Answered step by step

Verified Expert Solution

Question

1 Approved Answer

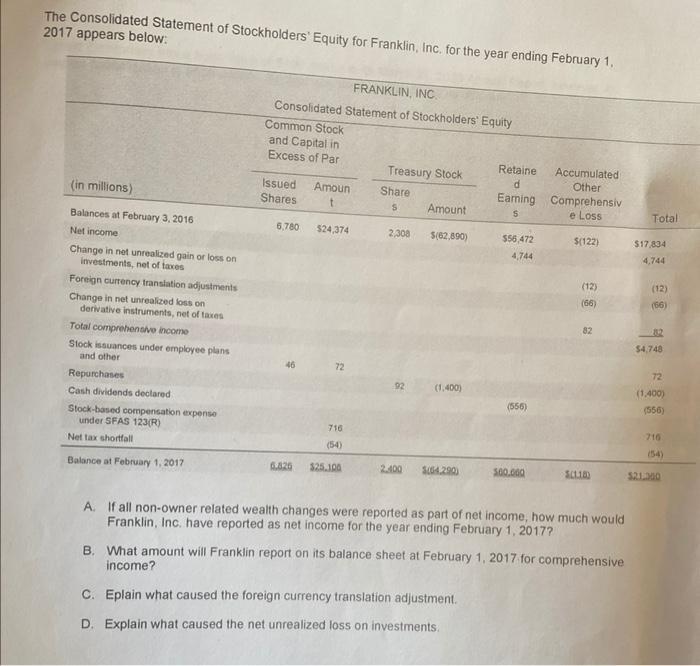

The Consolidated Statement of Stockholders' Equity for Franklin, Inc. for the year ending February 1, 2017 appears below: (in millions) Balances at February 3,

The Consolidated Statement of Stockholders' Equity for Franklin, Inc. for the year ending February 1, 2017 appears below: (in millions) Balances at February 3, 2016 Net income Change in net unrealized gain or loss on investments, net of taxes Foreign currency translation adjustments Change in net unrealized loss on derivative instruments, net of taxes Total comprehensive income Stock issuances under employee plans and other Repurchases Cash dividends declared Stock-based compensation expense under SFAS 123(R) Net tax shortfall Balance at February 1, 2017 FRANKLIN, INC. Consolidated Statement of Stockholders' Equity Common Stock and Capital in Excess of Par Issued Amoun Shares t 6,780 $24,374 72 716 (54) 6.825 $25.100 Treasury Stock Share S Amount 2,308 $(62,890) (1,400) 2.400 $(64.290) Retaine d Earning $ $56,472 4,744 C. Eplain what caused the foreign currency translation adjustment. D. Explain what caused the net unrealized loss on investments. (556) 300.000 Accumulated Other Comprehensiv e Loss $(122) (12) (66) 82 $(118) A. If all non-owner related wealth changes were reported as part of net income, how much would Franklin, Inc. have reported as net income for the year ending February 1, 2017? B. What amount will Franklin report on its balance sheet at February 1, 2017 for comprehensive income? Total $17,834 4,744 (12) (66) 82 $4,748 72 (1,400) (556) (54) $21.300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started