Answered step by step

Verified Expert Solution

Question

1 Approved Answer

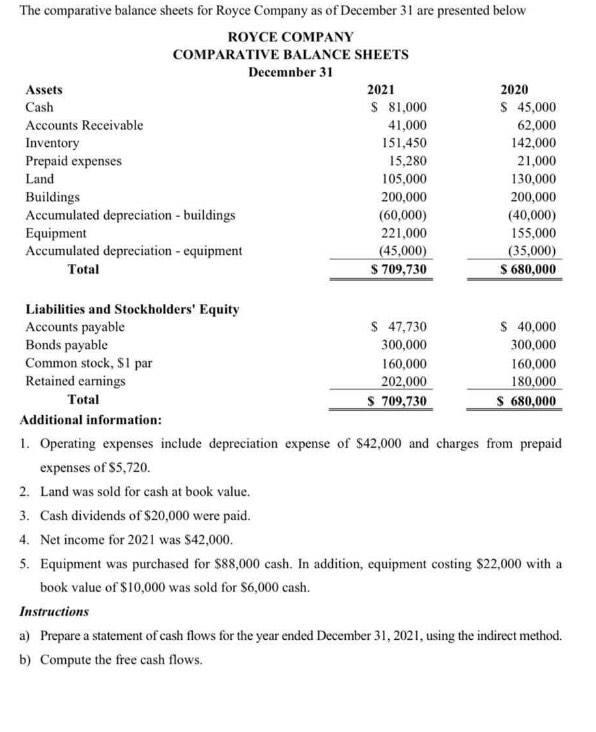

The comparative balance sheets for Royce Company as of December 31 are presented below ROYCE COMPANY COMPARATIVE BALANCE SHEETS December 31 2021 Assets Cash

The comparative balance sheets for Royce Company as of December 31 are presented below ROYCE COMPANY COMPARATIVE BALANCE SHEETS December 31 2021 Assets Cash 2020 $ 45,000 $ 81,000 Accounts Receivable 41,000 62,000 Inventory 151,450 142,000 Prepaid expenses 15,280 21,000 Land 105,000 130,000 Buildings 200,000 200,000 Accumulated depreciation - buildings (60,000) (40,000) Equipment 221,000 155,000 (45,000) (35,000) Accumulated depreciation - equipment Total $ 709,730 $ 680,000 Liabilities and Stockholders' Equity Accounts payable $ 47,730 $ 40,000 Bonds payable 300,000 300,000 Common stock, $1 par 160,000 160,000 Retained earnings 202,000 180,000 Total $ 709,730 $ 680,000 Additional information: 1. Operating expenses include depreciation expense of $42,000 and charges from prepaid expenses of $5,720. 2. Land was sold for cash at book value. 3. Cash dividends of $20,000 were paid. 4. Net income for 2021 was $42,000. 5. Equipment was purchased for $88,000 cash. In addition, equipment costing $22,000 with a book value of $10,000 was sold for $6,000 cash. Instructions a) Prepare a statement of cash flows for the year ended December 31, 2021, using the indirect method. b) Compute the free cash flows.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ROYCE COMPANY Statement of Cash flow For the year ended December 31 2021 Cash flow from operating ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started