Question

The comparative balance sheets for 2016 and 2015 and the income statement for 2016 are given below for Arduous Company. Additional information from Arduouss accounting

| The comparative balance sheets for 2016 and 2015 and the income statement for 2016 are given below for Arduous Company. Additional information from Arduouss accounting records is provided also. |

| ARDUOUS COMPANY Comparative Balance Sheets December 31, 2016 and 2015 ($ in millions) | ||||

| 2016 | 2015 | |||

| Assets | ||||

| Cash | $ | 150 | $ | 98 |

| Accounts receivable | 207 | 228 | ||

| Investment revenue receivable | 23 | 21 | ||

| Inventory | 223 | 217 | ||

| Prepaid insurance | 21 | 30 | ||

| Long-term investment | 207 | 142 | ||

| Land | 230 | 167 | ||

| Buildings and equipment | 429 | 434 | ||

| Less: Accumulated depreciation | (113) | (154) | ||

| Patent | 47 | 50 | ||

| $ | 1,424 | $ | 1,233 | |

| Liabilities | ||||

| Accounts payable | $ | 67 | $ | 99 |

| Salaries payable | 23 | 35 | ||

| Bond interest payable | 25 | 21 | ||

| Income tax payable | 29 | 34 | ||

| Deferred income tax liability | 45 | 25 | ||

| Notes payable | 31 | 0 | ||

| Lease liability | 99 | 0 | ||

| Bonds payable | 232 | 309 | ||

| Less: Discount on bonds | (39) | (42) | ||

| Shareholders Equity | ||||

| Common stock | 463 | 427 | ||

| Paid-in capitalexcess of par | 117 | 102 | ||

| Preferred stock | 92 | 0 | ||

| Retained earnings | 266 | 223 | ||

| Less: Treasury stock | (26) | 0 | ||

| $ | 1,424 | $ | 1,233 | |

| ARDUOUS COMPANY Income Statement For Year Ended December 31, 2016 ($ in millions) | ||||||

| Revenues and gain: | ||||||

| Sales revenue | $ | 575 | ||||

| Investment revenue | 29 | |||||

| Gain on sale of treasury bills | 2 | $ | 606 | |||

| Expenses and loss: | ||||||

| Cost of goods sold | 197 | |||||

| Salaries expense | 90 | |||||

| Depreciation expense | 11 | |||||

| Patent amortization expense | 2 | |||||

| Insurance expense | 24 | |||||

| Bond interest expense | 45 | |||||

| Loss on machine damage | 28 | |||||

| Income tax expense | 53 | 450 | ||||

| Net income | $ | 156 | ||||

| Additional information from the accounting records: | |

| a. | Investment revenue includes Arduous Companys $23 million share of the net income of Demur Company, an equity method investee. |

| b. | Treasury bills were sold during 2016 at a gain of $2 million. Arduous Company classifies its investments in Treasury bills as cash equivalents. |

| c. | A machine originally costing $104 million that was one-half depreciated was rendered unusable by a flood. Most major components of the machine were unharmed and were sold for $24 million. |

| d. | Temporary differences between pretax accounting income and taxable income caused the deferred income tax liability to increase by $20 million. |

| e. | The preferred stock of Tory Corporation was purchased for $42 million as a long-term investment. |

| f. | Land costing $63 million was acquired by issuing $32 million cash and a 15%, four-year, $31 million note payable to the seller. |

| g. | The right to use a building was acquired with a 15-year lease agreement; present value of lease payments, $99 million. |

| h. | $77 million of bonds were retired at maturity. |

| i. | In February, Arduous issued a 6% stock dividend (3 million shares). The market price of the $6 par value common stock was $8.50 per share at that time. |

| j. | In April, 1 million shares of common stock were repurchased as treasury stock at a cost of $26 million. |

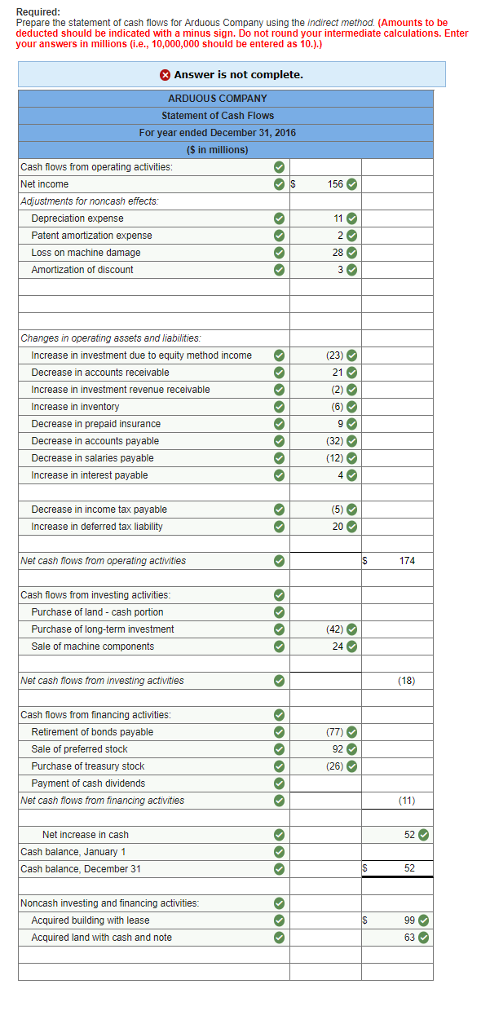

| Required: | |

| Prepare the statement of cash flows for Arduous Company using the indirect method. (Amounts to be deducted should be indicated with a minus sign. Do not round your intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10.).) | |

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started