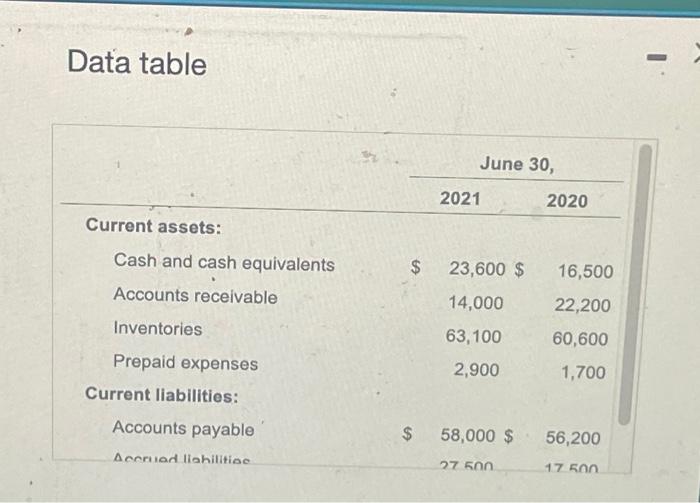

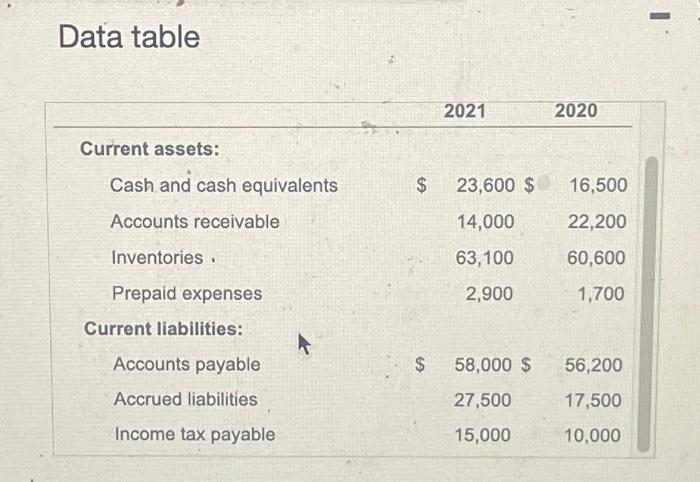

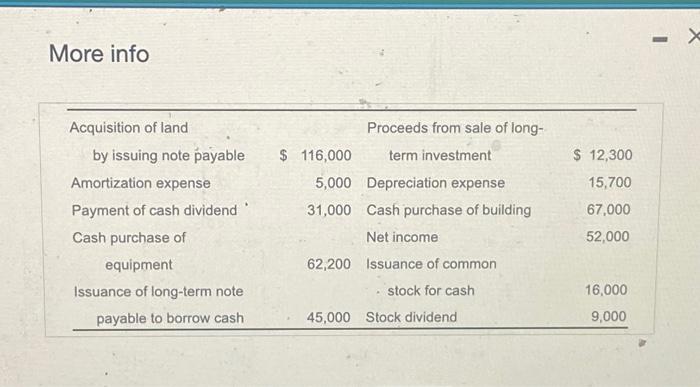

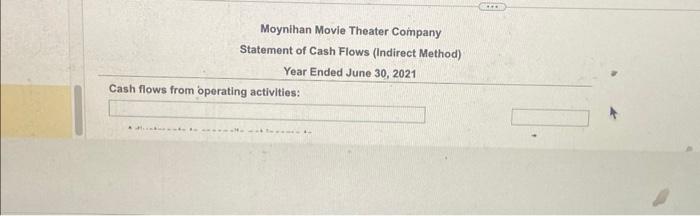

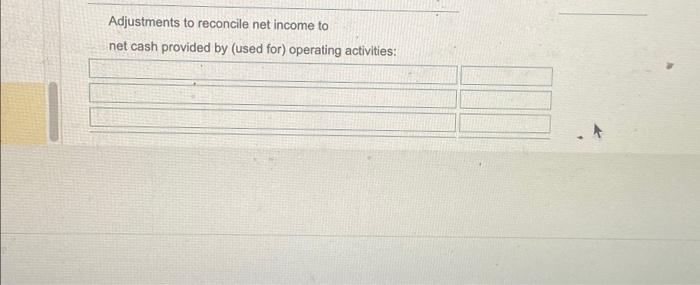

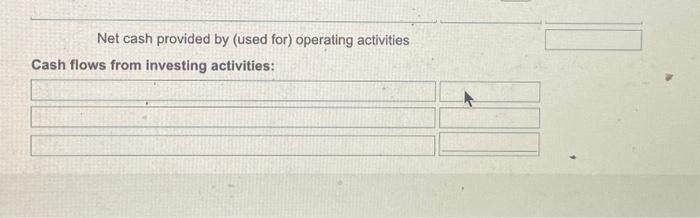

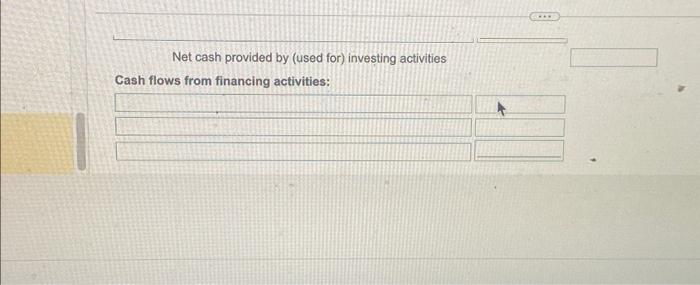

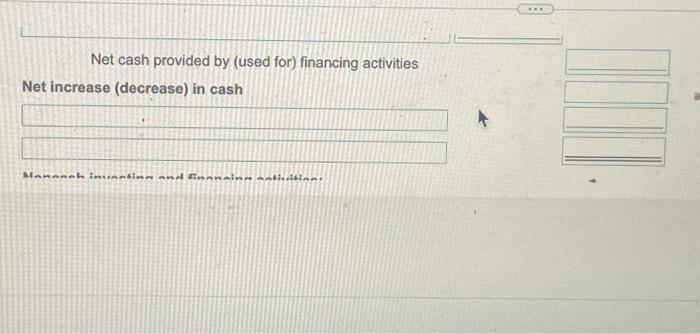

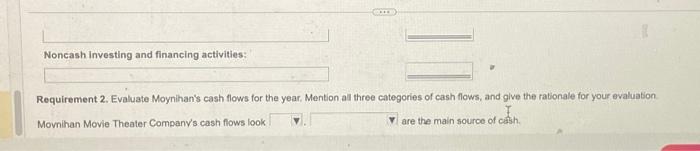

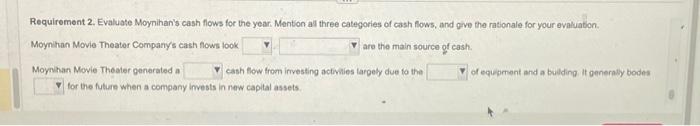

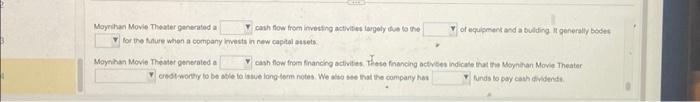

The comparative balance sheets of Moynihan Movie Theater Company at June 30, 2021 and 2020 , roported the following: (Click the icon to view the balance sheets.) Moynihar's transactions during the year ended June 30, 2021, included: (Click the icon to view the transaction data) Read the resuirmenents. Requirement 1. Prepare Moynihan Movie Theoter Company's statement of cosh fows foc the year ended June-30, 2021, using the indirsct method to report cash flows from operating acbvities. Report noncash investing and financing actities in an accomparying schedule. Start by completing the cash flows from operating activites. Then complete the remaining statement of cash fows and the accompanying schedule of noncash investing and financing activities. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in cash.) Moynihan Movie Theater Company Data table Data table More info Requirements 1. Prepare Moynihan Movie Theater Company's statement of cash flows for the year ended June 30, 2021, using the indirect method to report cash flows from operating activities. Report noncash investing and financing activities in an accompanying schedule. 2. Evaluate Moynihan's cash flows for the year. Mention all three categories of cash flows, and give the rationale for your evaluation. Requirement 1. Prepare Moynihan Move Theater Company's statement of cesh flows for the year ended June 30, 2021, using the indirect method to report casth fows from operating activibes. Report noncash investing and financing octivities in an accompanying schedule. Start by completing the cash fiows from operating activites. Then complete the remaining statement of cash flows and the accompamying schedule of noncash investing and financha activies. (Ube parentheses or a minus sign for numberi to be subtracted and for a net decrease in cash.) Moynihan Movie Theater Company Moynihan Movie Theater Company Statement of Cash Flows (Indirect Method) Year Ended June 30, 2021 Cash flows from operating activities: Adjustments to reconcile net income to net cash provided bv (used for) nnaratinn antivitise. Net cash provided by (used for) operating activities Net cash provided by (used for) investing activities Net cash provided by (used for) financing activities Net increase (decrease) in cash Requirement 2. Evaluate Moynihan's cash flows for the year. Mention all three categories of cash flows, and give the rationale for your evaluation. Movnihan Movie Theater Company's cash flows look are the main source of coth. Requirement 2. Evaluate Moynihan's cash flows for the year. Mention all three categories of cash flows, and oive the rationale for your evaluaton. Moynitan Movie Theater Company's cash flows look are the main source of cash. Moynhan Movie Theater generated a cash flow from irrvesting activies largely due to the of equament and a bullding it generaly bodes for the future when a company invests in new capltal assets. Moyrinan Movie Thyaler ganerated a paih fow frem investing activities largely ide to the of equiment and abllding it generally bocte for the talue when a company ivests in now capital atseta. cobsi wortig lo be stle to istue longiterm notes. We albo ste that the company has Nunds ba pay cath chibents