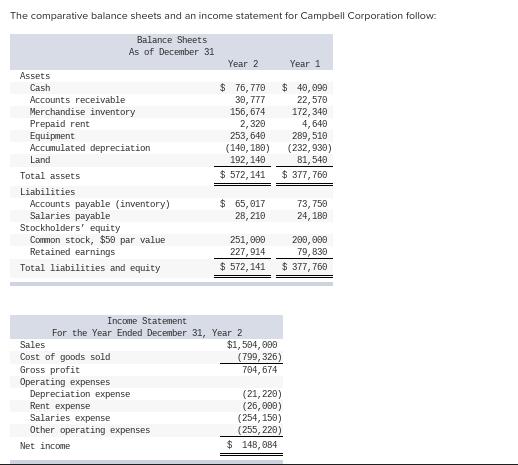

Question: The comparative balance sheets and an income statement for Campbell Corporation follow: Balance Sheets As of December 31 Assets Cash Accounts receivable Merchandise inventory

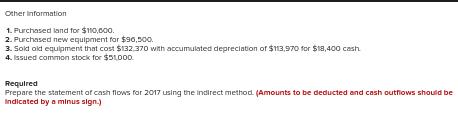

The comparative balance sheets and an income statement for Campbell Corporation follow: Balance Sheets As of December 31 Assets Cash Accounts receivable Merchandise inventory Prepaid rent Equipment Accumulated depreciation Land Total assets Liabilities Accounts payable (inventory) Salaries payable Stockholders' equity Common stock, $50 par value Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit Operating expenses. Year 2 Depreciation expense Rent expense Salaries expense Other operating expenses. Net income $76,770 39,777 156,674 2,329 253, 640 (140, 180) 192,140 $ 572,141 $ 65,017 28, 210 Income Statement For the Year Ended December 31, Year 2 251,000 227,914 $ 572,141 $ 40,090 22,570 172,340 4,640 289,510 (232, 930) 81,540 $ 377,760 $1,504,000 (799, 326) 704,674 Year 1 (21,220) (26,000) (254,150) (255, 229) $ 148, 084 73,750 24,180 200,000 79,839 $ 377,760 Other Information 1. Purchased land for $110,000. 2. Purchased new equipment for $90,500 3. Sold old equipment that cost $132.370 with accumulated depreciation of $113,970 for $18,400 cash 4. Issued common stock for $51,000. Required Prepare the statement of cash flows for 2017 using the indirect method. (Amounts to be deducted and cash outflows should be Indicated by a minus sign.)

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

To prepare the statement of cash flows for Campbell Corporation for the year ended December 31 Year 2 using the indirect method we will follow these steps 1 Start with net income from the Income State... View full answer

Get step-by-step solutions from verified subject matter experts