Question

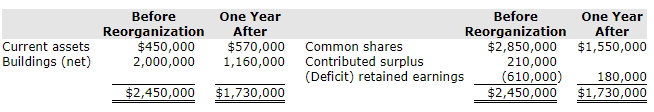

The condensed balance sheets of Pronghorn Limited, a small private company that follows ASPE, follow for the periods immediately before, and one year after, it

The condensed balance sheets of Pronghorn Limited, a small private company that follows ASPE, follow for the periods immediately before, and one year after, it had completed a financial reorganization:

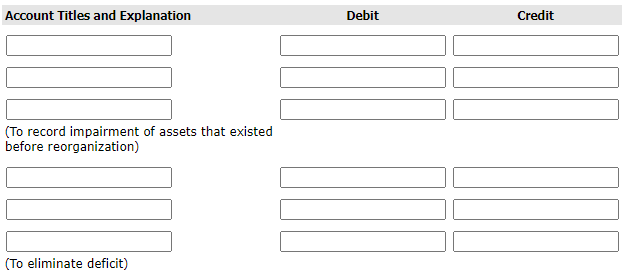

For the year following the financial reorganization, the company reported net income of $208,000 and depreciation expense of $60,000, and paid a cash dividend of $28,000. As part of the reorganization, the company wrote down inventory by $120,000 in order to reflect circumstances that existed before the reorganization. Also, the deficit, and any revaluation adjustment, was accounted for by charging amounts against contributed surplus until it was eliminated, with any remaining amount being charged against common shares. The common shares are widely held and there is no controlling interest. No purchases or sales of plant assets and no share transactions occurred in the year following the reorganization. Prepare all the journal entries made at the time of the reorganization.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started