Answered step by step

Verified Expert Solution

Question

1 Approved Answer

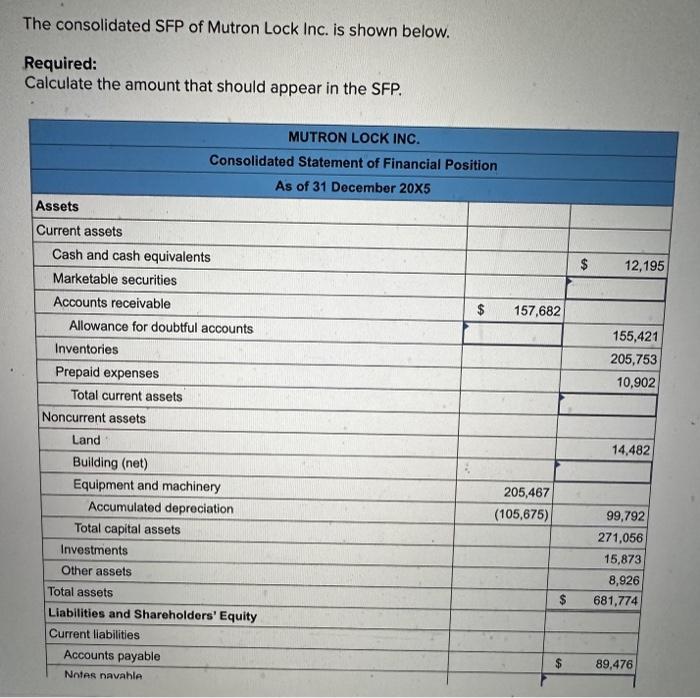

The consolidated SFP of Mutron Lock Inc. is shown below. Required: Calculate the amount that should appear in the SFP. Assets Current assets Cash

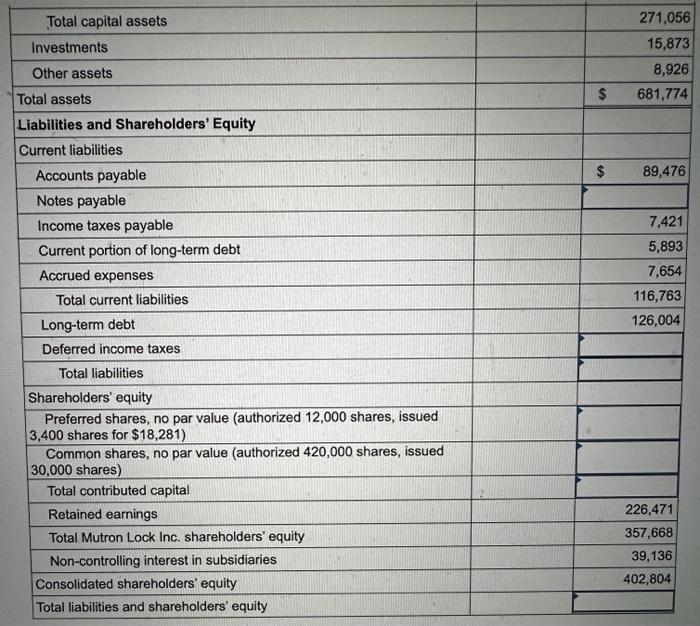

The consolidated SFP of Mutron Lock Inc. is shown below. Required: Calculate the amount that should appear in the SFP. Assets Current assets Cash and cash equivalents Marketable securities Accounts receivable Allowance for doubtful accounts Inventories Prepaid expenses Total current assets MUTRON LOCK INC. Consolidated Statement of Financial Position As of 31 December 20X5 Noncurrent assets Land Building (net) Equipment and machinery Accumulated depreciation Total capital assets Investments Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Accounts payable Notes navable $ 157,682 205,467 (105,675) $ $ 12,195 155,421 205,753 10,902 14,482 99,792 271,056 15,873 8,926 681,774 89,476 Total capital assets Investments Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Accounts payable Notes payable Income taxes payable Current portion of long-term debt Accrued expenses Total current liabilities Long-term debt Deferred income taxes. Total liabilities Shareholders' equity Preferred shares, no par value (authorized 12,000 shares, issued 3,400 shares for $18,281) Common shares, no par value (authorized 420,000 shares, issued 30,000 shares) Total contributed capital Retained earnings Total Mutron Lock Inc. shareholders' equity Non-controlling interest in subsidiaries Consolidated shareholders' equity Total liabilities and shareholders' equity $ $ 271,056 15,873 8,926 681,774 89,476 7,421 5,893 7,654 116,763 126,004 226,471 357,668 39,136 402,804

Step by Step Solution

There are 3 Steps involved in it

Step: 1

CALCULATIONS Current Assets Cash and cash equivalents 12195 Marketable securities 157682 Accounts re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started