Answered step by step

Verified Expert Solution

Question

1 Approved Answer

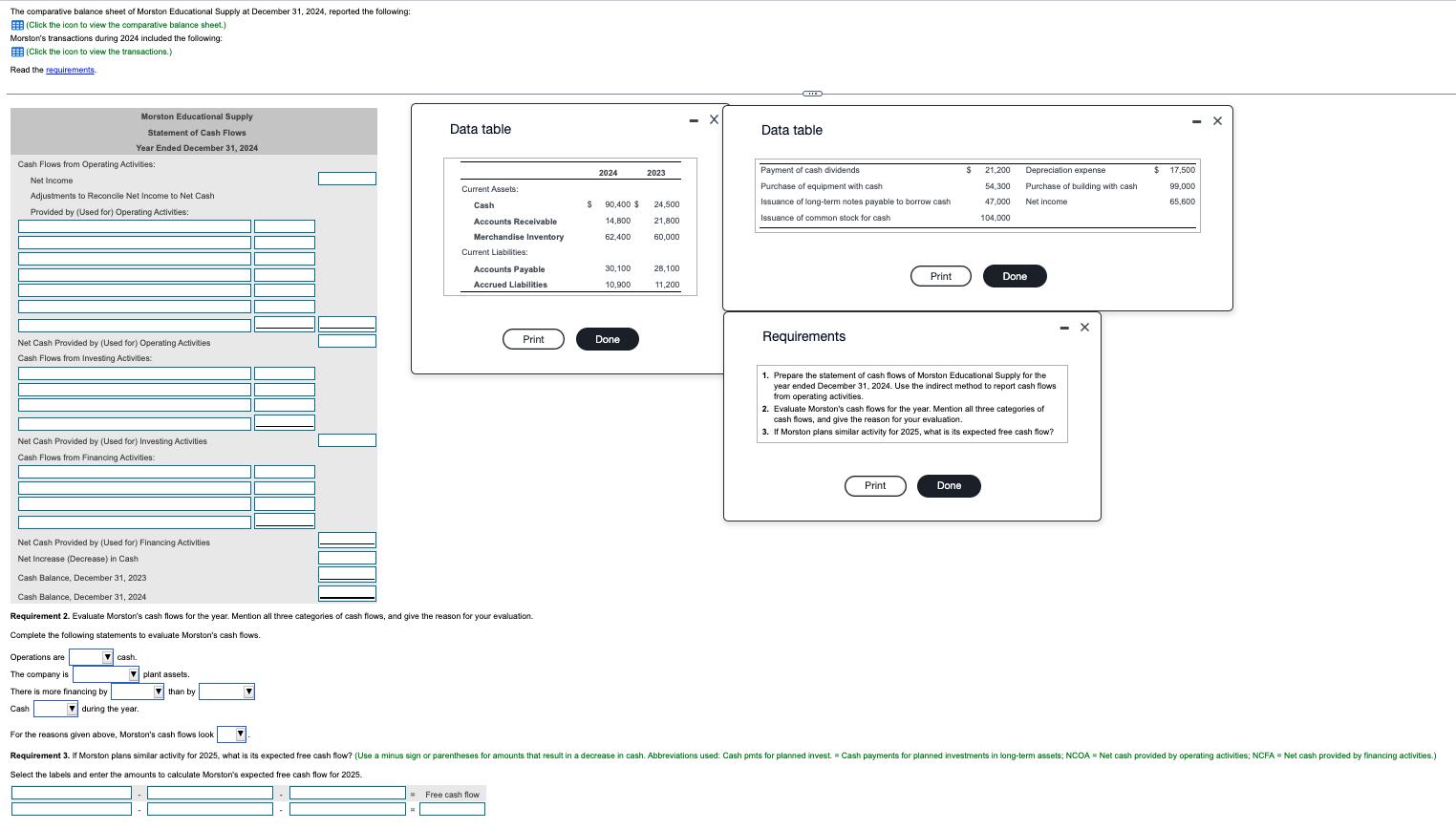

The comparative balance sheet of Morston Educational Supply at December 31, 2024, reported the following: (Click the icon to view the comparative balance sheet.)

The comparative balance sheet of Morston Educational Supply at December 31, 2024, reported the following: (Click the icon to view the comparative balance sheet.) Morston's transactions during 2024 included the following: (Click the icon to view the transactions.) Read the requirements Morston Educational Supply Statement of Cash Flows Data table Year Ended December 31, 2024 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: CI Data table 2024 2023 Payment of cash dividends $ 21,200 Depreciation expense $ 17,500 Current Assets: Purchase of equipment with cash 54,300 Purchase of building with cash Cash $ Accounts Receivable 90,400 $ 14,800 24,500 Issuance of long-term notes payable to borrow cash 47,000 Net income 99,000 65,600 21,800 Issuance of common stock for cash 104,000 Merchandise Inventory 62,400 60,000 Current Liabilities: Accounts Payable 30,100 28,100 Print Done Accrued Liabilities 10,900 11,200 Print Done Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2023 Cash Balance, December 31, 2024 Requirement 2. Evaluate Morston's cash flows for the year. Mention all three categories of cash flows, and give the reason for your evaluation. Complete the following statements to evaluate Morston's cash flows. Requirements 1. Prepare the statement of cash flows of Morston Educational Supply for the year ended December 31, 2024. Use the indirect method to report cash flows from operating activities. 2. Evaluate Morston's cash flows for the year. Mention all three categories of cash flows, and give the reason for your evaluation. 3. If Morston plans similar activity for 2025, what is its expected free cash flow? Print Done - X Operations are The company is cash. plant assets. than by during the year. There is more financing by Cash For the reasons given above, Morston's cash flows look Requirement 3. If Morston plans similar activity for 2025, what is its expected free cash flow? (Use a minus sign or parentheses for amounts that result in a decrease in cash. Abbreviations used: Cash pmts for planned invest. = Cash payments for planned investments in long-term assets; NCOA = Net cash provided by operating activities; NCFA = Net cash provided by financing activities.) Select the labels and enter the amounts to calculate Morston's expected free cash flow for 2025. Free cash flow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started