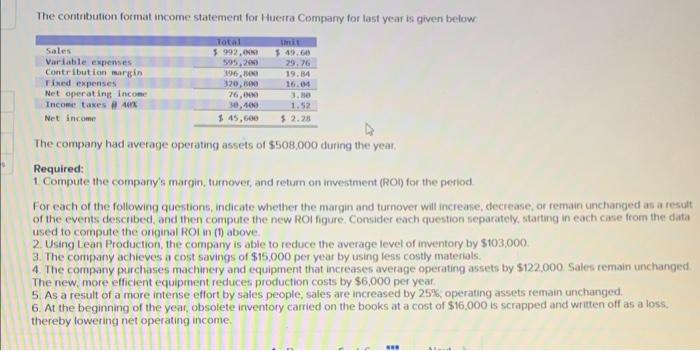

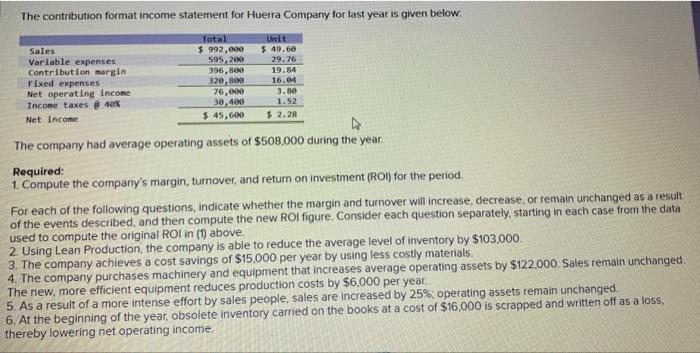

The contribution format income statement for Huerra Company for last year is qiven befow. The company had average operating assets of 5508,000 during the year. Required: 1. Compute the company's margin, turnover, and retum on investment (ROI) for the period For each of the following questions, indicate whether the margin and turnover will increase, decrease, of remain unchanged as a result of the events described, and then compute the new ROl figure. Consider each question separately, starting in each case from the data used to compute the onginal ROA in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $103,000 3. The company achieves a cost savings of $15,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122.000. Sales remain unchanged The new, more efficient equipment reduces production costs by $6,000 per year 5. As a result of a more intense effort by sales people, sales are increased by 25%, operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $16,000 is scrapped and witten off as a loss. thereby lowering net operating income. The contribution format income statement for Huerra Company for last year is given below The company had average operating assets of $508,000 during the year Required: 1. Compute the company's margin, turnover, and return on investment (ROl) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above 2. Using Lean Production, the company is able to reduce the average level of inventory by $103,000. 3. The company achieves a cost savings of $15,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increases average operating assets by $122,000. Sales remain unchanged. The new, more efficient equipment reduces production costs by $6,000 per year. 5. As a result of a more intense effort by sales people, sales are increased by 25%, operating assets remain unchanged 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $16.000 is scrapped and written off as a loss. thereby lowering net operating income