Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company whishes to distribute $200,000 to its shareholders The company has 30,000 shares of common stock outstanding 1. Assuming the value of the

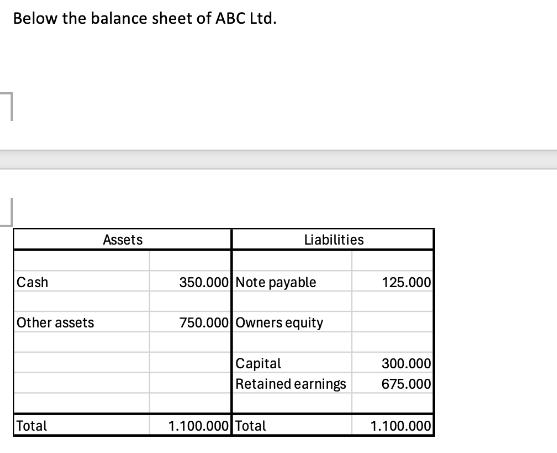

The company whishes to distribute $200,000 to its shareholders The company has 30,000 shares of common stock outstanding 1. Assuming the value of the company equals the value of its total assets, what are the par value and market value of one share of stock? 2. Prepare a balance sheet of the company in case it decides to distribute a $200,000 dividend. Calculate the value of one share of stick after the dividend payment 3. Assume now that instead of paying dividends the company decides to repurchase some of its stocks for $200,000. Prepare the balance sheet after the stock repurchase and calculate the new value of one share of stock 1 Below the balance sheet of ABC Ltd. Assets Liabilities Cash 350.000 Note payable 125.000 Other assets 750.000 Owners equity Capital 300.000 Retained earnings 675.000 Total 1.100.000 Total 1.100.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started