Question

The components of earnings before income taxes are as follows: Answer the following. Formulas are required for each calculation as applicable. Year 3 Year 2

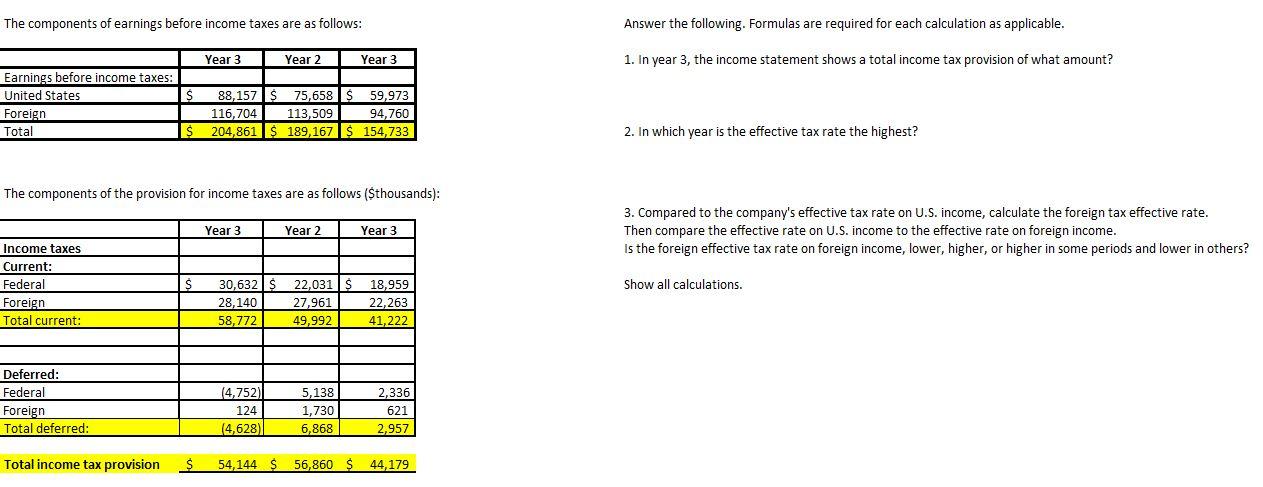

The components of earnings before income taxes are as follows: Answer the following. Formulas are required for each calculation as applicable. Year 3 Year 2 Year 3 1. In year 3, the income statement shows a total income tax provision of what amount? Earnings before income taxes: United States $88,157 $75,658 $59,973 Foreign 116,704 113,509 94,760 Total $204,861 $189,167 $154,733 2. In which year is the effective tax rate the highest? The components of the provision for income taxes are as follows ($thousands): 3. Compared to the company's effective tax rate on U.S. income, calculate the foreign tax effective rate. Year 3 Year 2 Year 3 Then compare the effective rate on U.S. income to the effective rate on foreign income. Income taxes Is the foreign effective tax rate on foreign income, lower, higher, or higher in some periods and lower in others? Current: Federal $30,632 $22,031 $18,959 Show all calculations. Foreign 28,140 27,961 22,263 Total current: 58,772 49,992 41,222 Deferred: Federal (4,752) 5,138 2,336 Foreign 124 1,730 621 Total deferred: (4,628) 6,868 2,957 Total income tax provision $54,144 $56,860 $44,179

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started