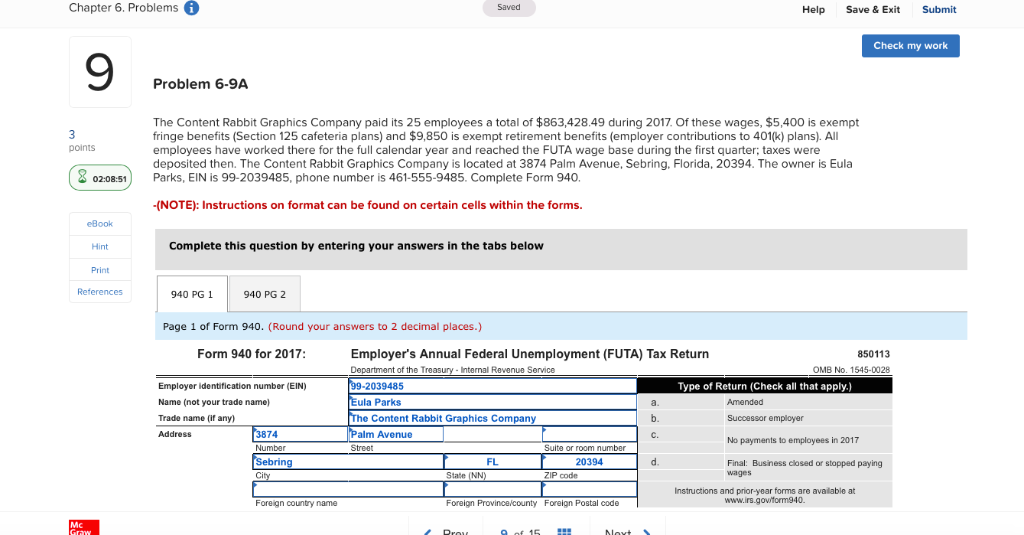

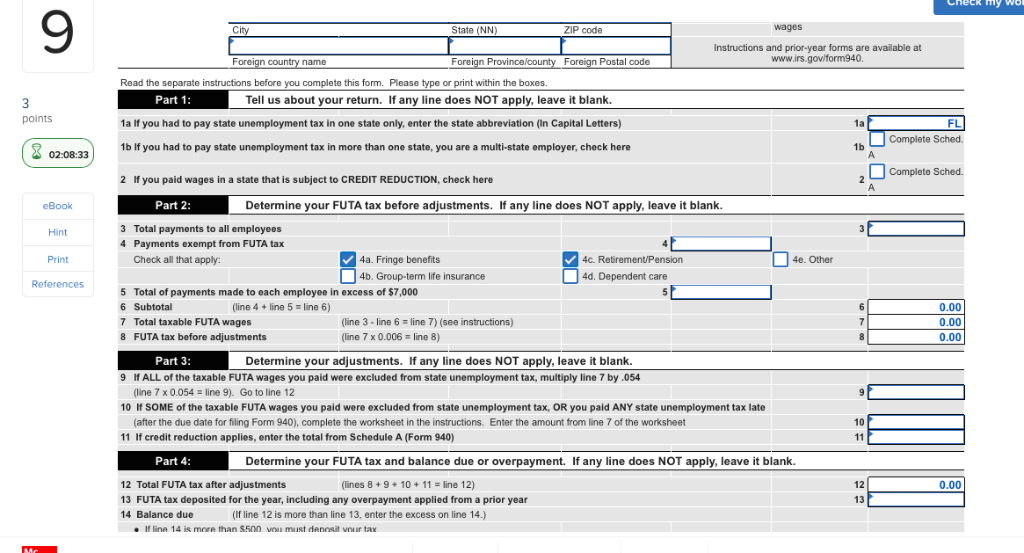

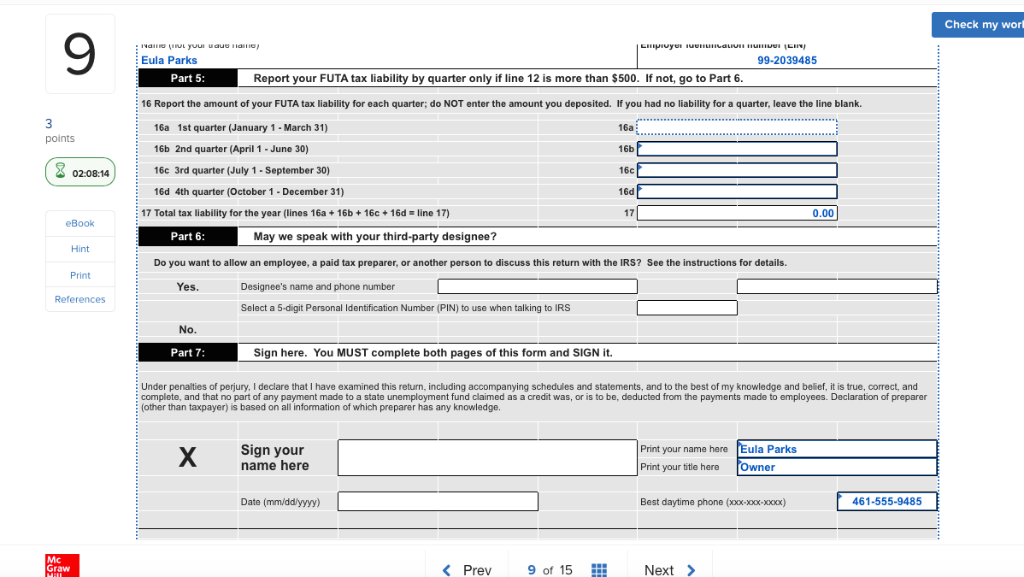

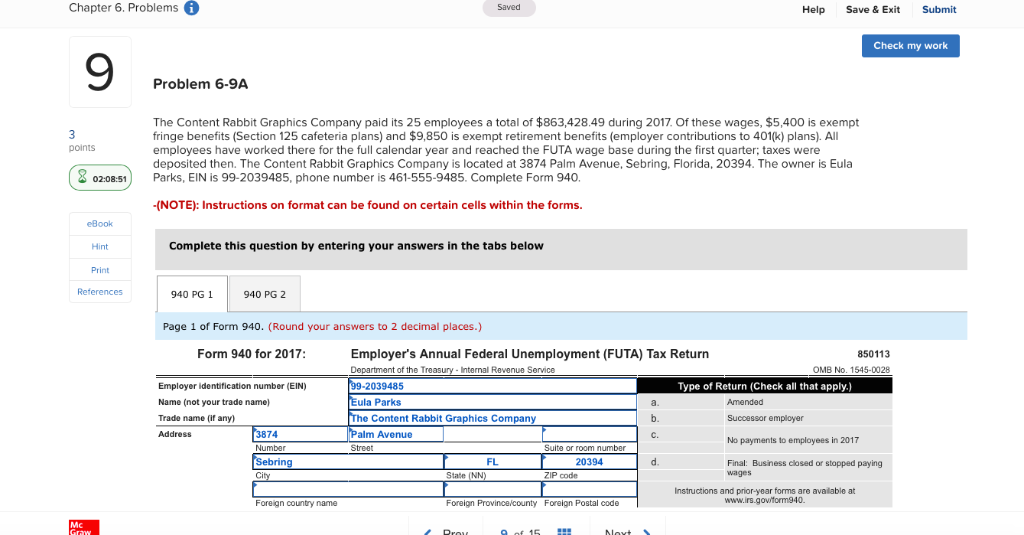

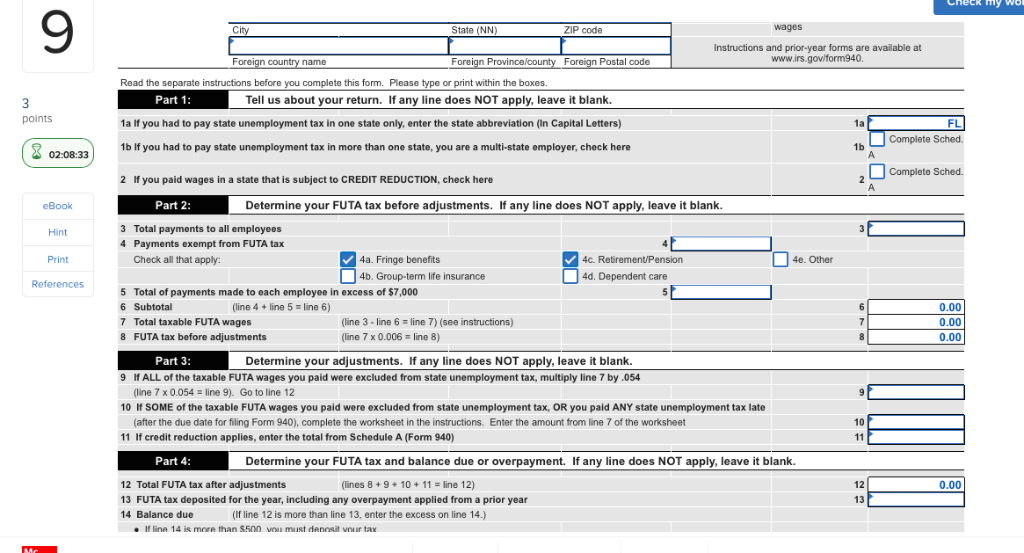

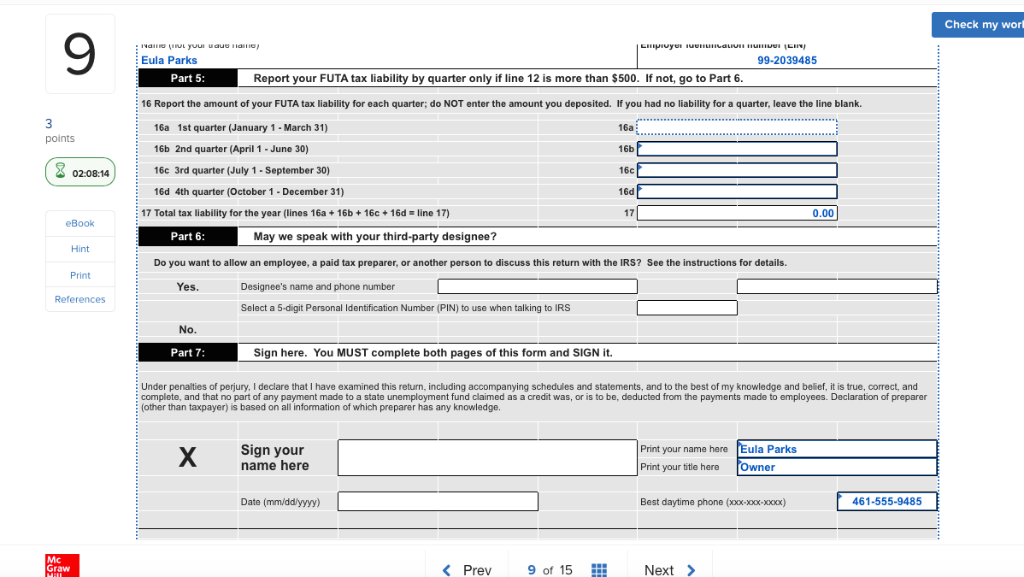

The Content Rabbit Graphics Company paid its 25 employees a total of $863,428.49 during 2017. Of these wages, $5,400 is exempt fringe benefits (Section 125 cafeteria plans) and $9,850 is exempt retirement benefits (employer contributions to 401(k) plans). All employees have worked there for the full calendar year and reached the FUTA wage base during the first quarter; taxes were deposited then. The Content Rabbit Graphics Company is located at 3874 Palm Avenue, Sebring, Florida, 20394. The owner is Eula Parks, EIN is 99-2039485, phone number is 461-555-9485. Complete Form 940.

Check my worl Eula Parks 99-2039485 Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6 16 Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 3 points 16a 1st quarter (January 1- March 31) 16a 16b 16c 16d 17 16b 2nd quarter (April 1-June 30) 02:08-1416c 3rd quarter (July 1- September 30) 16d 4th quarter (October 1 December 31) 17 Total tax liability for the year (lines 16a+ 16b+16c 16dline 17) 0.00 eBook Part 6 May we speak with your third-party designee? Hint Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details. Print Yes. Designee's name and phone number References Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS No. Part 7: Sign here. You MUST complete both pages of this form and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Sign your name here Print your name here Eula Parks Print your title hereOwner Date (mm/ddlyyyy) Best daytime phone (xxx) 461-555-9485 Mc Graw Prev 9 of 15 Next Check my worl Eula Parks 99-2039485 Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6 16 Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank. 3 points 16a 1st quarter (January 1- March 31) 16a 16b 16c 16d 17 16b 2nd quarter (April 1-June 30) 02:08-1416c 3rd quarter (July 1- September 30) 16d 4th quarter (October 1 December 31) 17 Total tax liability for the year (lines 16a+ 16b+16c 16dline 17) 0.00 eBook Part 6 May we speak with your third-party designee? Hint Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details. Print Yes. Designee's name and phone number References Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS No. Part 7: Sign here. You MUST complete both pages of this form and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Sign your name here Print your name here Eula Parks Print your title hereOwner Date (mm/ddlyyyy) Best daytime phone (xxx) 461-555-9485 Mc Graw Prev 9 of 15 Next