Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The company's ownership group has come to you for guidance. They are considering whether to sell their company; they want you to determine the

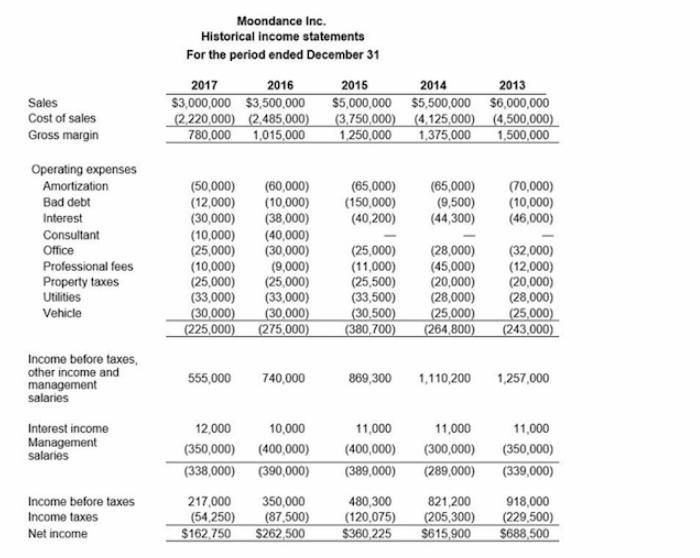

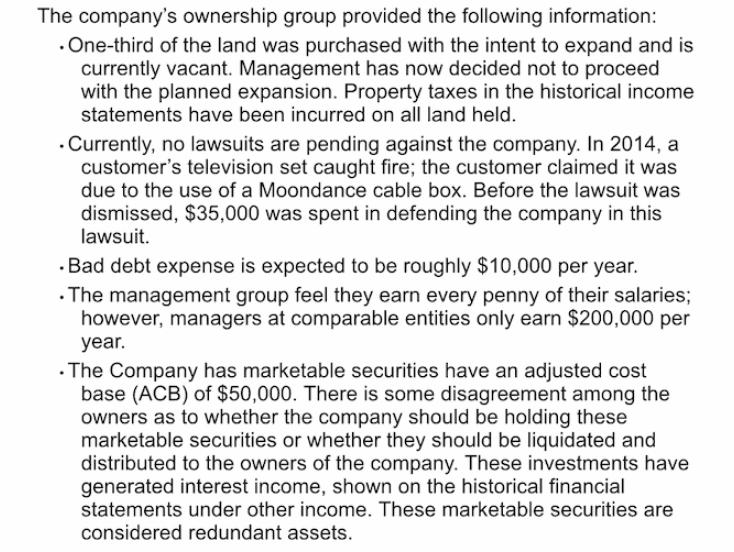

The company's ownership group has come to you for guidance. They are considering whether to sell their company; they want you to determine the fair market value (FMV) of the shares of the company under the capitalized cash flow approach assuming the company does not go forward with the 3D high-definition product. As a first step, please provide ownership with a Normalized EBITDA based on the approach discussed in class using the historical information provided below. Your normalization should begin with Income before taxes. Sales Cost of sales Gross margin Operating expenses Amortization Bad debt Interest Consultant Office Professional fees Property taxes Utilities Vehicle Income before taxes, other income and management salaries Interest income Management salaries Income before taxes Income taxes Net income Moondance Inc. Historical income statements For the period ended December 31 2017 2016 $3,000,000 $3,500,000 (2,220,000) (2,485,000) 780,000 1,015,000 (50,000) (60,000) (65,000) (12,000) (10,000) (150,000) (30,000) (38,000) (40,200) (10,000) (40,000) (25,000) (30,000) (10,000) (9,000) (25,000) (25,000) (33,000) (33,000) (30,000) (30,000) (225,000) (275,000) 555,000 740,000 2015 2014 2013 $5,000,000 $5,500,000 $6,000,000 (3,750,000) (4,125,000) (4,500,000) 1,250,000 1,375,000 1,500,000 217,000 350,000 (54,250) (87,500) $162,750 $262,500 (65,000) (9,500) (44,300) (25,000) (28,000) (11,000) (25,500) 869,300 (45,000) (20,000) (33,500) (28,000) (30,500) (25,000) (380,700) (264,800) 12,000 10,000 11,000 11,000 (350,000) (400,000) (400,000) (300,000) (338,000) (390,000) (389,000) (289,000) (70,000) (10,000) (46,000) 1,110,200 1,257,000 480,300 821,200 (120,075) (205,300) $360,225 $615,900 (32,000) (12,000) (20,000) (28,000) (25,000) (243,000) 11,000 (350,000) (339,000) 918,000 (229,500) $688,500 The company's ownership group provided the following information: .One-third of the land was purchased with the intent to expand and is currently vacant. Management has now decided not to proceed with the planned expansion. Property taxes in the historical income statements have been incurred on all land held. . Currently, no lawsuits are pending against the company. In 2014, a customer's television set caught fire; the customer claimed it was due to the use of a Moondance cable box. Before the lawsuit was dismissed, $35,000 was spent in defending the company in this lawsuit. . Bad debt expense is expected to be roughly $10,000 per year. . The management group feel they earn every penny of their salaries; however, managers at comparable entities only earn $200,000 per year. The Company has marketable securities have an adjusted cost base (ACB) of $50,000. There is some disagreement among the owners as to whether the company should be holding these marketable securities or whether they should be liquidated and distributed to the owners of the company. These investments have generated interest income, shown on the historical financial statements under other income. These marketable securities are considered redundant assets.

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided I will calculate the Normalized EBITDA for Moondance Inc using t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started