacement cost It is because t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started