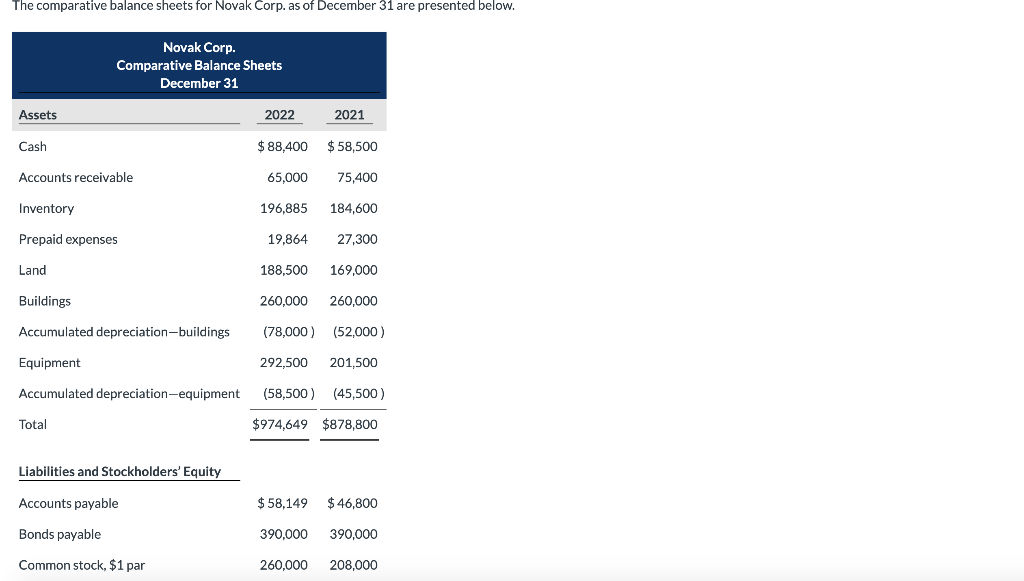

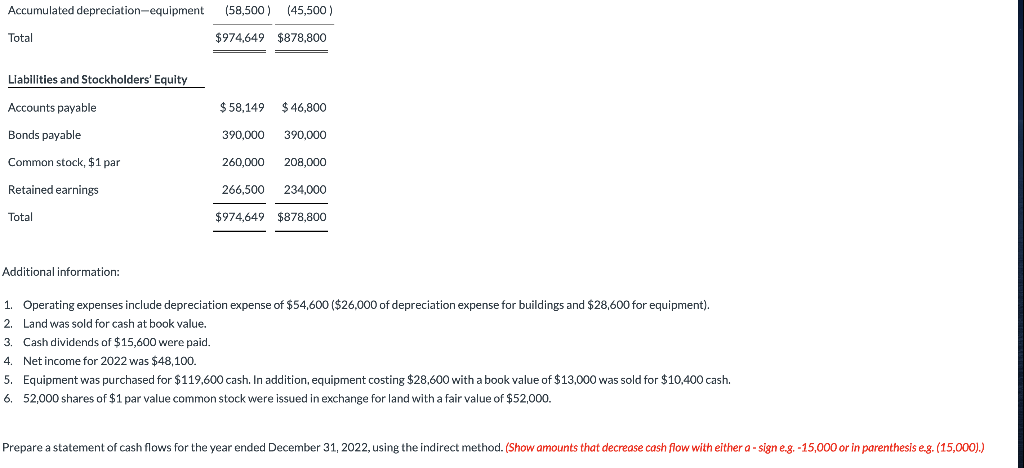

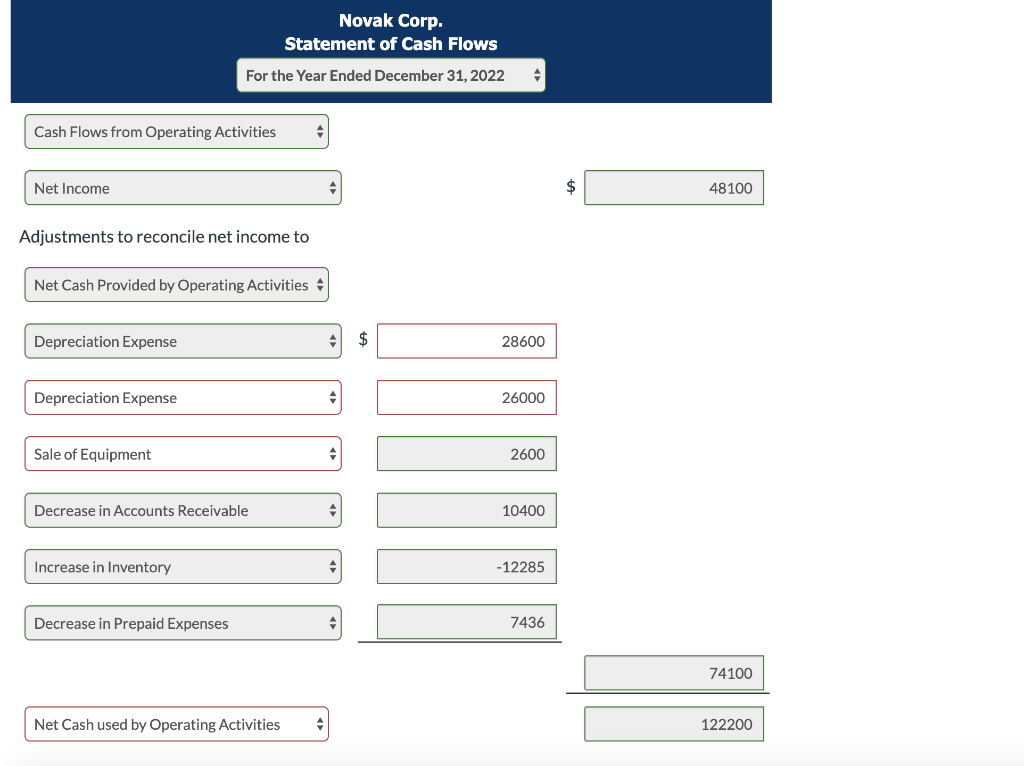

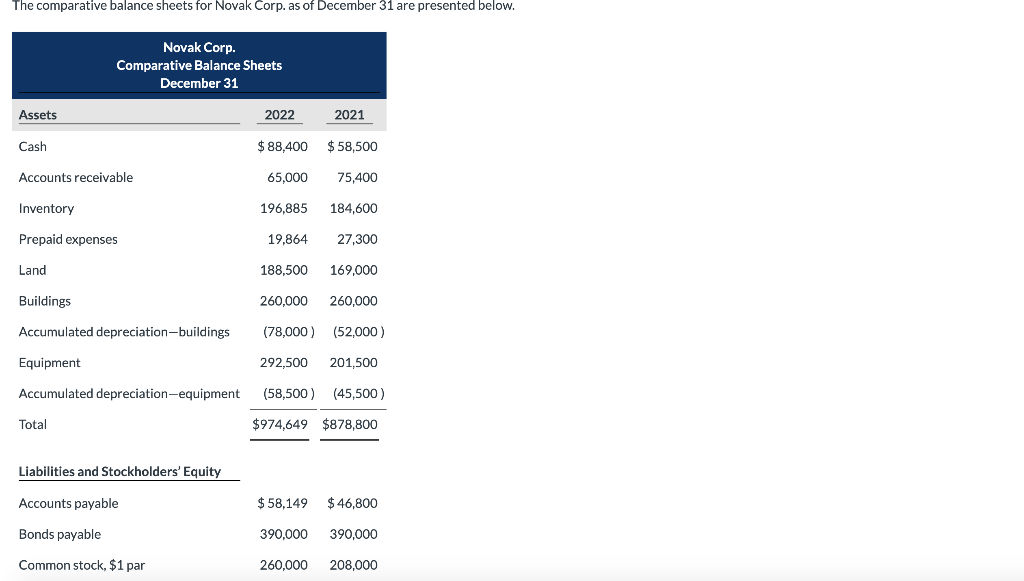

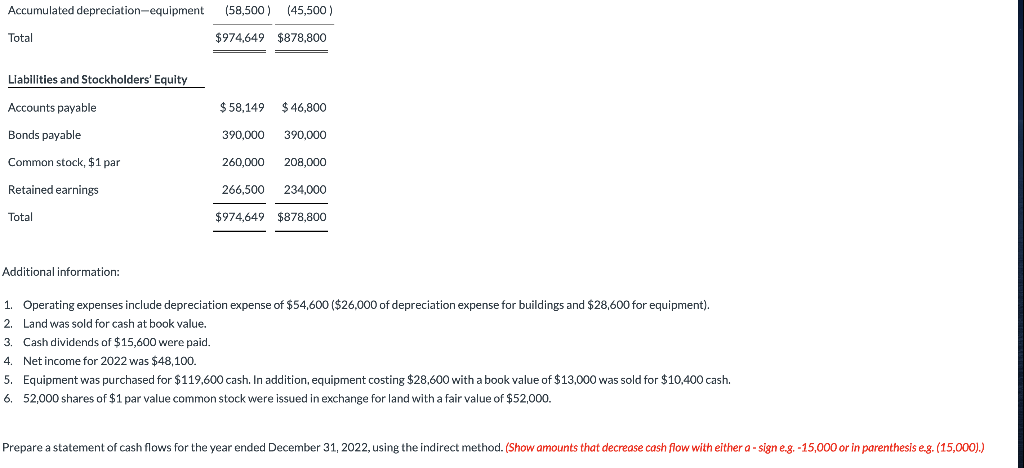

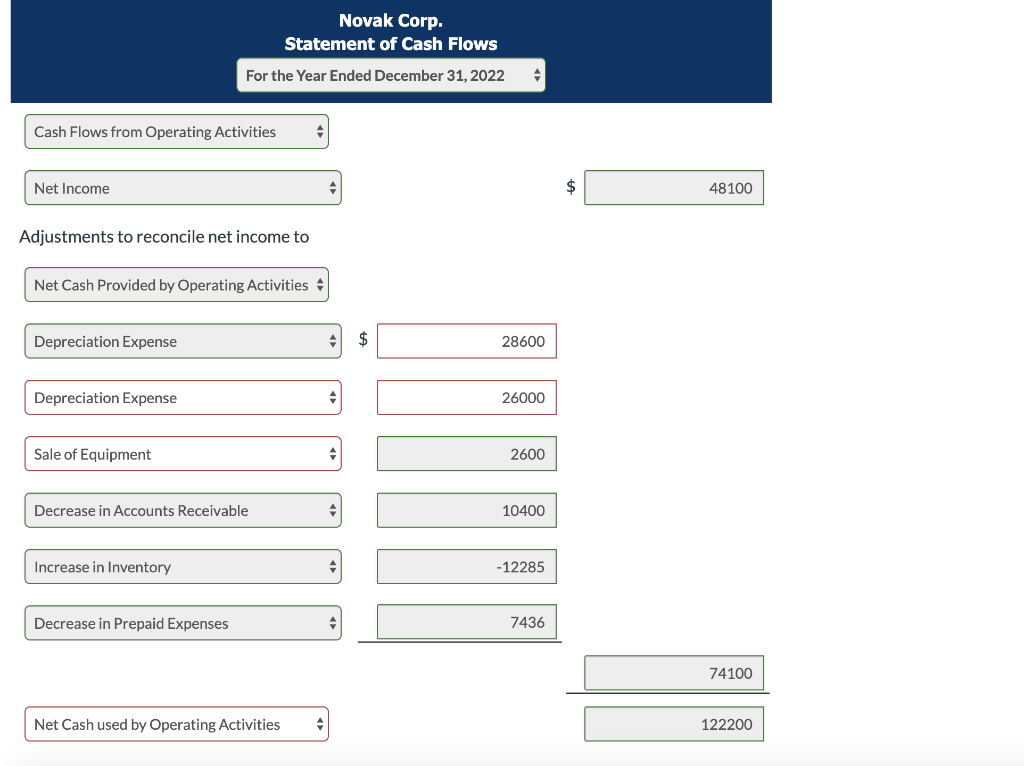

The comparative balance sheets for Novak Corp. as of December 31 are presented below. Novak Corp. Comparative Balance Sheets December 31 Assets 2022 2021 Cash $ 88,400 $ 58,500 Accounts receivable 65,000 75,400 Inventory 196,885 19,864 184,600 27,300 Prepaid expenses Land 188,500 169,000 Buildings 260,000 260,000 Accumulated depreciation-buildings (78,000) (52,000) Equipment 292,500 (58,500 201,500 (45,500) Accumulated depreciation-equipment Total $974,649 $878,800 Liabilities and Stockholders' Equity Accounts payable $58,149 $46,800 Bonds payable 390,000 260,000 390,000 208,000 Common stock, $1 par Accumulated depreciation-equipment (58,500 ) (45,500) Total $974,649 $878,800 Liabilities and Stockholders' Equity Accounts payable $58,149 $46,800 Bonds payable 390,000 390,000 Common stock, $1 par 260,000 208,000 Retained earnings 266,500 234,000 Total $974,649 $878,800 Additional information: 1. Operating expenses include depreciation expense of $54,600 ($26,000 of depreciation expense for buildings and $28,600 for equipment). 2. Land was sold for cash at book value. 3. Cash dividends of $15,600 were paid. 4. Net income for 2022 was $48,100. 5. Equipment was purchased for $119,600 cash. In addition, equipment costing $28,600 with a book value of $13,000 was sold for $10,400 cash. 6. 52,000 shares of $1 par value common stock were issued in exchange for land with a fair value of $52,000. Prepare a statement of cash flows for the year ended December 31, 2022, using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis eg. (15,000).) Novak Corp. Statement of Cash Flows For the Year Ended December 31, 2022 - Cash Flows from Operating Activities Net Income $ 48100 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense $ $ 28600 Depreciation Expense 26000 Sale of Equipment 2600 Decrease in Accounts Receivable 10400 Increase in Inventory -12285 Decrease in Prepaid Expenses 7436 74100 Net Cash used by Operating Activities 122200 Cash Flows from Investing Activities Purchase of Equipment (119600) Sale of Equipment 10400 Sale of Land 32500 Cash Flows from Investing Activities 76700 15600 15600 29900 58500 88400