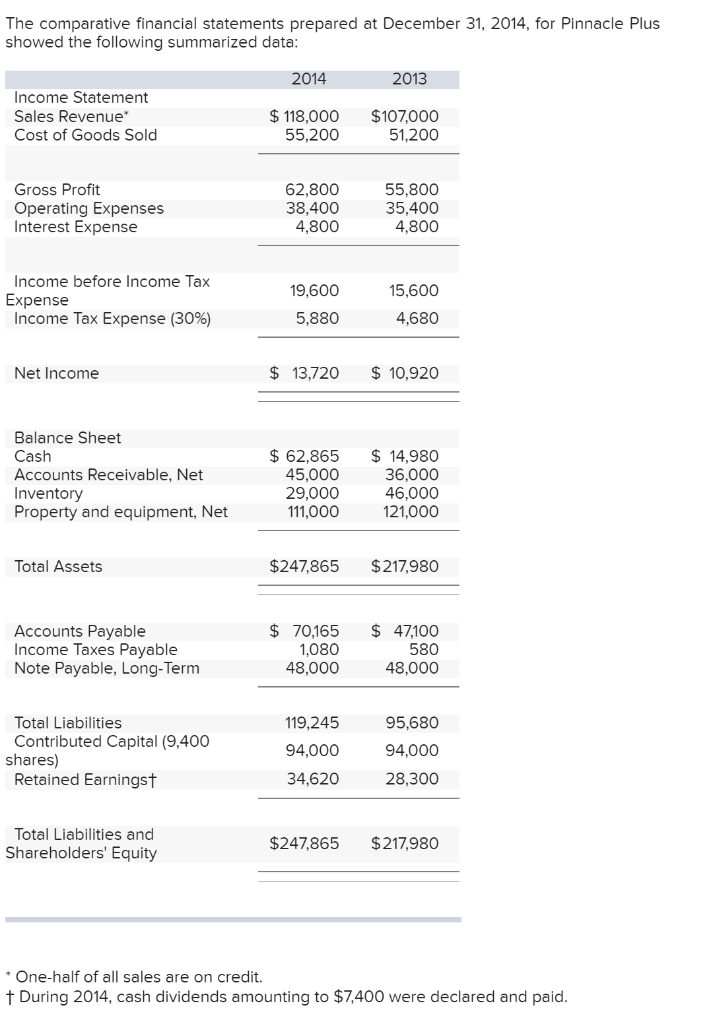

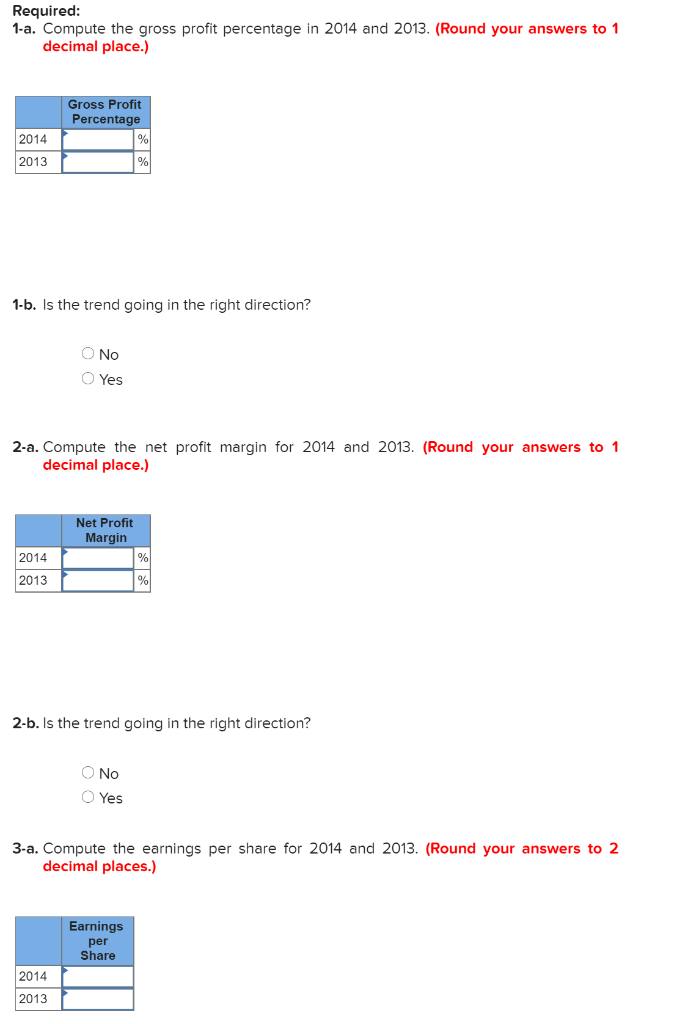

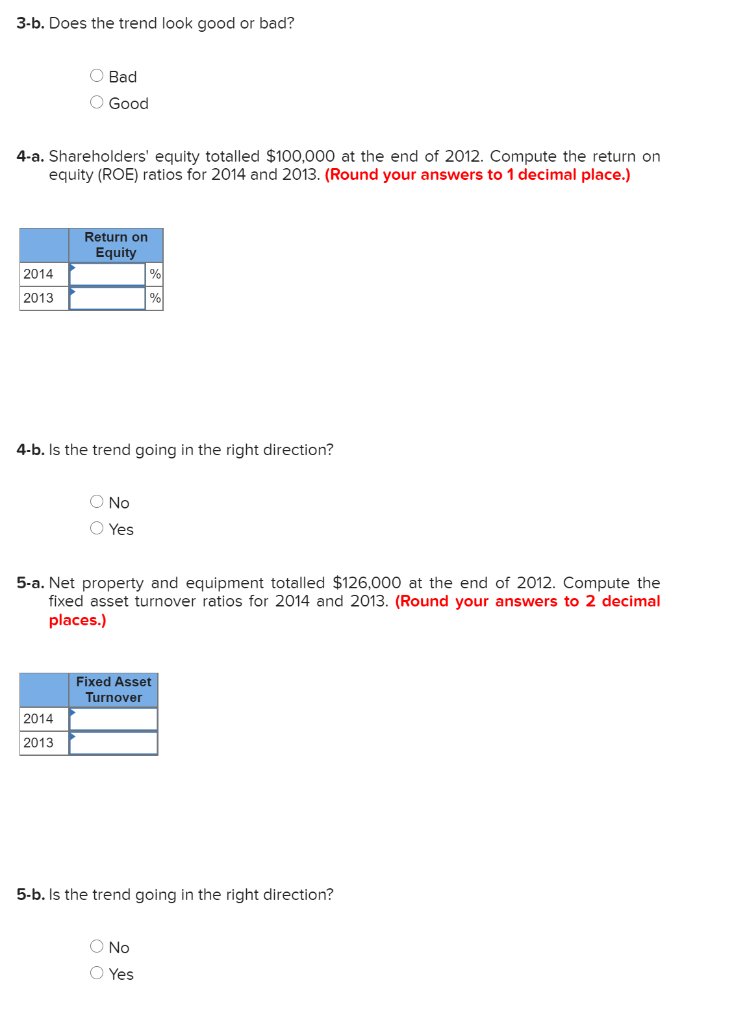

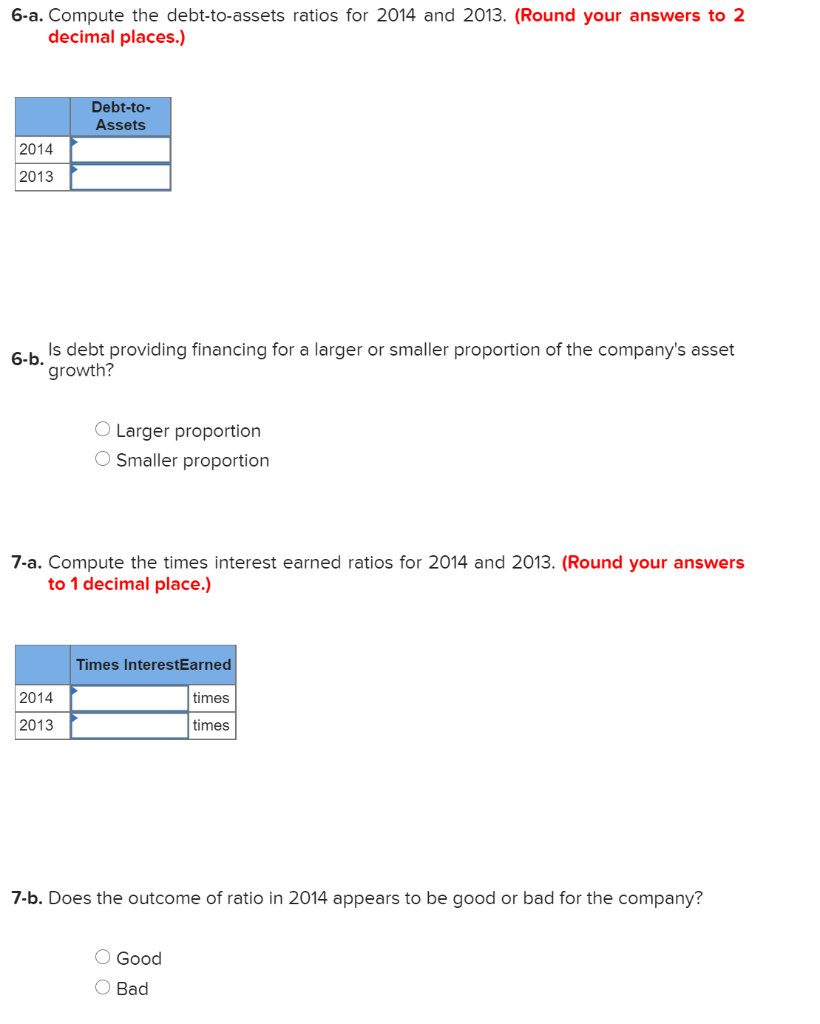

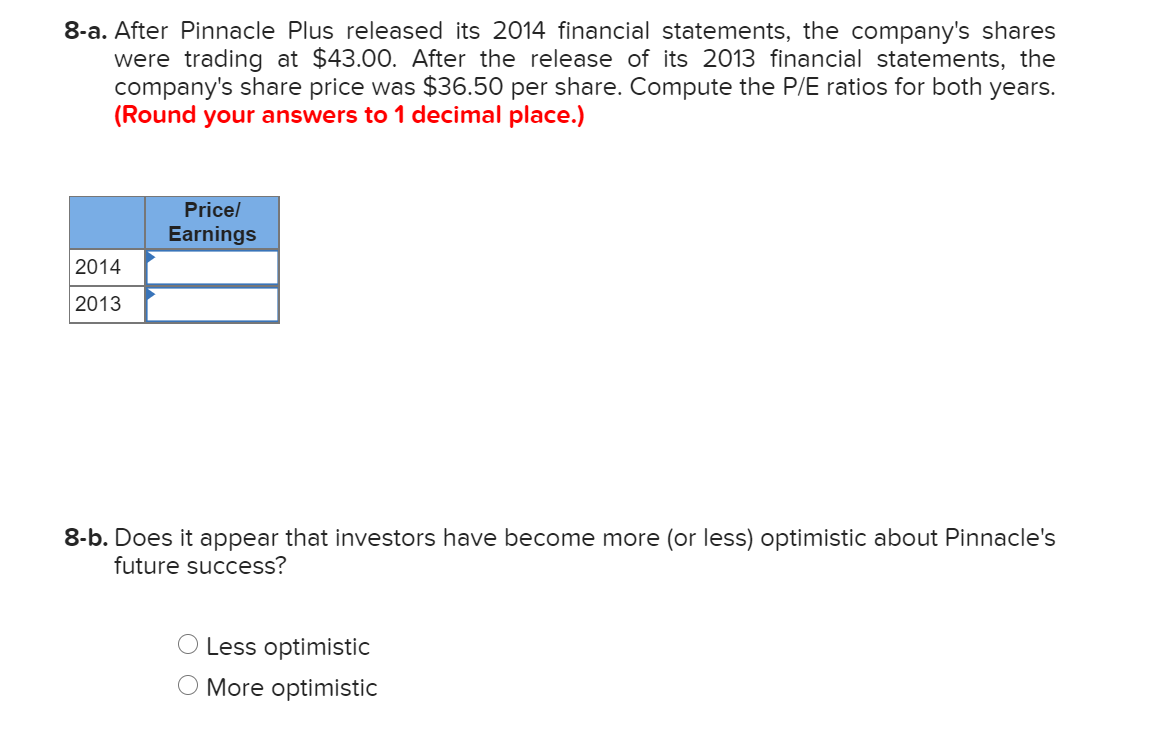

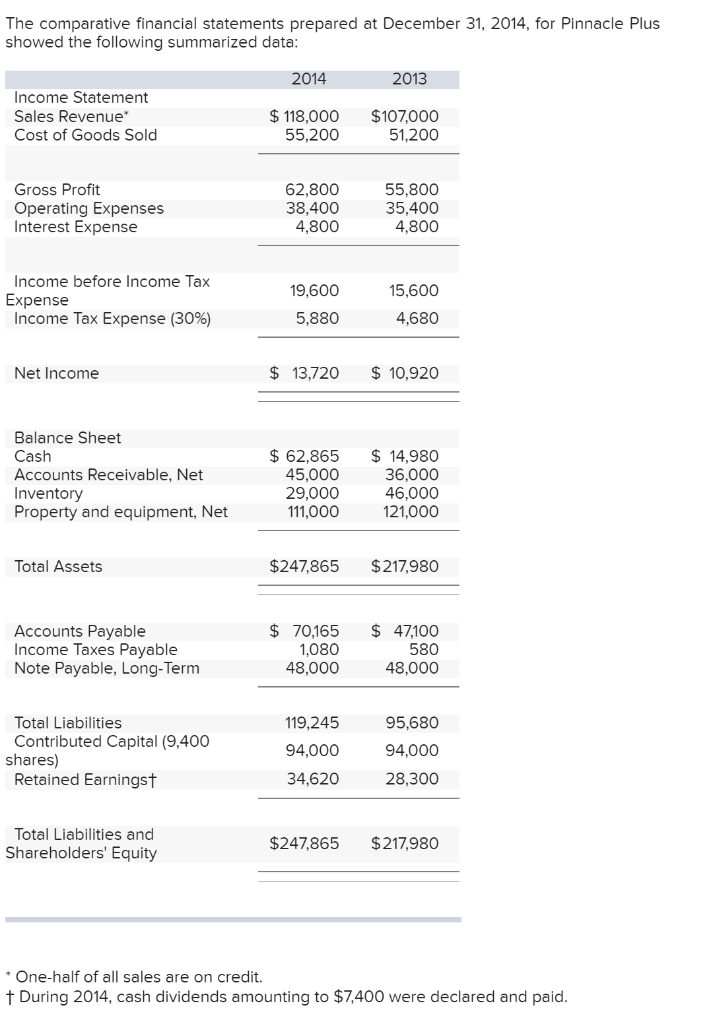

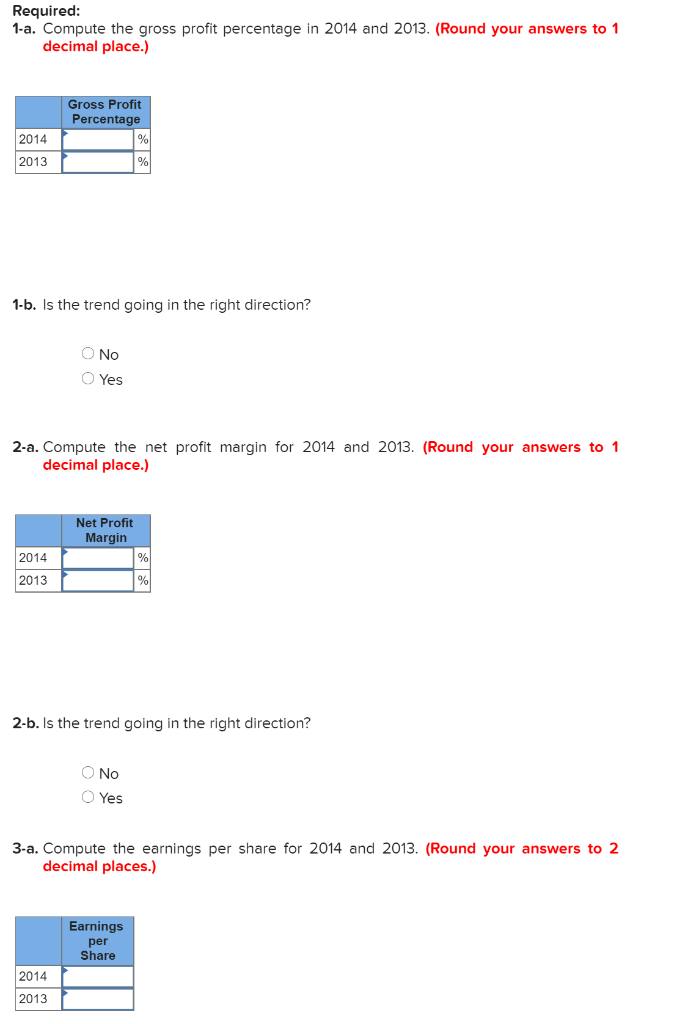

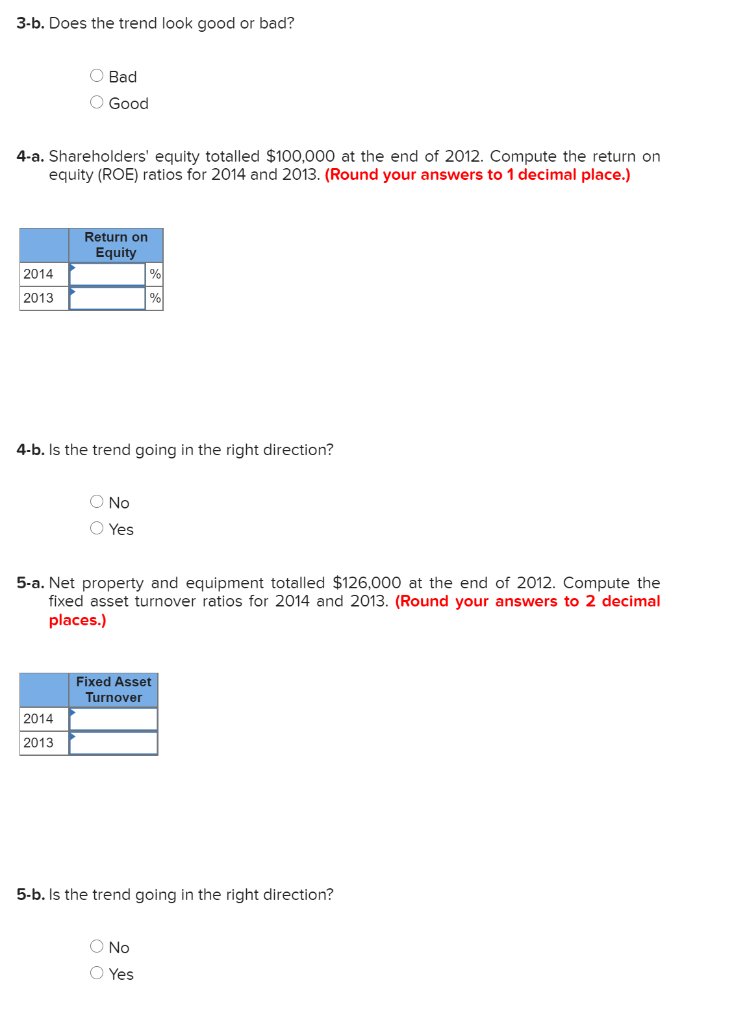

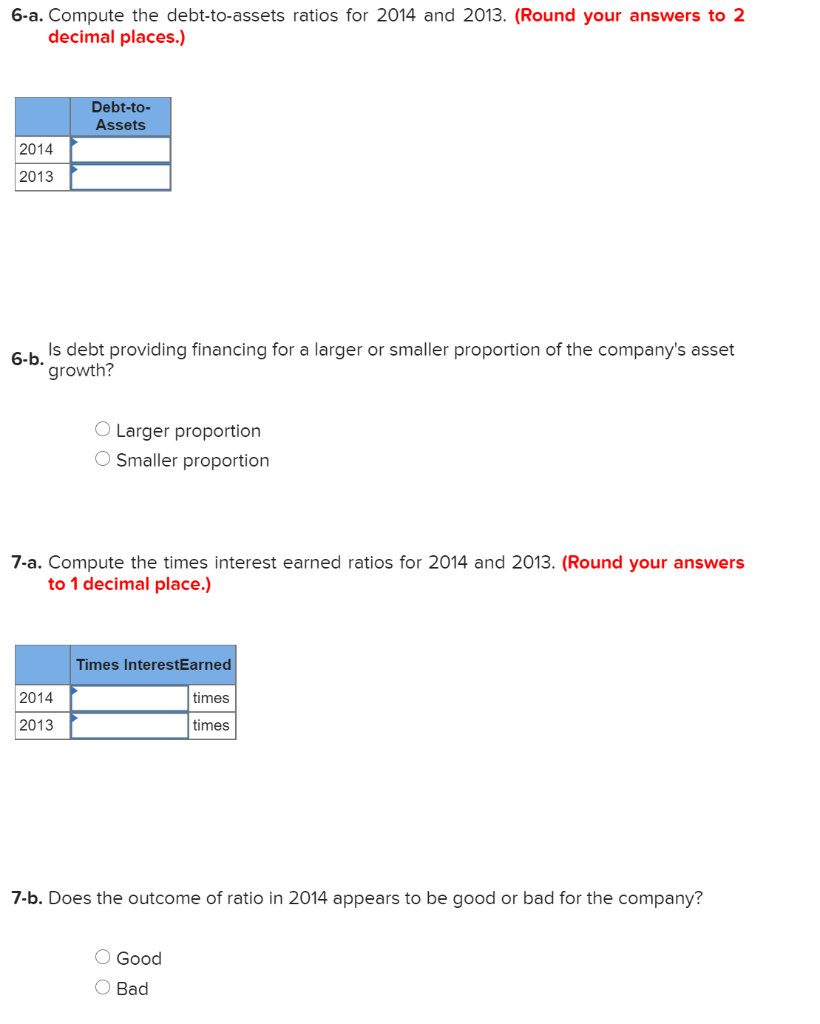

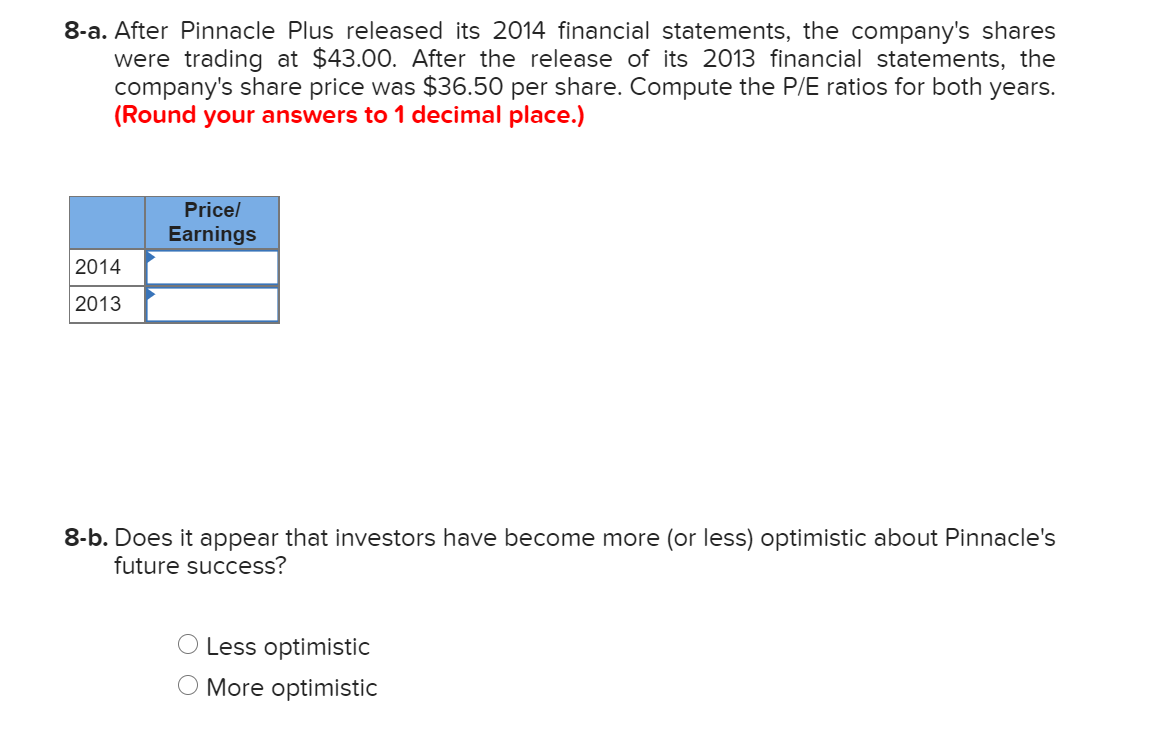

The comparative financial statements prepared at December 31, 2014, for Pinnacle Plus showed the following summarized data: 2014 2013 Income Statement Sales Revenue Cost of Goods Sold $ 118,000 55,200 $107.000 51,200 Gross Profit Operating Expenses Interest Expense 62,800 38,400 4,800 55.800 35,400 4.800 15,600 Income before Income Tax Expense Income Tax Expense (30%) 19,600 5,880 4,680 Net Income $ 13,720 $ 10,920 Balance Sheet Cash Accounts Receivable, Net Inventory Property and equipment, Net $ 62,865 45,000 29,000 111,000 $ 14,980 36,000 46,000 121,000 Total Assets $247,865 $217,980 Accounts Payable Income Taxes Payable Note Payable, Long-Term $ 70,165 1,080 48,000 $ 47,100 580 48,000 119,245 Total Liabilities Contributed Capital (9,400 shares) Retained Earningst 95,680 94,000 94,000 34,620 28,300 Total Liabilities and Shareholders' Equity $247,865 $217,980 * One-half of all sales are on credit. During 2014, cash dividends amounting to $7,400 were declared and paid. Required: 1-a. Compute the gross profit percentage in 2014 and 2013. (Round your answers to 1 decimal place.) Gross Profit Percentage 2014 2013 1-b. Is the trend going in the right direction? No Yes 2-a. Compute the net profit margin for 2014 and 2013. (Round your answers to 1 decimal place.) Net Profit Margin 2014 2013 2-b. Is the trend going in the right direction? O No O Yes 3-a. Compute the earnings per share for 2014 and 2013. (Round your answers to 2 decimal places.) Earnings per Share 2014 2013 3-b. Does the trend look good or bad? O Bad O Good 4-a. Shareholders' equity totalled $100,000 at the end of 2012. Compute the return on equity (ROE) ratios for 2014 and 2013. (Round your answers to 1 decimal place.) Return on Equity 2014 2013 4-b. Is the trend going in the right direction? O No O Yes 5-a. Net property and equipment totalled $126,000 at the end of 2012. Compute the fixed asset turnover ratios for 2014 and 2013. (Round your answers to 2 decimal places.) Fixed Asset Turnover 2014 2013 5-b. Is the trend going in the right direction? O No O Yes 6-a. Compute the debt-to-assets ratios for 2014 and 2013. (Round your answers to 2 decimal places.) Debt-to- Assets 2014 2013 6-b. Is debt providing financing for a larger or smaller proportion of the company's asset growth? Larger proportion OSmaller proportion 7-a. Compute the times interest earned ratios for 2014 and 2013. (Round your answers to 1 decimal place.) Times InterestEarned 2014 times 2013 times 7-b. Does the outcome of ratio in 2014 appears to be good or bad for the company? O Good O Bad 8-a. After Pinnacle Plus released its 2014 financial statements, the company's shares were trading at $43.00. After the release of its 2013 financial statements, the company's share price was $36.50 per share. Compute the P/E ratios for both years. (Round your answers to 1 decimal place.) Pricel Earnings 2014 2013 8-b. Does it appear that investors have become more (or less) optimistic about Pinnacle's future success? O Less optimistic O More optimistic