Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The controllei for Haley Corporation is concerned about certain business transactions that th company experienced during 2018. The controller, after discussing these matters with various

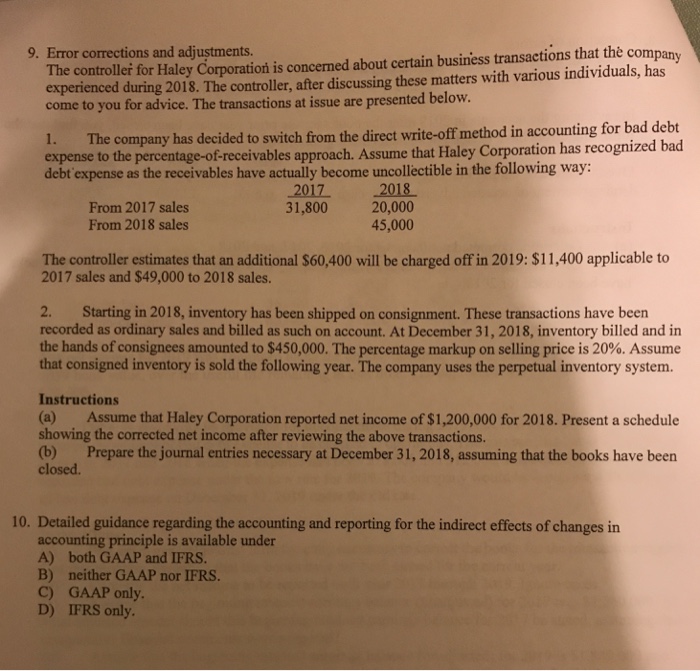

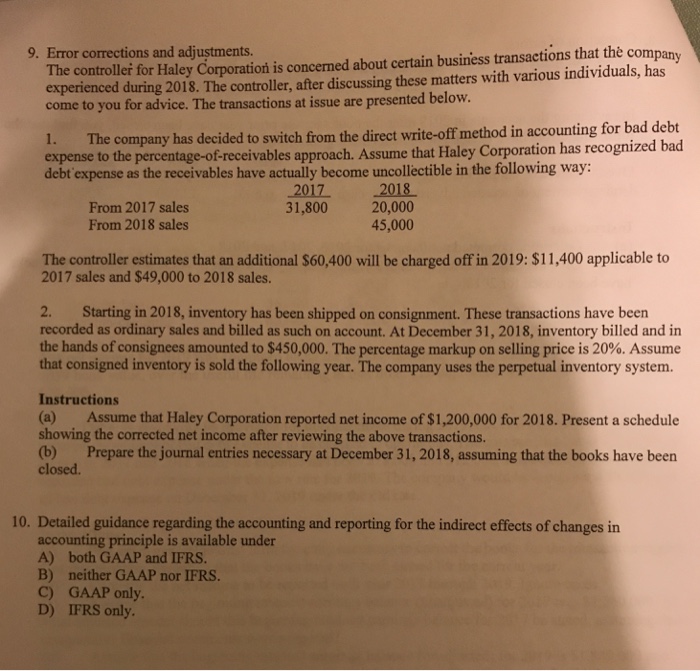

The controllei for Haley Corporation is concerned about certain business transactions that th company experienced during 2018. The controller, after discussing these matters with various individuals, has come to you for advice. The transactions at issue are presented below. 9. Error corrections and adjustments. 1. Th expense to the debt expense as the receivables have actually become uncollectible in the following way e company has decided to switch from the direct write-off method in accounting for bad debt . Assume that Haley Corporation has recognized bad percentage-of-receivables approach From 2017 sales From 2018 sales 20172018 1,800 20,000 45,000 The controller estimates that an additional $60,400 will be charged off in 2019: $11,400 applicable to 2017 sales and $49,000 to 2018 sales. 2. Starting in 2018, inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such on account. At December 31, 2018, inventory billed and in the hands of consignees amounted to $450,000. The percentage markup on selling price is 20%. Assume that consigned inventory is sold the following year. The company uses the perpetual inventory system. Instructions (a) Assume that Haley Corporation reported net income of $1,200,000 for 2018. Present a schedule showing the corrected net income after reviewing the above transactions. (b) Prepare the journal entries necessary at December 31, 2018, assuming that the books have been closed. 10. Detailed guidance regarding the accounting and reporting for the indirect effects of changes in accounting principle is available under A) both GAAP and IFRS. B) neither GAAP nor IFRS. C) GAAP only D) IFRS only The controllei for Haley Corporation is concerned about certain business transactions that th company experienced during 2018. The controller, after discussing these matters with various individuals, has come to you for advice. The transactions at issue are presented below. 9. Error corrections and adjustments. 1. Th expense to the debt expense as the receivables have actually become uncollectible in the following way e company has decided to switch from the direct write-off method in accounting for bad debt . Assume that Haley Corporation has recognized bad percentage-of-receivables approach From 2017 sales From 2018 sales 20172018 1,800 20,000 45,000 The controller estimates that an additional $60,400 will be charged off in 2019: $11,400 applicable to 2017 sales and $49,000 to 2018 sales. 2. Starting in 2018, inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such on account. At December 31, 2018, inventory billed and in the hands of consignees amounted to $450,000. The percentage markup on selling price is 20%. Assume that consigned inventory is sold the following year. The company uses the perpetual inventory system. Instructions (a) Assume that Haley Corporation reported net income of $1,200,000 for 2018. Present a schedule showing the corrected net income after reviewing the above transactions. (b) Prepare the journal entries necessary at December 31, 2018, assuming that the books have been closed. 10. Detailed guidance regarding the accounting and reporting for the indirect effects of changes in accounting principle is available under A) both GAAP and IFRS. B) neither GAAP nor IFRS. C) GAAP only D) IFRS only

The controllei for Haley Corporation is concerned about certain business transactions that th company experienced during 2018. The controller, after discussing these matters with various individuals, has come to you for advice. The transactions at issue are presented below. 9. Error corrections and adjustments. 1. Th expense to the debt expense as the receivables have actually become uncollectible in the following way e company has decided to switch from the direct write-off method in accounting for bad debt . Assume that Haley Corporation has recognized bad percentage-of-receivables approach From 2017 sales From 2018 sales 20172018 1,800 20,000 45,000 The controller estimates that an additional $60,400 will be charged off in 2019: $11,400 applicable to 2017 sales and $49,000 to 2018 sales. 2. Starting in 2018, inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such on account. At December 31, 2018, inventory billed and in the hands of consignees amounted to $450,000. The percentage markup on selling price is 20%. Assume that consigned inventory is sold the following year. The company uses the perpetual inventory system. Instructions (a) Assume that Haley Corporation reported net income of $1,200,000 for 2018. Present a schedule showing the corrected net income after reviewing the above transactions. (b) Prepare the journal entries necessary at December 31, 2018, assuming that the books have been closed. 10. Detailed guidance regarding the accounting and reporting for the indirect effects of changes in accounting principle is available under A) both GAAP and IFRS. B) neither GAAP nor IFRS. C) GAAP only D) IFRS only The controllei for Haley Corporation is concerned about certain business transactions that th company experienced during 2018. The controller, after discussing these matters with various individuals, has come to you for advice. The transactions at issue are presented below. 9. Error corrections and adjustments. 1. Th expense to the debt expense as the receivables have actually become uncollectible in the following way e company has decided to switch from the direct write-off method in accounting for bad debt . Assume that Haley Corporation has recognized bad percentage-of-receivables approach From 2017 sales From 2018 sales 20172018 1,800 20,000 45,000 The controller estimates that an additional $60,400 will be charged off in 2019: $11,400 applicable to 2017 sales and $49,000 to 2018 sales. 2. Starting in 2018, inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such on account. At December 31, 2018, inventory billed and in the hands of consignees amounted to $450,000. The percentage markup on selling price is 20%. Assume that consigned inventory is sold the following year. The company uses the perpetual inventory system. Instructions (a) Assume that Haley Corporation reported net income of $1,200,000 for 2018. Present a schedule showing the corrected net income after reviewing the above transactions. (b) Prepare the journal entries necessary at December 31, 2018, assuming that the books have been closed. 10. Detailed guidance regarding the accounting and reporting for the indirect effects of changes in accounting principle is available under A) both GAAP and IFRS. B) neither GAAP nor IFRS. C) GAAP only D) IFRS only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started