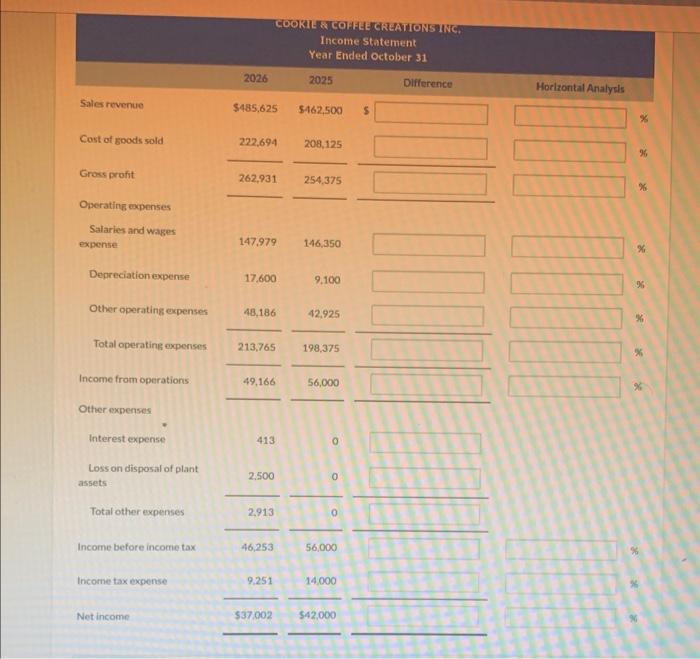

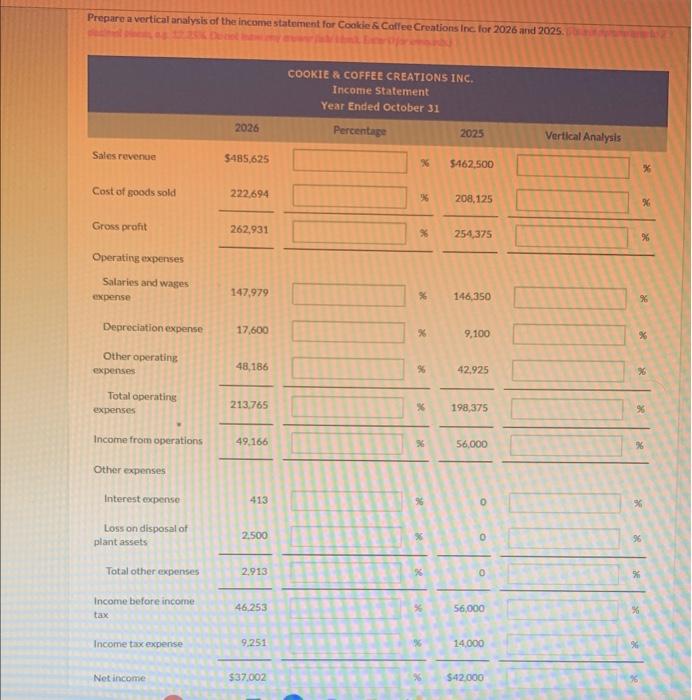

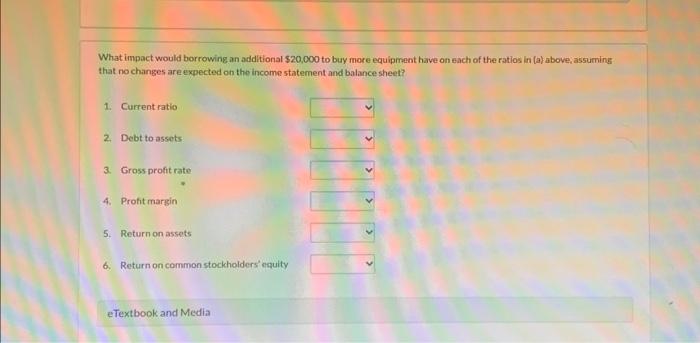

The comparative batanca aheet of Cookie 8. Colfevi Crevitorn lnti. at Octotser 31, 2026 for the mars 2026 and 2025 , and the income staternents for the remirs endod Cotober 31, 2025 arni 2026, are presenled below. Liablities and Stocicholders' Equity Accounts payabie Income taxes payable Dividends pryable Salaries and wages payable Interest payable Notepayable-current portion Notepayable-lont-term portion Preferred stock, no par, $6 cumulative -3.000 and 2,800 shares issued, respectively 15,00014,000 Common stock, $1 par 25,930 shares issued Additional paid in capital-treasury stock Retained earnings Less treasury stock Total liabilities and stockholders' equity Additional informatione Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more kitchen equipment. The loan would be repaid over a 4 -year period. The terms of the loan provide for equai semi-annual payments of $2.500 on May 1 and November 1 of each year, plus interest of 5% on the outstanding balance: Additional information: Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more kitchen equipment. The loan would be repaid over a 4-year period. The terms of the loan provide for equal semi-annual payments of $2,500 on May 1 and November 1 of each year, plus interest of 5% on the outstanding balance. Calculate the following ratios for 2025 and 2026. (Round cumtnt natlo ro 2 declmol places, eg. 12.61, delr (o ass?t: and grves profit rute to O decimol pisces, ess. 12 and all other answurs io 1 decimol place, in . 12.6\%) Operatine expenses Salaries and wages expense: 147,979146,350 Depreciation expense 2 \$6. \%. Income from operations Other expenses \%. Interest expense 4130 Loss on disposal of plant assets Total other expenses Income before income tax Income tax expense Net income Prepare a vertical analysis of the incume statement for What impact would borrowing an additional $20,000 to buy more equipment have on each of the ratios in (a) above; assuming that no changes are expected on the income statement and balance sheet? The comparative batanca aheet of Cookie 8. Colfevi Crevitorn lnti. at Octotser 31, 2026 for the mars 2026 and 2025 , and the income staternents for the remirs endod Cotober 31, 2025 arni 2026, are presenled below. Liablities and Stocicholders' Equity Accounts payabie Income taxes payable Dividends pryable Salaries and wages payable Interest payable Notepayable-current portion Notepayable-lont-term portion Preferred stock, no par, $6 cumulative -3.000 and 2,800 shares issued, respectively 15,00014,000 Common stock, $1 par 25,930 shares issued Additional paid in capital-treasury stock Retained earnings Less treasury stock Total liabilities and stockholders' equity Additional informatione Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more kitchen equipment. The loan would be repaid over a 4 -year period. The terms of the loan provide for equai semi-annual payments of $2.500 on May 1 and November 1 of each year, plus interest of 5% on the outstanding balance: Additional information: Natalie and Curtis are thinking about borrowing an additional $20,000 to buy more kitchen equipment. The loan would be repaid over a 4-year period. The terms of the loan provide for equal semi-annual payments of $2,500 on May 1 and November 1 of each year, plus interest of 5% on the outstanding balance. Calculate the following ratios for 2025 and 2026. (Round cumtnt natlo ro 2 declmol places, eg. 12.61, delr (o ass?t: and grves profit rute to O decimol pisces, ess. 12 and all other answurs io 1 decimol place, in . 12.6\%) Operatine expenses Salaries and wages expense: 147,979146,350 Depreciation expense 2 \$6. \%. Income from operations Other expenses \%. Interest expense 4130 Loss on disposal of plant assets Total other expenses Income before income tax Income tax expense Net income Prepare a vertical analysis of the incume statement for What impact would borrowing an additional $20,000 to buy more equipment have on each of the ratios in (a) above; assuming that no changes are expected on the income statement and balance sheet