Answered step by step

Verified Expert Solution

Question

1 Approved Answer

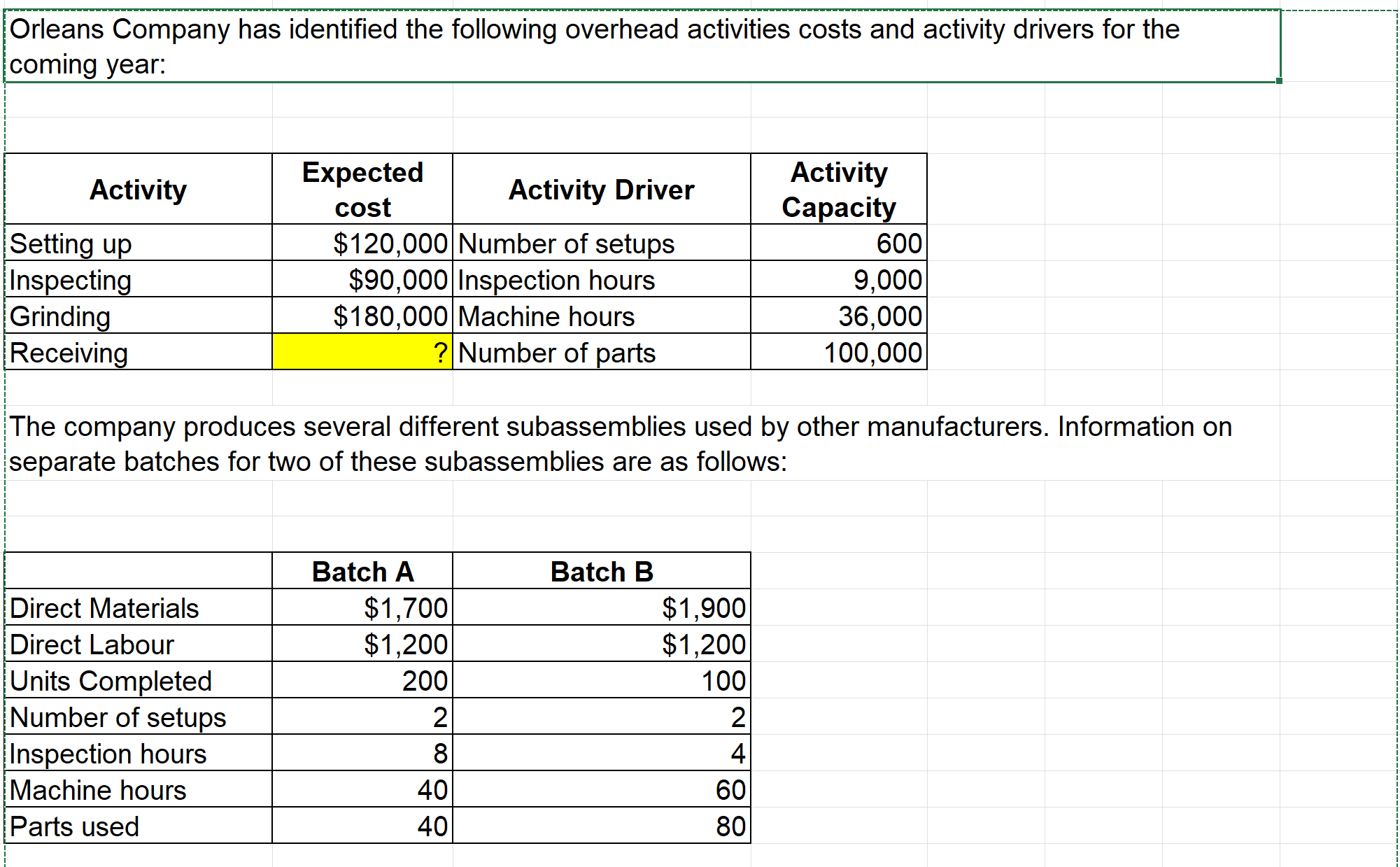

The company's normal activity is 20,000 direct labour hours. Each batch uses 100 hours of direct labour. Upon investigation, you discover that Receiving employs a

| The company's normal activity is 20,000 direct labour hours. Each batch uses 100 hours of direct labour. Upon investigation, you discover that Receiving employs a worker, who spends 75% of her time on the receiving activity and 25% of her time on inspecting products. Her salary is $80,000. Receiving also uses a forklift, at a cost of $12,000 per year for depreciation and fuel. The forklift is used only in receiving. | ||||||||

| Requirments: | ||||||||

| Part A (2.5 marks) | show all calculations .5 marks for solution; 2 marks for calculations | |||||||

| What is the total cost assigned to the receiving activity? In other words what would be the amount for the table above | ||||||||

| Part B (2.5 marks) | show all calculations .5 marks for solution; 2 marks for calculations | |||||||

| What is The activity rate for receiving? | ||||||||

| Part C (2.5 marks) | show all calculations .5 marks for solution; 2 marks for calculations | |||||||

| What is the activity rate for setting up equipment? | ||||||||

| Part D (2.5 marks) | show all calculations .5 marks for solution; 2 marks for calculations | |||||||

| What is the activity rate for Grinding? | ||||||||

| Part E (2.5 marks) | show all calculations .5 marks for solution; 2 marks for calculations | |||||||

| What is the unit cost for Batch A, using activity rates? | ||||||||

| Part F (2.5 marks) | show all calculations .5 marks for solution; 2 marks for calculations | |||||||

| If direct labour hours are used to assign total overhead costs, what is the rate per Direct Labour Hour? |

Orleans Company has identified the following overhead activities costs and activity drivers for the coming year: The company produces several different subassemblies used by other manufacturers. Information on separate batches for two of these subassemblies are as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started