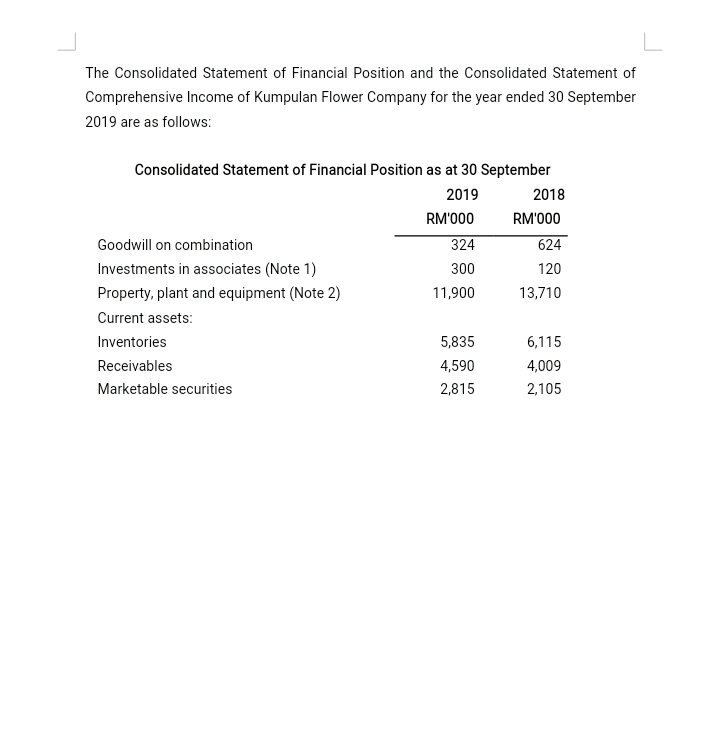

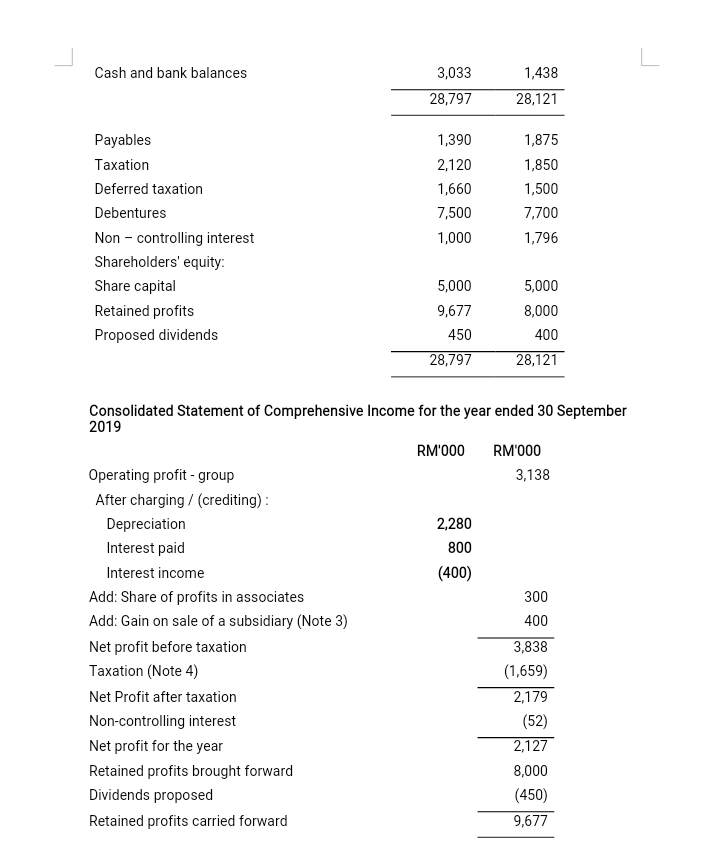

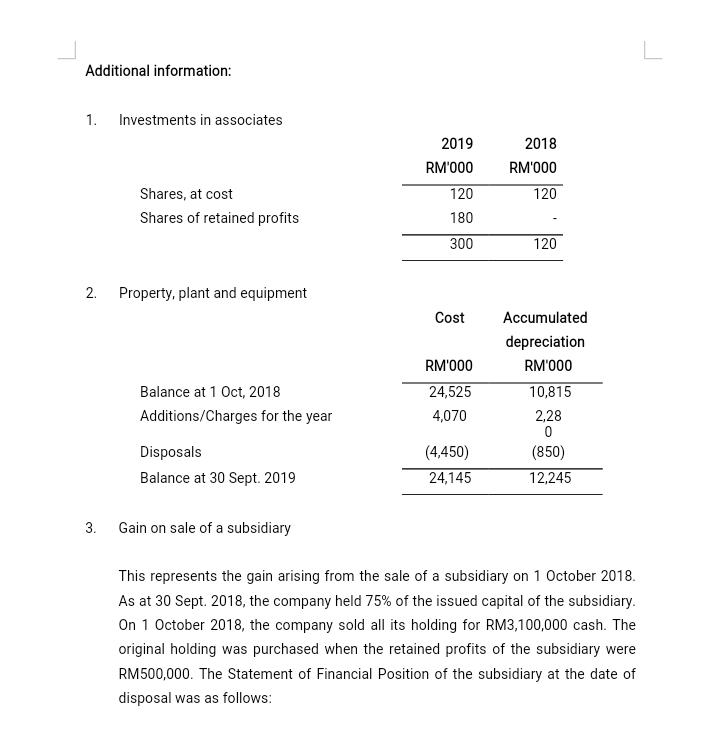

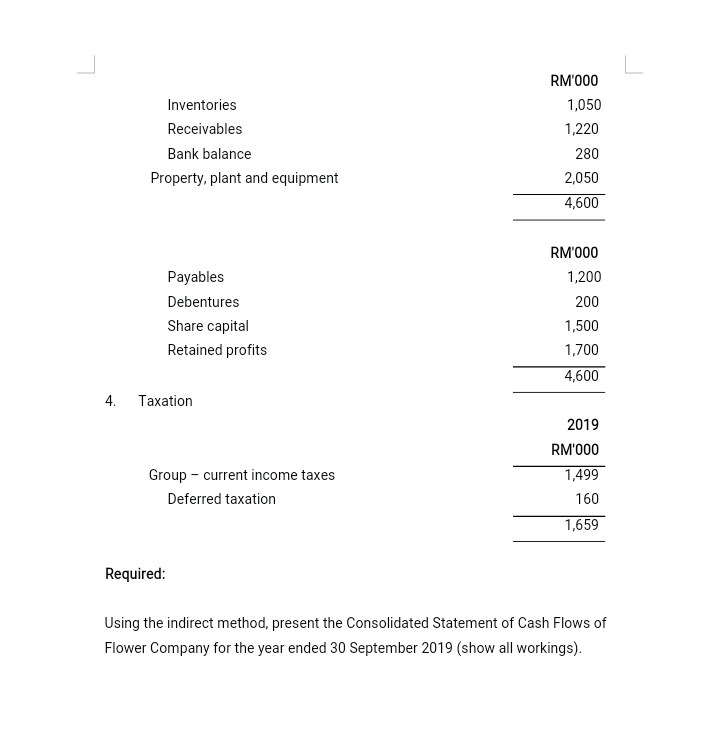

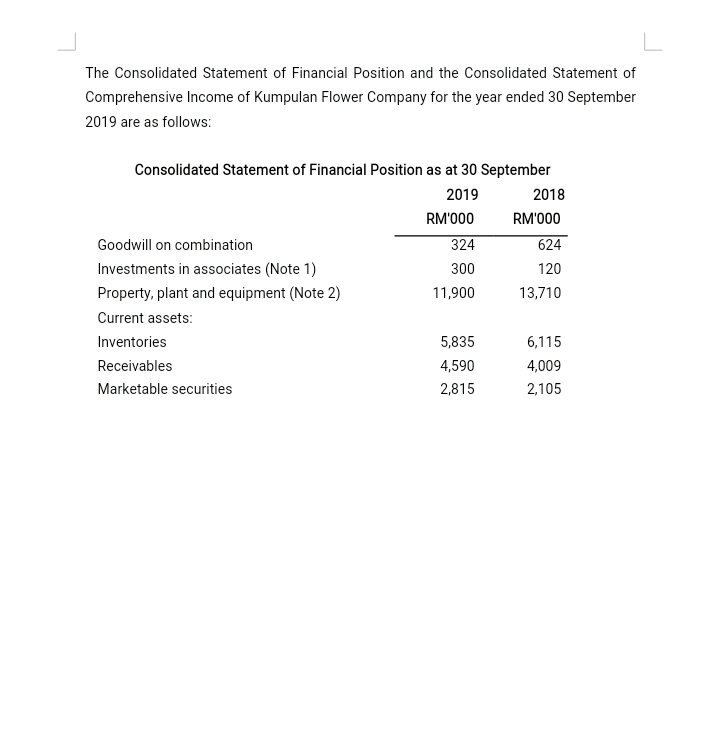

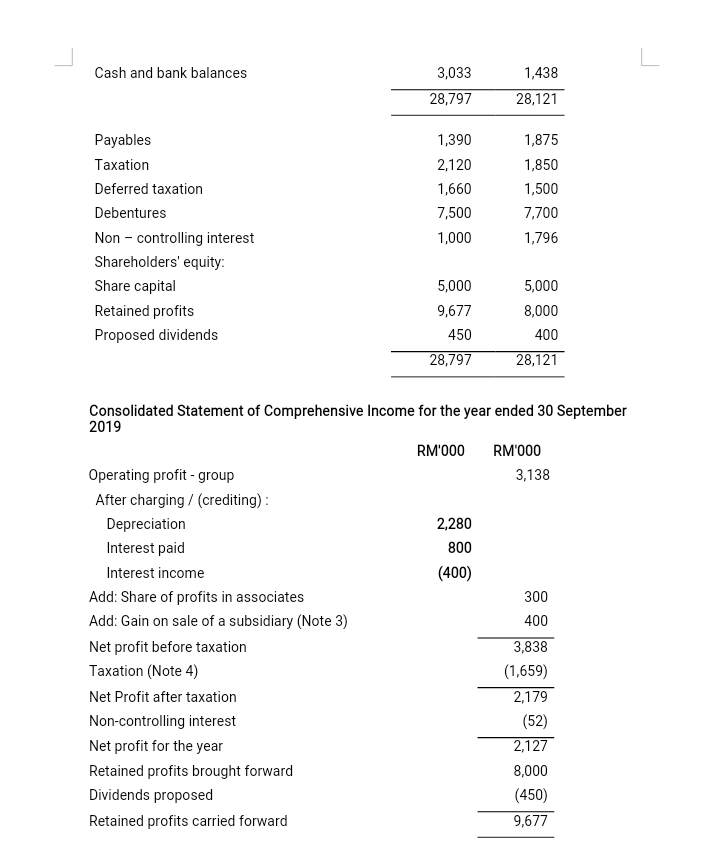

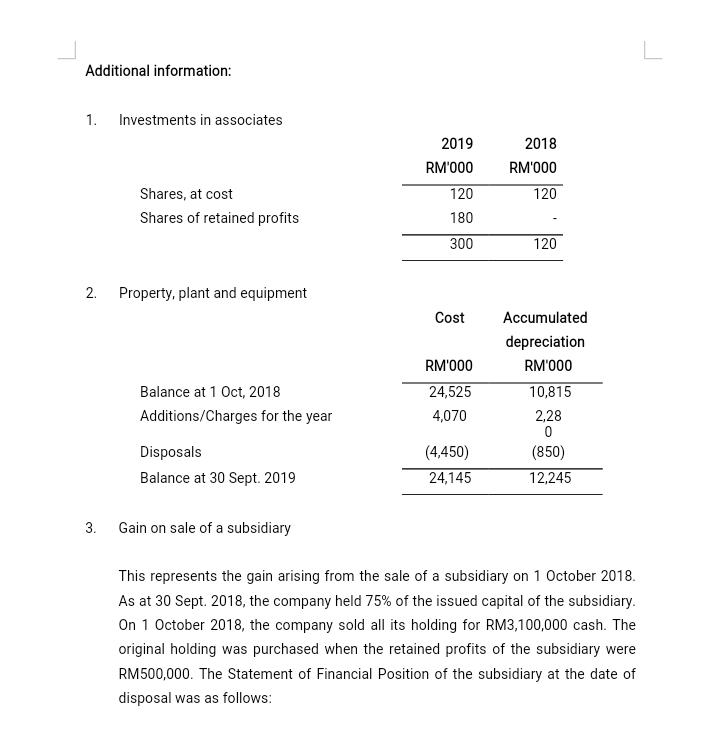

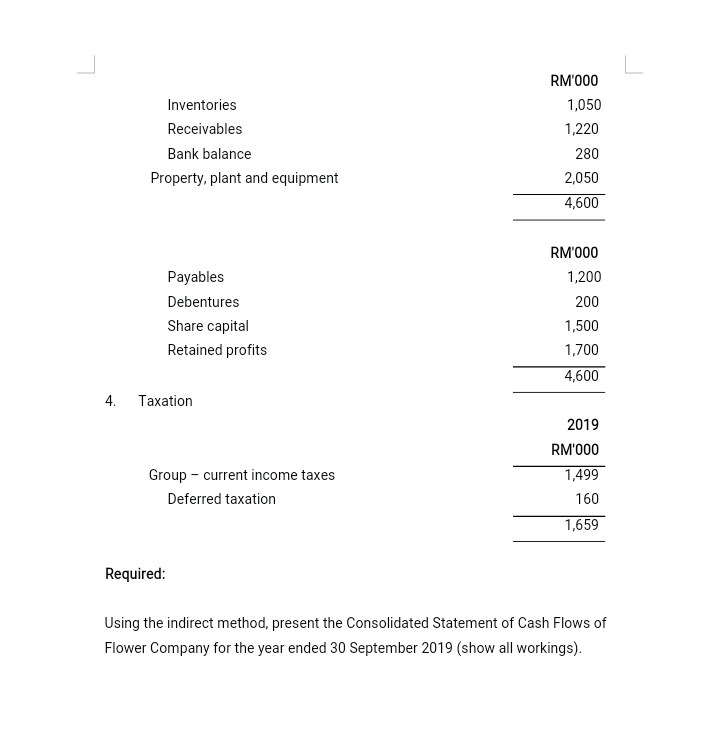

The Consolidated Statement of Financial Position and the Consolidated Statement of Comprehensive Income of Kumpulan Flower Company for the year ended 30 September 2019 are as follows: Consolidated Statement of Financial Position as at 30 September 2019 2018 RM'000 RM'000 Goodwill on combination 324 624 Investments in associates (Note 1) 300 120 Property, plant and equipment (Note 2) 11,900 13,710 Current assets: Inventories 5,835 6,115 Receivables 4,590 4,009 Marketable securities 2,815 2,105 L Cash and bank balances 3,033 28,797 1,438 28,121 Payables Taxation Deferred taxation Debentures Non-controlling interest Shareholders' equity: Share capital Retained profits Proposed dividends 1,390 2,120 1,660 7,500 1,000 1,875 1,850 1,500 7,700 1,796 5,000 9,677 450 28,797 5,000 8,000 400 28,121 Consolidated Statement of Comprehensive Income for the year ended 30 September 2019 RM'000 RM'000 Operating profit - group 3,138 After charging / (crediting): Depreciation 2,280 Interest paid 800 Interest income (400) Add: Share of profits in associates 300 Add: Gain on sale of a subsidiary (Note 3) 400 Net profit before taxation 3,838 Taxation (Note 4) (1,659) Net Profit after taxation 2,179 Non-controlling interest (52) Net profit for the year 2,127 Retained profits brought forward 8,000 Dividends proposed (450) Retained profits carried forward 9,677 Additional information: 1. Investments in associates 2018 RM'000 2019 RM'000 120 180 300 Shares, at cost Shares of retained profits 120 120 2. Property, plant and equipment Cost Balance at 1 Oct, 2018 Additions/Charges for the year RM'000 24,525 4,070 Accumulated depreciation RM'000 10,815 2,28 0 (850) 12,245 Disposals Balance at 30 Sept. 2019 (4,450) 24,145 3. Gain on sale of a subsidiary This represents the gain arising from the sale of a subsidiary on 1 October 2018. As at 30 Sept. 2018, the company held 75% of the issued capital of the subsidiary. On 1 October 2018, the company sold all its holding for RM3,100,000 cash. The original holding was purchased when the retained profits of the subsidiary were RM500,000. The Statement of Financial Position of the subsidiary at the date of disposal was as follows: Inventories Receivables Bank balance Property, plant and equipment RM'000 1,050 1,220 280 2,050 4,600 Payables Debentures Share capital Retained profits RM'000 1,200 200 1,500 1,700 4,600 4. Taxation Group - current income taxes Deferred taxation 2019 RM'000 1,499 160 1,659 Required: Using the indirect method, present the Consolidated Statement of Cash Flows of Flower Company for the year ended 30 September 2019 (show all workings). The Consolidated Statement of Financial Position and the Consolidated Statement of Comprehensive Income of Kumpulan Flower Company for the year ended 30 September 2019 are as follows: Consolidated Statement of Financial Position as at 30 September 2019 2018 RM'000 RM'000 Goodwill on combination 324 624 Investments in associates (Note 1) 300 120 Property, plant and equipment (Note 2) 11,900 13,710 Current assets: Inventories 5,835 6,115 Receivables 4,590 4,009 Marketable securities 2,815 2,105 L Cash and bank balances 3,033 28,797 1,438 28,121 Payables Taxation Deferred taxation Debentures Non-controlling interest Shareholders' equity: Share capital Retained profits Proposed dividends 1,390 2,120 1,660 7,500 1,000 1,875 1,850 1,500 7,700 1,796 5,000 9,677 450 28,797 5,000 8,000 400 28,121 Consolidated Statement of Comprehensive Income for the year ended 30 September 2019 RM'000 RM'000 Operating profit - group 3,138 After charging / (crediting): Depreciation 2,280 Interest paid 800 Interest income (400) Add: Share of profits in associates 300 Add: Gain on sale of a subsidiary (Note 3) 400 Net profit before taxation 3,838 Taxation (Note 4) (1,659) Net Profit after taxation 2,179 Non-controlling interest (52) Net profit for the year 2,127 Retained profits brought forward 8,000 Dividends proposed (450) Retained profits carried forward 9,677 Additional information: 1. Investments in associates 2018 RM'000 2019 RM'000 120 180 300 Shares, at cost Shares of retained profits 120 120 2. Property, plant and equipment Cost Balance at 1 Oct, 2018 Additions/Charges for the year RM'000 24,525 4,070 Accumulated depreciation RM'000 10,815 2,28 0 (850) 12,245 Disposals Balance at 30 Sept. 2019 (4,450) 24,145 3. Gain on sale of a subsidiary This represents the gain arising from the sale of a subsidiary on 1 October 2018. As at 30 Sept. 2018, the company held 75% of the issued capital of the subsidiary. On 1 October 2018, the company sold all its holding for RM3,100,000 cash. The original holding was purchased when the retained profits of the subsidiary were RM500,000. The Statement of Financial Position of the subsidiary at the date of disposal was as follows: Inventories Receivables Bank balance Property, plant and equipment RM'000 1,050 1,220 280 2,050 4,600 Payables Debentures Share capital Retained profits RM'000 1,200 200 1,500 1,700 4,600 4. Taxation Group - current income taxes Deferred taxation 2019 RM'000 1,499 160 1,659 Required: Using the indirect method, present the Consolidated Statement of Cash Flows of Flower Company for the year ended 30 September 2019 (show all workings)