Answered step by step

Verified Expert Solution

Question

1 Approved Answer

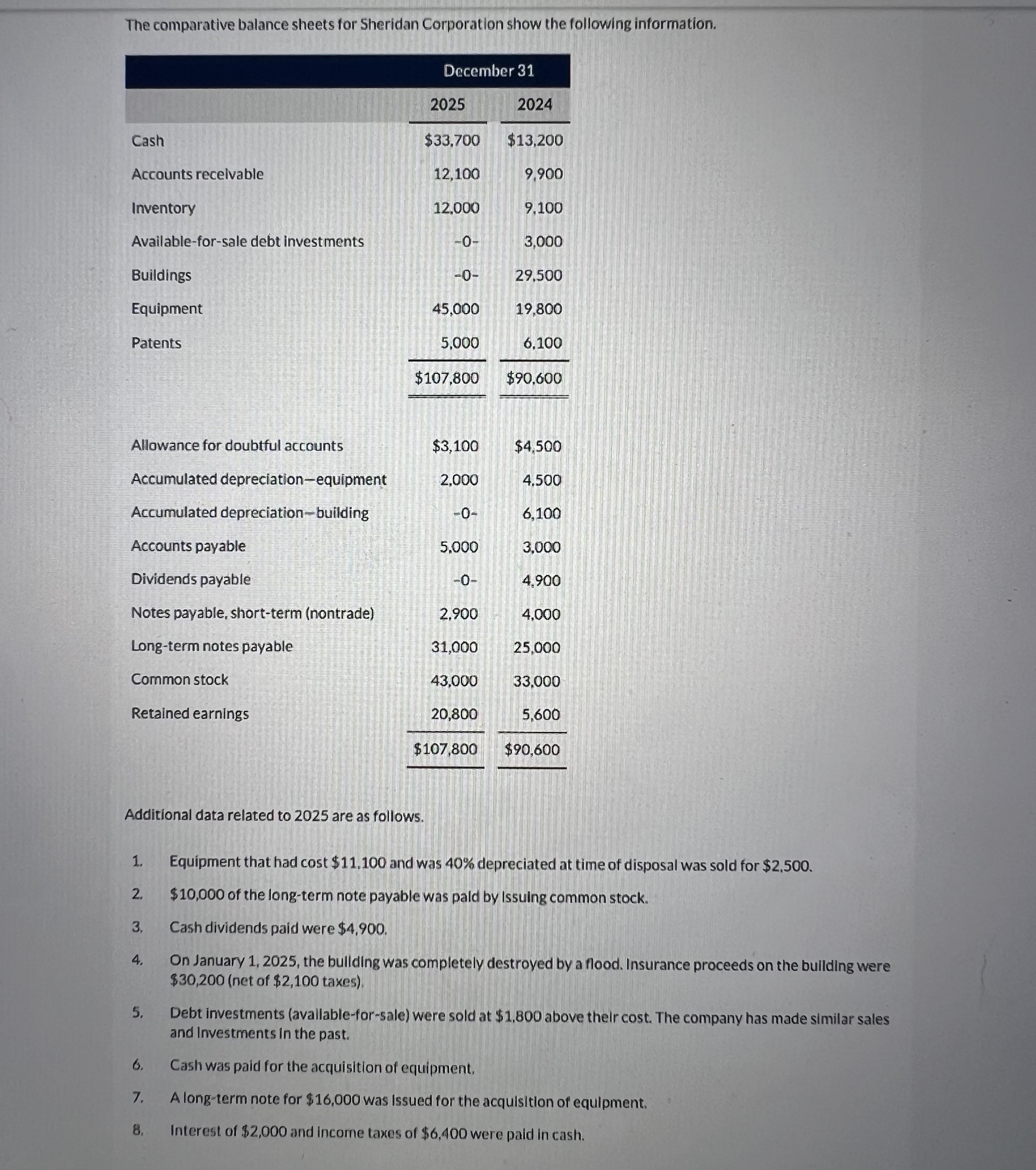

The comparative balance sheets for Sheridan Corporation show the folloving information. The comparative balance sheets for Sheridan Corporation show the folloving information. Additional data related

The comparative balance sheets for Sheridan Corporation show the folloving information. The comparative balance sheets for Sheridan Corporation show the folloving information.

Additional data related to are as follows.

Equipment that had cost $ and was depreciated at time of disposal was sold for $

$ of the longterm note payable was pald by Issuing common stock.

Cash dividends paid were $

On January the bullding was completely destroyed by a flood. Insurance proceeds on the bullding were

$net of $ taxes

Debt investments avallableforsale were sold at $ above thelr cost. The company has made similar sales

and Investments in the past.

Cash was paid for the acquisition of equipment.

A longterm note for $ was issued for the acquisition of equipment.

Interest of $ and income taxes of $ were paid in cash. Prepare a statement of cash flows using the indired method, Show amounts that decrease cash flow with

either a sign eg or in parenthesis eg

SHERIDAN CORPORATION

statement of Cash Flows

Adjustments to reconcile net income to Supplemental disclosures of cash flow information:

eTexibook and Modia

Attempts: of used

Additional data related to are as follows.

Equipment that had cost $ and was depreciated at time of disposal was sold for $

$ of the longterm note payable was pald by Issuing common stock.

Cash dividends paid were $

On January the bullding was completely destroyed by a flood. Insurance proceeds on the bullding were

$net of $ taxes

Debt investments avallableforsale were sold at $ above thelr cost. The company has made similar sales

and Investments in the past.

Cash was paid for the acquisition of equipment.

A longterm note for $ was issued for the acquisition of equipment.

Interest of $ and income taxes of $ were paid in cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started