Answered step by step

Verified Expert Solution

Question

1 Approved Answer

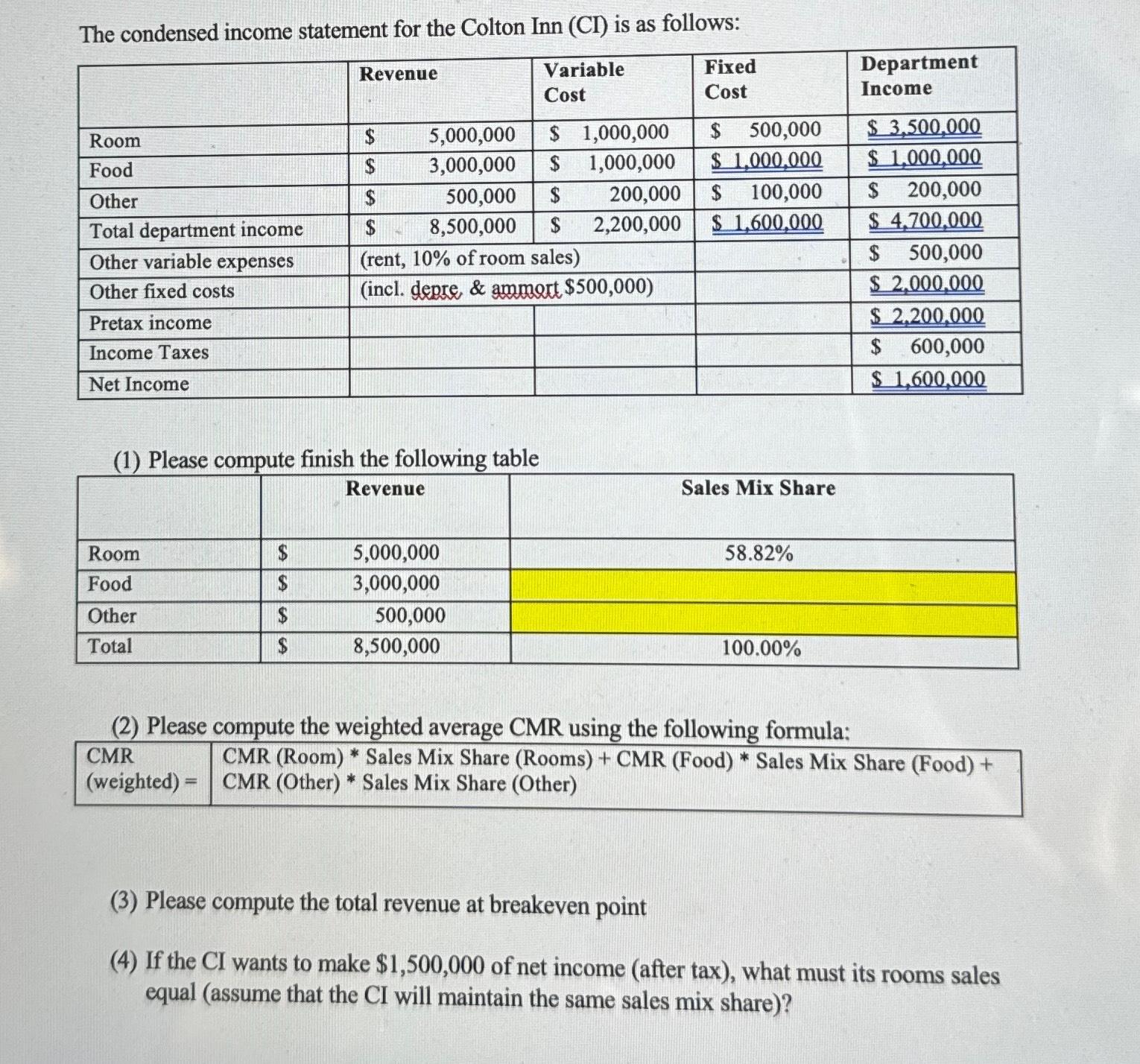

The condensed income statement for the Colton Inn (CI) is as follows: Revenue Variable Cost Room Food Other Total department income Other variable expenses

The condensed income statement for the Colton Inn (CI) is as follows: Revenue Variable Cost Room Food Other Total department income Other variable expenses Other fixed costs Pretax income Income Taxes Net Income Room Food (1) Please compute finish the following table Revenue Other Total $ $ 5,000,000 3,000,000 500,000 $ $ $ 1,000,000 1,000,000 200,000 $ 2,200,000 8,500,000 (rent, 10% of room sales) (incl. depre, & ammort $500,000) $ $ $ $ $ $ 5,000,000 3,000,000 500,000 8,500,000 Fixed Cost $ 500,000 $1,000,000 $ 100,000 $1,600,000 Sales Mix Share 58.82% 100.00% (2) Please compute the weighted average CMR using the following formula: CMR (weighted)= Department Income $3,500,000 $1,000,000 $ 200,000 $ 4,700,000 $ 500,000 $ 2,000,000 $2,200,000 600,000 $1,600,000 CMR (Room)* Sales Mix Share (Rooms) + CMR (Food) * Sales Mix Share (Food) + CMR (Other)* Sales Mix Share (Other) (3) Please compute the total revenue at breakeven point (4) If the CI wants to make $1,500,000 of net income (after tax), what must its rooms sales equal (assume that the CI will maintain the same sales mix share)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the table with Sales Mix Share for Food and Other we need to calculate their respective ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started