Question

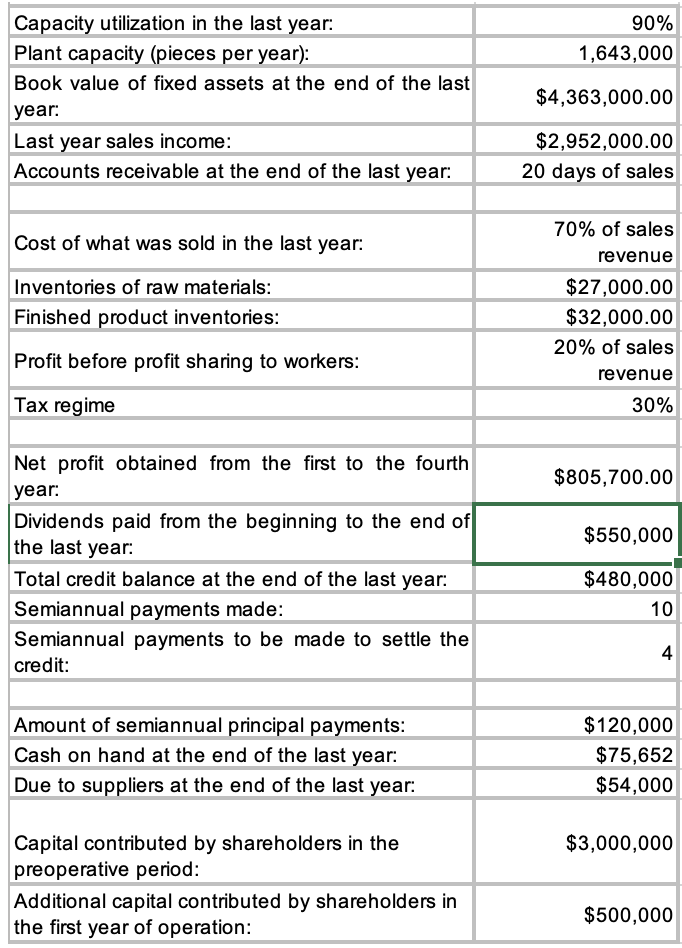

The company XYZ, S.A. de C.V. 5 years ago it set up an industrial plant to manufacture product A. To carry out the installation it

The company XYZ, S.A. de C.V. 5 years ago it set up an industrial plant to manufacture product A. To carry out the installation it was necessary to take out a long-term loan.

The business, like most companies that start operations, obtained significant losses in the first year of operation; however, from the second year on, he has been working with great success. Therefore, you, who have businesses in the same industrial sector, are interested in acquiring the total share package.

Current investors are willing to sell if they are paid 125% of its original value for each share.

The available information that they can give you so that you know the current situation of the company is the following:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started