Answered step by step

Verified Expert Solution

Question

1 Approved Answer

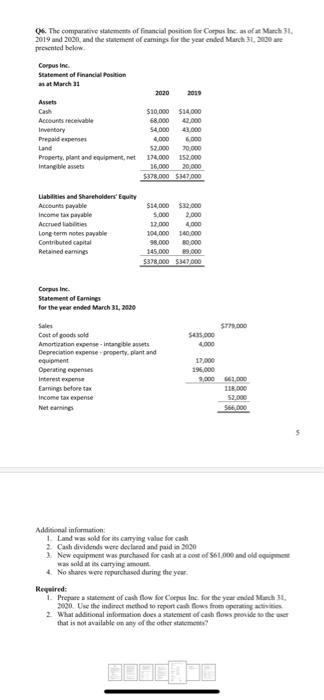

Q6. The comparative statements of financial position for Corpus Inc. as ofa March 31, 2019 and 2000, and the statement of camings for the

Q6. The comparative statements of financial position for Corpus Inc. as ofa March 31, 2019 and 2000, and the statement of camings for the year ended March 31, 2000 are presented below. Corpus inc. Seatement of financial Position anat March 31 2020 Assets Cash S10,000 $14.000 68.000 54.000 Accounts receivable 42,000 Inventory 43.000 Prepaid experses 4.000 6.000 Land S2.000 000 Property, plant and equipment, net 174.000 1s2000 16,000 20.000 $378,000 S47,000 Intangbie assets Liabilities and Shareholders' Equity Accounts payatle Income tan payable S14,000 S32.000 5,000 2,000 Accrued lablities 12,000 4.000 Long term notes payable Contributed capital Retained earmings 104,000 140.0o00 98,000 B000 145.000 9.000 5378.000 S347.000 Corpus inc. Statement of Earmings for the year ended March 31, 2020 Sales ST.000 Cost of goods sold Amortization enpense - intangible assets Depreciation expense property. plant and equipment Operating expenses sas,000 4000 17.000 196,000 Interest expense 9,000 1.00o Earmings before tax 118.000 Income tax expense 52,000 Net earnings S66,000 Additional information: 1. Land was sold for its carying valae for cash 2 Cash dividends uere declared and paid in 2020 1. New oquipment was purchased for cash at a cont of S61.000 and old oquipment was sold at its carrying amount 4. No shares were repurchased during the yeur. Required: 1. Prepare a statement of cash flow foe Corpus Inc. for the year ended Mah 31. 2000. Use the indirect method to report cad flows from operatingatities 2 What additional inkormation does a statement of cash flows provide o the ser that is not available on any of the other statements?

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Cash Flow Statement Statement of Cash Flows For the Years Ending December 31 2020 A Cash Flows fr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started