Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Connoer Company has the following capital structures: Mortgage bonds, 6% Common stock (1 million shares) Retained earnings P20,000,000 25,000,000 55,000,000 P100,000,000 Mortgage bonds

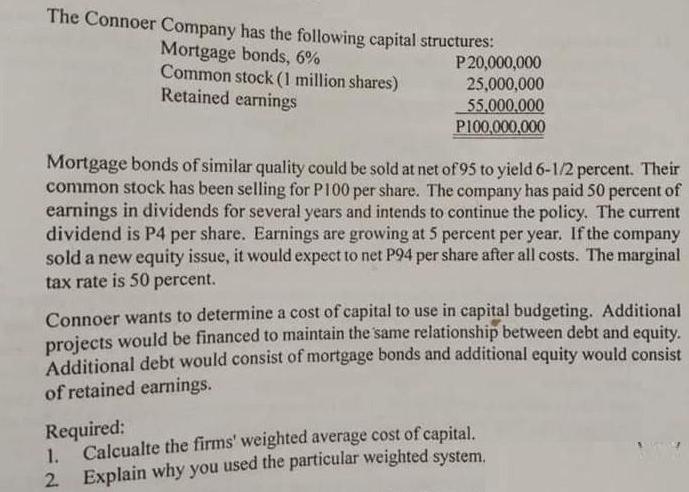

The Connoer Company has the following capital structures: Mortgage bonds, 6% Common stock (1 million shares) Retained earnings P20,000,000 25,000,000 55,000,000 P100,000,000 Mortgage bonds of similar quality could be sold at net of 95 to yield 6-1/2 percent. Their common stock has been selling for P100 per share. The company has paid 50 percent of earnings in dividends for several years and intends to continue the policy. The current dividend is P4 per share. Earnings are growing at 5 percent per year. If the company sold a new equity issue, it would expect to net P94 per share after all costs. The marginal tax rate is 50 percent. Connoer wants to determine a cost of capital to use in capital budgeting. Additional projects would be financed to maintain the same relationship between debt and equity. Additional debt would consist of mortgage bonds and additional equity would consist of retained earnings. Required: 1. Calcualte the firms' weighted average cost of capital. 2. Explain why you used the particular weighted system.

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 Weighted Average Cost of Capital WACC 2 WACC x 2 Market Value of Equity Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started