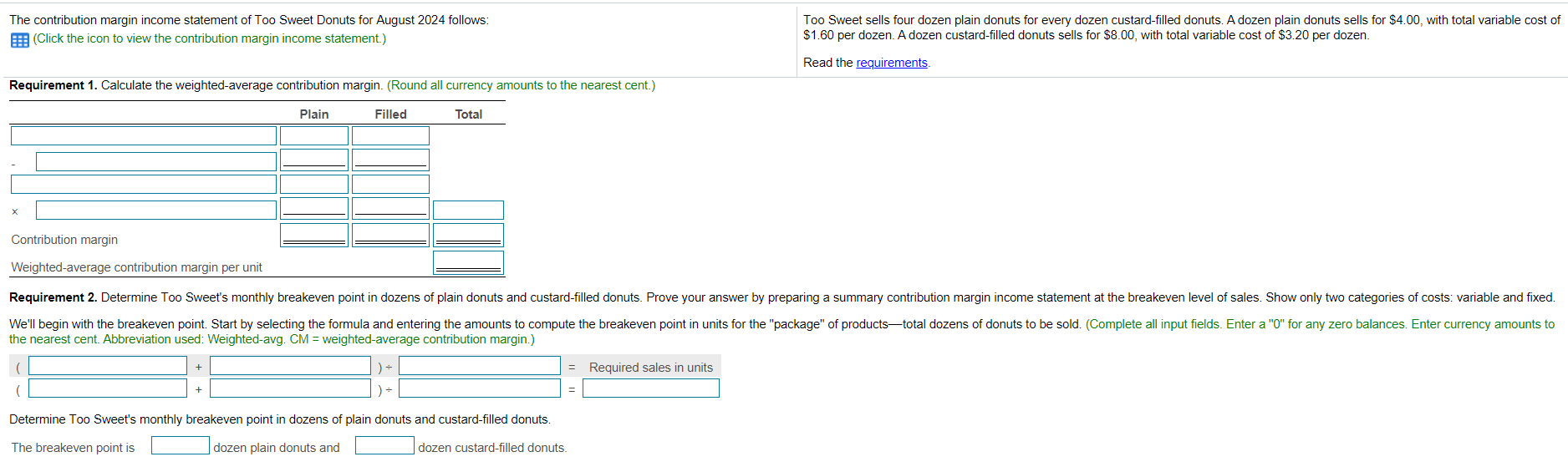

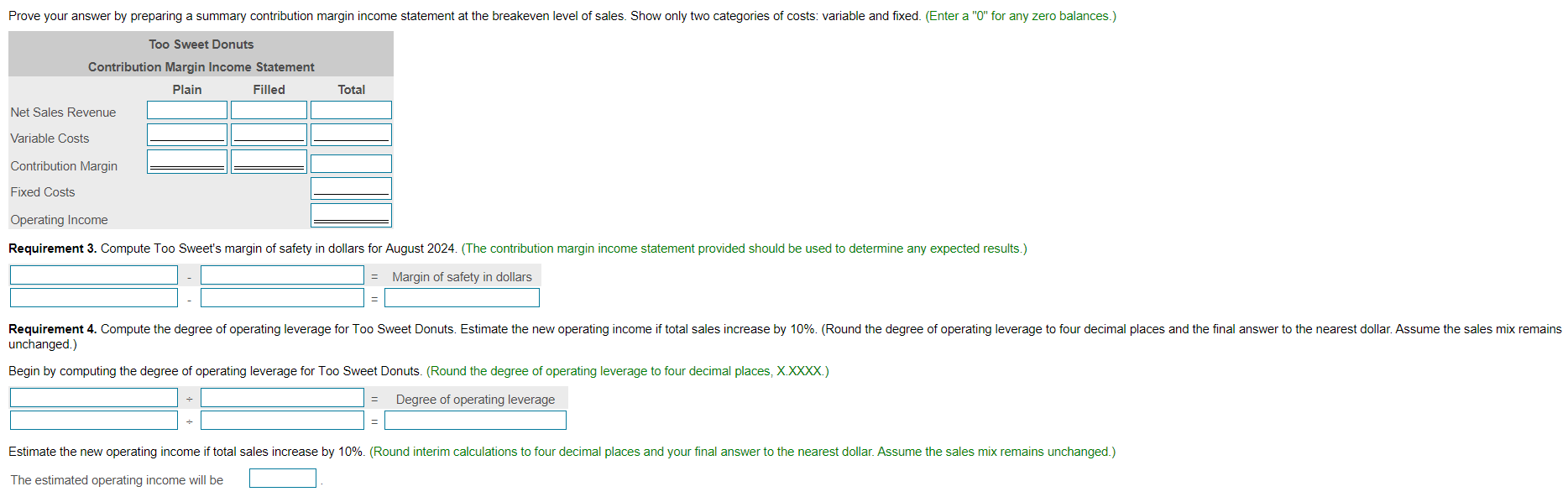

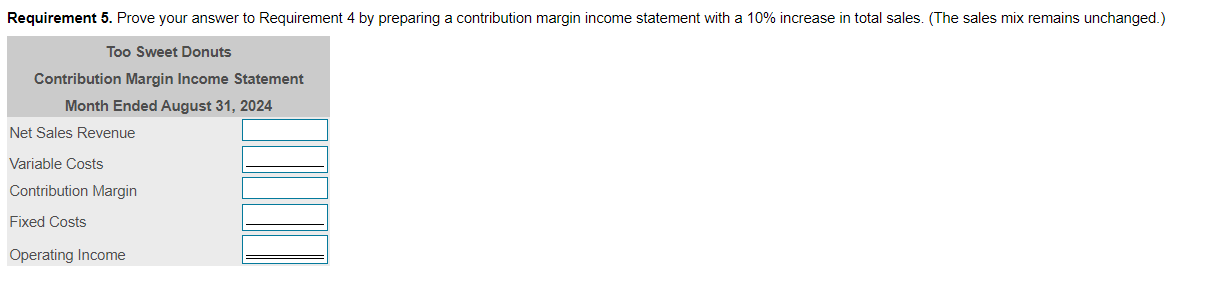

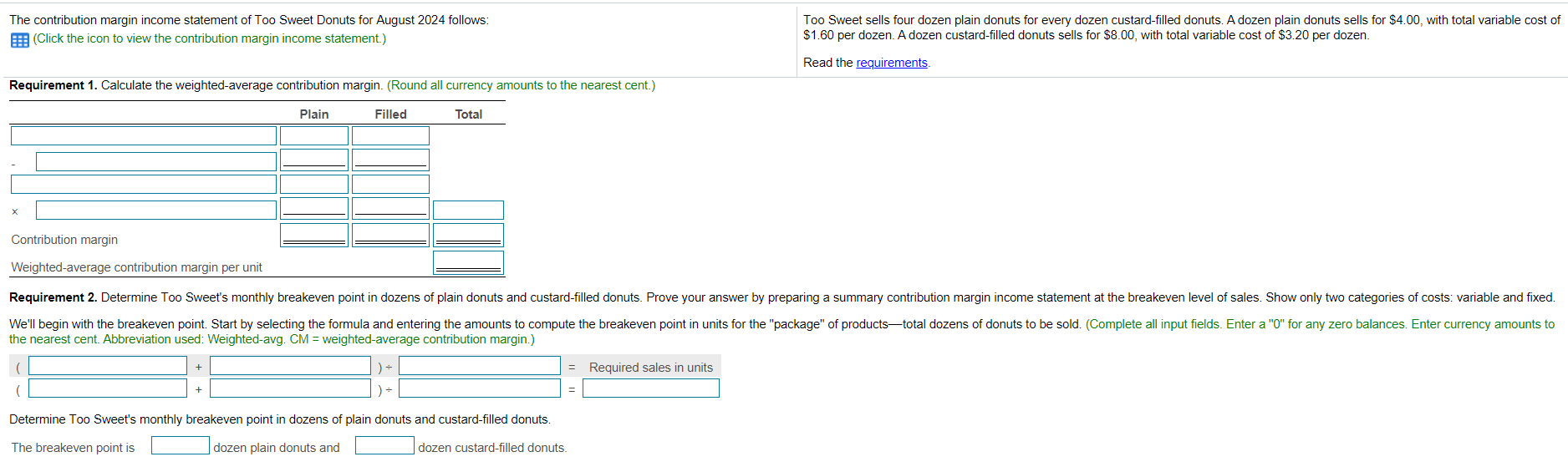

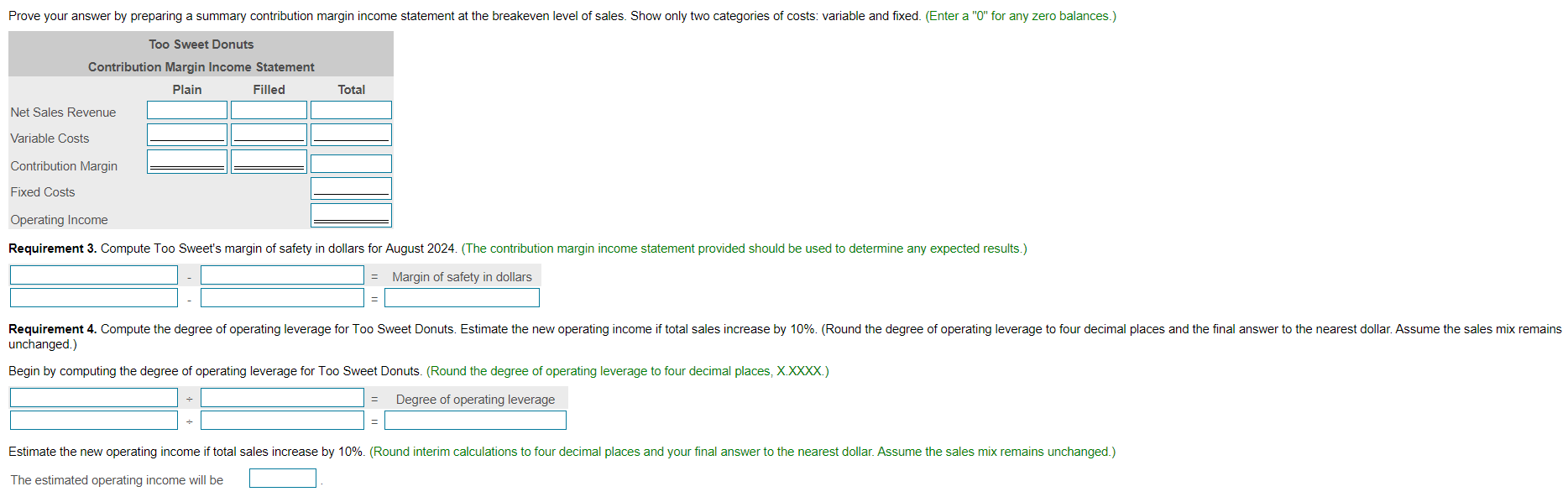

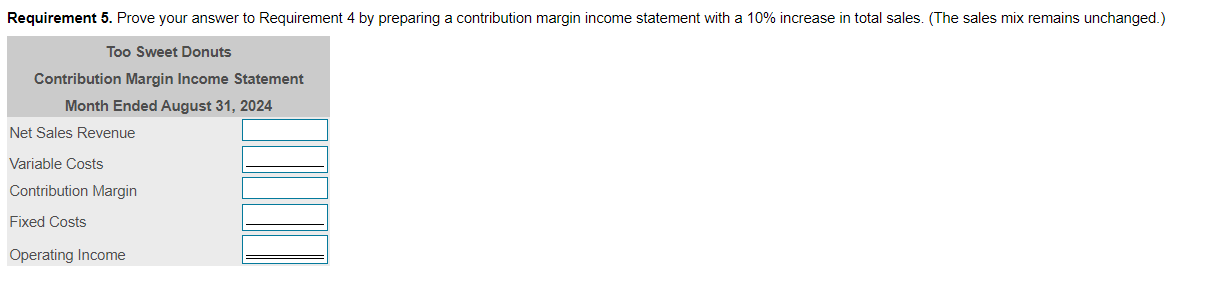

The contribution margin income statement of Too Sweet Donuts for August 2024 follows: (Click the icon to view the contribution margin income statement.) Too Sweet sells four dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $4.00, with total variable cost of $1.60 per dozen. A dozen custard-filled donuts sells for $8.00, with total variable cost of $3.20 per dozen. Read the requirements Requirement 1. Calculate the weighted-average contribution margin. (Round all currency amounts to the nearest cent.) Plain Filled Total Contribution margin Weighted average contribution margin per unit Requirement 2. Determine Too Sweet's monthly breakeven point in dozens of plain donuts and custard-filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of costs: variable and fixed. We'll begin with the breakeven point. Start by selecting the formula and entering the amounts to compute the breakeven point in units for the "package" of productstotal dozens of donuts to be sold. (Complete all input fields. Enter a "0" for any zero balances. Enter currency amounts to the nearest cent. Abbreviation used: Weighted-avg. CM = weighted average contribution margin.) ) = Required sales in units Determine Too Sweet's monthly breakeven point in dozens of plain donuts and custard-filled donuts. The breakeven point is dozen plain donuts and dozen custard-filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of costs: variable and fixed. (Enter a "0" for any zero balances.) Too Sweet Donuts Contribution Margin Income Statement Plain Filled Total Net Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income Requirement 3. Compute Too Sweet's margin of safety in dollars for August 2024. (The contribution margin income statement provided should be used to determine any expected results.) Margin of safety in dollars Requirement 4. Compute the degree of operating leverage for Too Sweet Donuts. Estimate the new operating income if total sales increase by 10%. (Round the degree of operating leverage to four decimal places and the final answer to the nearest dollar. Assume the sales mix remains unchanged.) Begin by computing the degree of operating leverage for Too Sweet Donuts. (Round the degree of operating leverage to four decimal places, X.XXXX.) Degree of operating leverage Estimate the new operating income if total sales increase by 10%(Round interim calculations to four decimal places and your final answer to the nearest dollar. Assume the sales mix remains unchanged.) The estimated operating income will be Requirement 5. Prove your answer to Requirement 4 by preparing a contribution margin income statement with a 10% increase in total sales. (The sales mix remains unchanged.) Too Sweet Donuts Contribution Margin Income Statement Month Ended August 31, 2024 Net Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income The contribution margin income statement of Too Sweet Donuts for August 2024 follows: (Click the icon to view the contribution margin income statement.) Too Sweet sells four dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $4.00, with total variable cost of $1.60 per dozen. A dozen custard-filled donuts sells for $8.00, with total variable cost of $3.20 per dozen. Read the requirements Requirement 1. Calculate the weighted-average contribution margin. (Round all currency amounts to the nearest cent.) Plain Filled Total Contribution margin Weighted average contribution margin per unit Requirement 2. Determine Too Sweet's monthly breakeven point in dozens of plain donuts and custard-filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of costs: variable and fixed. We'll begin with the breakeven point. Start by selecting the formula and entering the amounts to compute the breakeven point in units for the "package" of productstotal dozens of donuts to be sold. (Complete all input fields. Enter a "0" for any zero balances. Enter currency amounts to the nearest cent. Abbreviation used: Weighted-avg. CM = weighted average contribution margin.) ) = Required sales in units Determine Too Sweet's monthly breakeven point in dozens of plain donuts and custard-filled donuts. The breakeven point is dozen plain donuts and dozen custard-filled donuts. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of costs: variable and fixed. (Enter a "0" for any zero balances.) Too Sweet Donuts Contribution Margin Income Statement Plain Filled Total Net Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income Requirement 3. Compute Too Sweet's margin of safety in dollars for August 2024. (The contribution margin income statement provided should be used to determine any expected results.) Margin of safety in dollars Requirement 4. Compute the degree of operating leverage for Too Sweet Donuts. Estimate the new operating income if total sales increase by 10%. (Round the degree of operating leverage to four decimal places and the final answer to the nearest dollar. Assume the sales mix remains unchanged.) Begin by computing the degree of operating leverage for Too Sweet Donuts. (Round the degree of operating leverage to four decimal places, X.XXXX.) Degree of operating leverage Estimate the new operating income if total sales increase by 10%(Round interim calculations to four decimal places and your final answer to the nearest dollar. Assume the sales mix remains unchanged.) The estimated operating income will be Requirement 5. Prove your answer to Requirement 4 by preparing a contribution margin income statement with a 10% increase in total sales. (The sales mix remains unchanged.) Too Sweet Donuts Contribution Margin Income Statement Month Ended August 31, 2024 Net Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income