Answered step by step

Verified Expert Solution

Question

1 Approved Answer

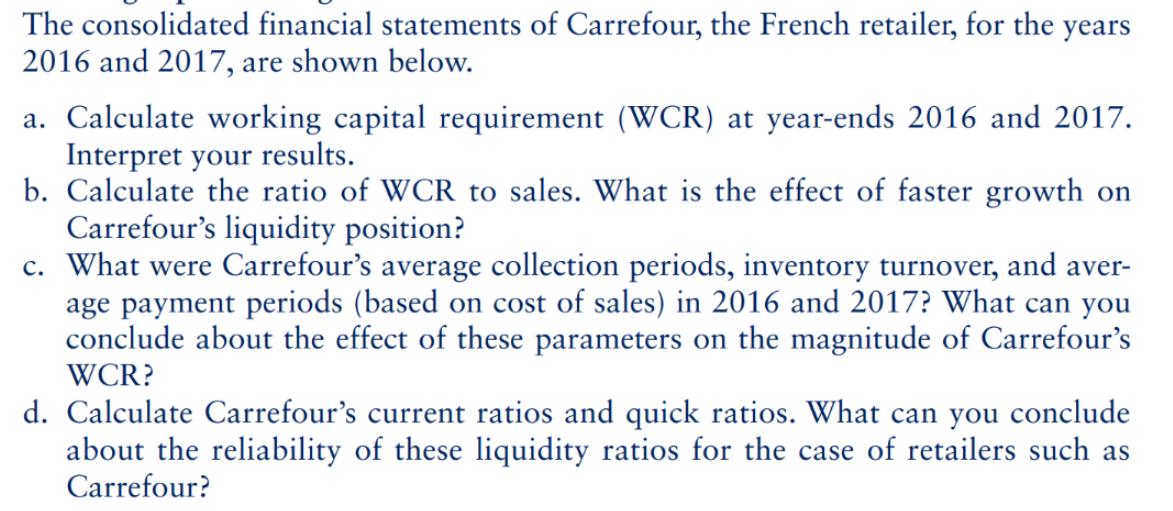

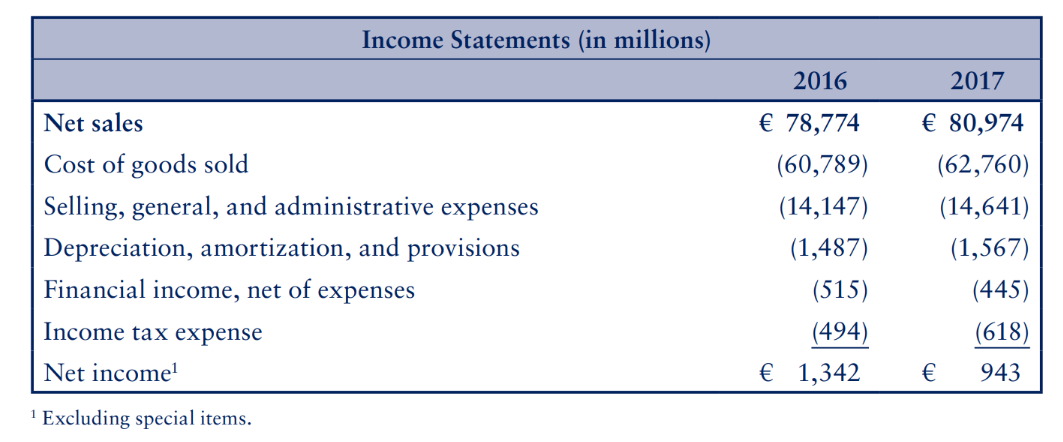

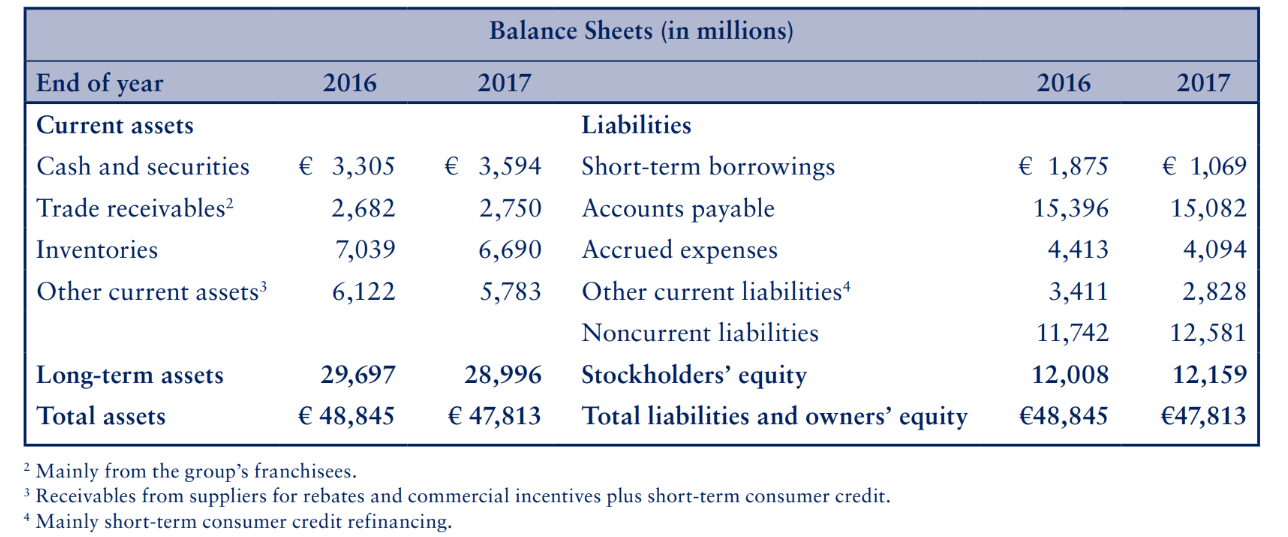

The consolidated financial statements of Carrefour, the French retailer, for the years 2016 and 2017, are shown below. a. Calculate working capital requirement (WCR)

The consolidated financial statements of Carrefour, the French retailer, for the years 2016 and 2017, are shown below. a. Calculate working capital requirement (WCR) at year-ends 2016 and 2017. Interpret your results. b. Calculate the ratio of WCR to sales. What is the effect of faster growth on Carrefour's liquidity position? c. What were Carrefour's average collection periods, inventory turnover, and aver- age payment periods (based on cost of sales) in 2016 and 2017? What can you conclude about the effect of these parameters on the magnitude of Carrefour's WCR? d. Calculate Carrefour's current ratios and quick ratios. What can you conclude about the reliability of these liquidity ratios for the case of retailers such as Carrefour? Income Statements (in millions) Net sales Cost of goods sold Selling, general, and administrative expenses Depreciation, amortization, and provisions Financial income, net of expenses Income tax expense Net income Excluding special items. 2016 78,774 (60,789) (14,147) (1,487) (515) (494) 1,342 2017 80,974 (62,760) (14,641) (1,567) (445) (618) 943 End of year Current assets Cash and securities Trade receivables Inventories Other current assets Long-term assets Total assets 2016 3,305 2,682 7,039 6,122 29,697 48,845 Balance Sheets (in millions) 2017 3,594 2,750 6,690 5,783 Liabilities Short-term borrowings Accounts payable Accrued expenses Other current liabilities4 Noncurrent liabilities 28,996 Stockholders' equity 47,813 Total liabilities and owners' equity 2 Mainly from the group's franchisees. 3 Receivables from suppliers for rebates and commercial incentives plus short-term consumer credit. 4 Mainly short-term consumer credit refinancing. 2016 1,875 15,396 4,413 3,411 11,742 12,008 48,845 2017 1,069 15,082 4,094 2,828 12,581 12,159 47,813 The consolidated financial statements of Carrefour, the French retailer, for the years 2016 and 2017, are shown below. a. Calculate working capital requirement (WCR) at year-ends 2016 and 2017. Interpret your results. b. Calculate the ratio of WCR to sales. What is the effect of faster growth on Carrefour's liquidity position? c. What were Carrefour's average collection periods, inventory turnover, and aver- age payment periods (based on cost of sales) in 2016 and 2017? What can you conclude about the effect of these parameters on the magnitude of Carrefour's WCR? d. Calculate Carrefour's current ratios and quick ratios. What can you conclude about the reliability of these liquidity ratios for the case of retailers such as Carrefour? Income Statements (in millions) Net sales Cost of goods sold Selling, general, and administrative expenses Depreciation, amortization, and provisions Financial income, net of expenses Income tax expense Net income Excluding special items. 2016 78,774 (60,789) (14,147) (1,487) (515) (494) 1,342 2017 80,974 (62,760) (14,641) (1,567) (445) (618) 943 End of year Current assets Cash and securities Trade receivables Inventories Other current assets Long-term assets Total assets 2016 3,305 2,682 7,039 6,122 29,697 48,845 Balance Sheets (in millions) 2017 3,594 2,750 6,690 5,783 Liabilities Short-term borrowings Accounts payable Accrued expenses Other current liabilities4 Noncurrent liabilities 28,996 Stockholders' equity 47,813 Total liabilities and owners' equity 2 Mainly from the group's franchisees. 3 Receivables from suppliers for rebates and commercial incentives plus short-term consumer credit. 4 Mainly short-term consumer credit refinancing. 2016 1,875 15,396 4,413 3,411 11,742 12,008 48,845 2017 1,069 15,082 4,094 2,828 12,581 12,159 47,813

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

I will attempt to calculate the working capital requirement WCR and perform the requested calculations However please note that the financial statemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started